The American Dream

21 February 2023

Hi, The Investor’s Podcast Network Community!

We enjoyed the day off yesterday, but financial markets are back to business today, and so are we 📝

Investors weren’t happy to be back, though, with stocks selling off as 10-year Treasury rates surged.

Small-cap stocks (companies with a market capitalization of roughly between $300 million and $2 billion) had their worst day of the year, off by about 2.9%, as measured by the Russell 2000.

💭 These smaller, growth-sensitive businesses are more vulnerable to economic slowdowns. Consequently, they responded to the Fed’s rate-hiking efforts by declining 22% last year — The S&P 500 fell 19.64% in 2022.

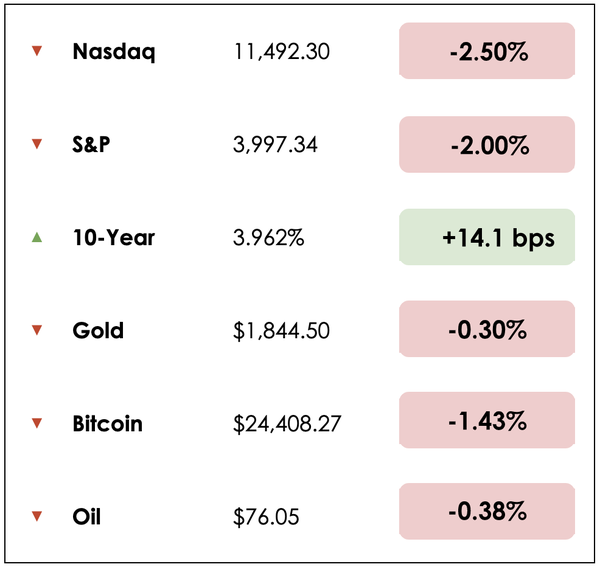

Here’s the rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Should we all be working 4-day weeks?

- Walmart as an indicator of consumer spending

- Plus, our main story on affording the American Dream

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

💼 A 4-Day Workweek? (WSJ)

Explained:

- You might want to send this to your boss: After testing a 4-day work week, some companies say they don’t want to stop, citing productivity holding steady and fewer employees quitting.

- A majority of U.K. companies participating in a test of a 4-day workweek said they would stick with it after logging sharp drops in worker turnover and absenteeism while largely maintaining productivity during the six-month study.

- In one of the largest trials of a four-day week, 61 British businesses ranging from banks to fast-food restaurants to marketing agencies gave their 2,900 workers a paid day off a week to see whether they could get as much done while working less, but more effectively. More than 90% said they would continue testing the shorter weeks, while 18 planned to make it permanent.

Why it matters:

- “At the beginning, this was about pandemic burnout for a lot of employers. Now it’s more of a retention and recruitment issue for many of them,” said Juliet Schor, an economist and sociologist at Boston College.

- This isn’t the first study confirming that more hours working doesn’t necessarily lead to greater output. In a study in Iceland involving more than 2,500 employees across industries, researchers found most workers maintained or improved their productivity and reported reduced stress.

- Widespread adoption is still far from a reality, though. Most companies that have experimented with a 4-day week are small employers, and larger companies haven’t embraced the concept. Further, some workers have reported struggling to finish everything in a shorter time frame.

🛍️ Walmart’s Cautious Outlook (NYT)

Explained:

- Walmart (WMT) has warned that shoppers are feeling the squeeze of higher prices, reporting strong results for the holiday shopping season but saying this year would be tougher sledding.

- The retail giant, which can provide a barometer of consumer demand, said sales would be muted in 2023 as shoppers navigate high inflation.

- Walmart’s revenue and profit grew more quickly than analysts expected for the three months through January, which includes the holiday shopping season. Its quarterly revenue of $164 billion was 7.3% higher than a year earlier. December was the best month for sales in history at Walmart’s U.S. stores despite inflation peaking at 41-year-highs last summer.

Why it matters:

- Walmart warned that it expected inflation would weigh on consumers. It’s a similar story at Home Depot (HD), which said profits would be slimmer this year.

- All told, the economic picture remains unclear. In January, job growth was strong, and consumers kept spending, though large corporations are warning the spending will decrease this year. Inflation is falling but remains elevated, and the Federal Reserve has raised its benchmark interest rate eight times since last March.

- Some key suppliers, like Procter & Gamble (PG) and Unilever, have said they would continue raising prices this year, forcing retailers like Walmart to choose between raising their own prices or seeing profit margins shrink.

Affording the American Dream

How achievable is the American Dream? It’s an emotional question at the core of our national identity.

To answer that, the Ludwig Institute for Shared Economic Prosperity (LISEP) has constructed a “Minimal Quality of Life (MQL) Index.”

While other affordability and inflation indexes tend to focus more broadly, LISEP argues that costs for the bare essentials, specifically housing, groceries, and health care, have jumped dramatically post-Covid.

LISEP found that this “true cost of living index” has risen over 49% more than the Consumer Price Index (CPI).

The real numbers

For all of us who live in the real world, beyond the all-encompassing benchmark calculations of central bankers and economists, it comes as little surprise to hear that day-to-day living expenses have risen considerably faster than the figures reported by government institutions.

We’ve seen it for ourselves, whether in skyrocketing egg or toilet paper prices at the store, surging prices at the gas pump, more expensive prescription drugs, or the worsening affordability crisis for housing in many metropolitan areas.

While the true cost of living has increased considerably in the last few years, that alone is not necessarily interesting since we all know that generally from our own experiences.

LISEP, however, goes one step further. They account for the basic recreational activities necessary to maintain physical and mental health by quantifying the costs associated with the “pursuit of happiness,” a fundamental aspect of the American Dream.

Calculating the MQL Index

To do this, they tracked the costs associated with seven of the most common recreational pastimes for families over the past 20 years, including eating out, watching TV, physical activity, and celebrating holidays.

There’s more to the promises of a middle-class lifestyle than just housing, groceries, and health care. LISEP hopes to capture the changes in affordability for these important experiential expenses.

It’s an ambitious undertaking. To discern eating-out costs, they used government-provided per diem data as a proxy for the cost of restaurant dinners. For entertainment costs, they monitored prices for basic TV services (with adjustments for transitions to streaming services).

For physical activity, they used adult sports equipment, such as bikes, helmets, and sneakers, to represent the financial burden on Americans just to stay active while measuring the cost of participating in school sports for children. They even tracked the affordability of local sporting events like minor league baseball.

And for family vacations, a critical aspect of many middle-class lifestyles, they tracked the cost of gas, tolls, and food for three days, hoping to reflect the iconic tradition of weekend road trip getaways.

Building on this, they also tracked costs associated with our favorite winter holidays, ranging from expected expenditures for one gift for each child and spouse in a household to decorations and a festive dinner.

Putting it all together

These are simple metrics that target the defining features of American middle-class life. The findings are fascinating: When adding these experiential costs from the Minimal Quality of Life Index to their True Living Cost calculations (housing, groceries, and healthcare), LISEP found that no family earning the median household income in 2021 of $70,784 could reasonably afford the inputs into the American Dream, nor could they in 2001, either.

Since 2001, basic recreational costs have risen 38% for the average family, whereas the CPI for recreation only rose 19% over the same period. As a result, two in five American families can’t afford standard recreation activities.

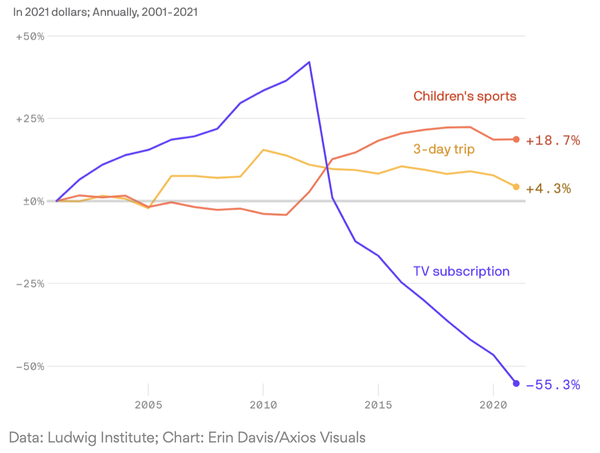

Interestingly, eating-out costs have grown the most within the “pursuit of happiness” spending basket, with holiday gifts also becoming more comparatively expensive while TV subscriptions, thanks to streaming, take up a smaller portion of the typical family’s recreational spending.

For a family with two children, LISEP estimates that they would have spent roughly $3,323 on recreation in 2001, and today, they would spend over $5,000 — that’s more than a 50% increase in two decades.

Takeaways

Fortunately, the MQL index has actually been declining since 2013 in nominal terms, thanks to streaming packages that are much cheaper than cable. The TV component of the index fell from almost $750 per year in 2012 to $277 in 2021 — a 63% decline.

This huge decline in the largest part of our recreational expenses has dwarfed more modest increases elsewhere, such as children’s sports and 3-day trips.

LISEP still paints a stunning picture, telling us that the pursuit of happiness is unaffordable for many families. More surprisingly, it hasn’t been affordable for at least 20 years.

While CPI metrics serve a valuable purpose in interpreting price changes broadly in a systematic way, there’s good reason to question how well they reflect the realities facing everyday Americans.

For most of us, daily necessities and simple recreation costs that enable us to enjoy life have risen far faster than standard inflation figures capture.

Dive deeper

Check out LISEP’s resources on the MQL Index here to learn more.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.