The risk in owning Chinese equities

5 July 2022

Hey, The Investor’s Podcast Network Community!

Welcome to The Investor’s Podcast’s daily newsletter: We Study Markets.

The first day back to work after a long weekend is never easy. Hopefully, we can be a distraction from all those other emails you have to catch up on 😁.

Let’s dive in!

In The News

😢 Greyscale’s Bitcoin Trust application to convert to an ETF denied by the SEC (Nasdaq)

Explained:

- Despite increasing institutional adoption of Bitcoin, ETFs in Canada, and an active futures market in the U.S., the SEC has refused to approve a number of applications from firms hoping to be the first to launch such a project. Many in the space saw Greyscale’s application as having the best chances for approval, but those hopes were dashed last week. An ETF approval would be hugely legitimizing for the digital asset and would also make it much easier for many to invest in Bitcoin directly through their brokerage and retirement accounts. Greyscale’s Bitcoin Trust has served as sort of a de facto ETF in the space for many, but its structure as a trust makes it more similar to a closed-end fund, which means it’s far less efficient than ETFs and can trade at large discounts or premiums to its net asset value (NAV), unlike ETFs, which have daily share redemption/creation processes to neutralize price variations from the NAV.

What to do:

- Current ‘Bitcoin’ ETFs are actually just based on the futures price of Bitcoin, meaning they don’t physically hold Bitcoin directly like Greyscale does (and was hoping to do in ETF form). Because of some unique costs related to futures trading, like the cost of rolling over monthly contracts when the market is in ‘contango‘, these futures-based Bitcoin ETFs do not perfectly track the price of Bitcoin and are actually anticipated to chronically underperform against it. This is likely not a good way for most people to invest in Bitcoin. For those intrigued by the Greyscale Bitcoin Trust’s discount to NAV which means its shares trade at a discount to the current value of the Bitcoin that backs them up, this imbalance is now unlikely to be arbitraged away anytime soon as it would have been if the trust was converted to an ETF. In other words, yes you can buy Bitcoin at a discount (over 30% recently) through shares of the Greyscale Bitcoin Trust, but the path to realizing this discount is highly uncertain. If you’re interested in Bitcoin, there are a lot of great ways to buy it directly and custody it yourself.

👏 Fidelity introduces direct Indexing for the masses (FT)

Explained:

- Direct indexing is seen by some as the next big innovation in passive investing technology. Whereas mutual funds, and then later ETFs, provided their own revolutions for previous generations, direct indexing is claimed to empower investors and, “will allow users to rebalance, purchase and redeem an entire portfolio of stocks with a single click.” While this service was previously only available to high net worth investors at other brokerages, Fidelity is pioneering this offering for everyone with minimums of just $1 invested to participate.

What to do:

- While Fidelity is the first of its competitors to offer this service, direct indexing is likely to become much more common and also affordable over the coming years. For some, it may be just a novelty to experiment with, while others will seek to create their own indices to track instead of being confined to the benchmarks tracked by mutual fund and ETF products. If you have a Fidelity account and participate in the ‘Fidelity Solo FidFolios platform’ then please let us know what you think – one thing to note is there’s a monthly fee of $4.99 to use the service.

🚨 Inflation in Turkey hits a 24-year record at nearly 79% (CNBC)

Explained:

- In conventional economic thinking, raising interest rates is typically the appropriate remedy to address elevated inflation. However, Turkey’s President, Recep Tayyip Erdogan is not conventional. He has instead instructed Turkey’s central bank to continue cutting interest rates. Interestingly, Erdogan has even described interest rates as, “The mother of all evil.” This refusal to raise rates, combined with the already high levels of inflation globally attributable to imbalances in supply and demand from the last two years of the pandemic in addition to the economic shock of Russia’s invasion of Ukraine, has created a disaster in the country. Unfortunately, so long as Erdogan is President, this partially self-inflicted crisis is unlikely to resolve itself, and the country’s central bank lacks the independence to make objective decisions.

What to do:

- Turkish equities are some of the most overlooked in the world due to many of Erdogan’s policies. For most investors, Turkey is likely not a good place to consider investing for the time being, though there are surely some undervalued companies buried beneath the economic chaos. If you are adventurous and risk-seeking, the trick will be to find undervalued companies whose revenue and cash flows are largely denominated in foreign currencies, such as dollars or euros. These companies will see their domestic operating costs, denominated in Turkish Lira, rapidly depreciating in time relative to their actual earnings, should those be earned from selling goods and services abroad.

Sponsored By

How do you make sure that you are investing with a “good” operator?

Dan Handford and his wife are currently invested in 54 different passive real estate syndications with 16 different operators in 10,000+ doors.

They use this exact list when deciding whether or not to invest with a particular group. Get access to the “7 Red Flags for Passive Real Estate Investing” to be confident in your next investment!

Deep Dive: Should You Own Chinese Stocks?

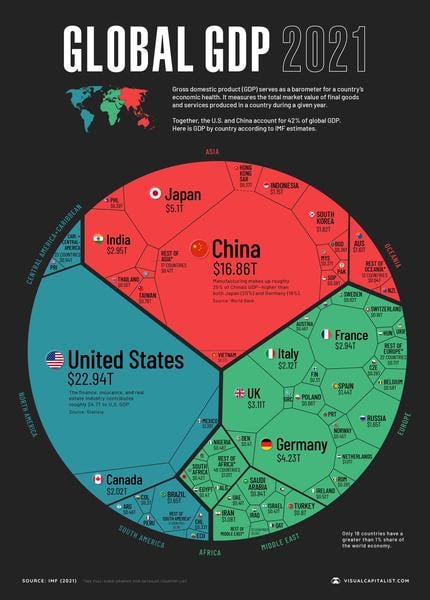

At the end of last year, Chinese equities held an estimated market capitalization of $14.1 trillion USD, representing roughly 12.6% of the total global market cap, per S&P Global. But China’s GDP is around 17.9% of the global economy, whereas the United States’ is 24.4%, yet the market cap of U.S. stocks is vastly disproportional at approximately 41.6% of the global total.

In other words, U.S equity markets are valued at a considerable premium relative to their actual share of total economic output – more than three times China’s share of global market cap despite having comparable sizes.

Add to this that for decades the Chinese economy has been reportedly growing much more rapidly than America’s, plus China’s considerably larger population and a correspondingly larger potential for future economic growth, and one may begin to seriously question if they’re exposed enough to Chinese markets.

So what’s the issue?

There’s a big difference between owning equities as a Chinese citizen in China versus owning them in your 401(k) in the U.S.

This is because of strict limits on foreign ownership of Chinese companies put in place by the ruling Chinese Communist Party (CCP), which means that for most of us picking individual stocks, like Alibaba, or allocating to broad emerging market ETFs, where Chinese equities tend to have a very high weighting of typically 30%, there’s good reason to better understand these differences.

The shares of Chinese stocks trading in the U.S. are sometimes not derived directly from these companies, but rather from what’s known as Variable Interest Entities (VIEs).

These are shell companies established outside of China to circumnavigate foreign-ownership laws, meaning they’re artificial, and based in places like the Bahamas. While theoretically being entitled to the earnings of the parent company operating in China, this is far from legally guaranteed.

In fact, this can be at best described as a legal gray area, where the CCP has chosen to ignore the dynamic, as Chinese companies have massively benefited from raising billions of dollars from Western capital markets.

(Chinese share classes can be confusing – here’s a nice guide breaking them down.)

In 2011, this VIE structure was brought to the forefront of investors’ minds when Yahoo and Softbank lost out as key shareholders in Alibaba, as Jack Ma was able to legally transfer the valuable Alipay unit to an entity he controlled without approval from other shareholders.

While a settlement was made with these foreign firms, the reimbursement was partially contingent on Alipay going public, but this was blocked by Chinese regulators in 2020 as part of Ant Group’s IPO.

For investors outside of China, the issue is that while you may be able to go into your brokerage account and purchase Chinese stocks, just like you would Apple or Tesla, what you actually are buying may prove drastically different.

Shares of U.S. companies traded in American stock markets represent legal guarantees to ownership within a democracy and independent court system, but this is not the case in China, and those ownership promises conveyed by the VIE system may not hold up should the U.S. and China see a future deterioration in their relationship.

If, for example, the U.S. bans listings of new Chinese stocks in its capital markets as a political response, the CCP may see little reason to continue turning a blind eye to the VIE model.

The issue of particular concern that may escalate tensions relates to Taiwan. The history is complex, and others are much more qualified to explain it than us, but the U.S.has made a strategic point to help Taiwan protect itself, and Joe Biden recently suggested the American military would be used to intervene directly should Taiwan’s sovereignty be threatened.

On the other hand, the CCP, and its leader Xi Jinping, in particular, have made it known quite publicly that bringing Taiwan under their control is one of their long-term goals.

What does this mean for those holding Chinese stocks in their investment accounts?

Well, possibly the same as it meant for foreigners holding Russian stocks after the invasion of Ukraine, the shares are effectively worthless, and there’s little hope of salvaging their value through international court systems.

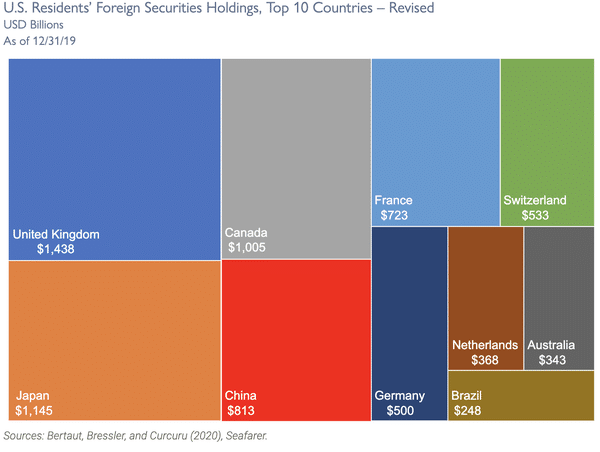

Russian equities are seldom a part of the average investor’s portfolio to any meaningful extent, but this is not true for Chinese equities.

Blindly investing in Chinese stocks, even through passive emerging market ETFs, may prove to be a painful oversight for many in Western countries should U.S. and Chinese relations ever take a turn for the worse, especially for those who failed to properly understand what they actually own when buying these shares.

The takeaway?

In some sense, a bet on Chinese equities (through the vehicle of U.S markets as opposed to investing directly in China with ‘A ‘ shares) is really a bet on continued normal diplomatic relations between the U.S. and China.

As we’ve recently uncovered with Russia, competing global superpowers can maintain years of interconnecting economic, financial market, and political relationships only to watch them almost entirely vanish overnight.

Great investors typically weigh event probabilities in their equity valuation, and although it’s quite hard to say if/when China would act to force reunification with Taiwan, the likelihood of this happening at some point in our lifetimes is uncomfortably high.

For long-term buy-and-hold investors seeking to diversify their portfolios with allocations to China, it may be worth seriously considering just how much exposure to Chinese equities through the VIE structure you’re willing to have, assuming that these could go to zero on a whim like investors in Russian stocks learned this year.

For traders and others with shorter time horizons, perhaps there’s still money to be made here, but how can those looking to compound wealth over time own something that’s long-term value is functionally zero, assuming it truly is ‘inevitable‘ for China to reunify a currently independent Taiwan?

Quote of the Day

“We can never be sure, but this seems like a reasonable time to start buying. Things may well go lower. In that case, I hope we’ll have the will to buy more. It makes no sense to say: ‘I’m not going to buy until we reach bottom’ We never know when we’re at the bottom.”

— Howard Marks, speaking with the Financial Times

Meaning

As financial markets have been rocked by large selloffs this year, true value investors, such as Howard Marks, are starting to look for bargains amidst the carnage.

His point here is that it’s impossible to pinpoint the exact right time to begin buying up financial assets after a downturn, but when valuations start to reach an attractive level, it’s smart to begin incrementally buying again.

Even if you’re convinced there’s more downside to come, as there may well be, you’re very unlikely to know when we’ve hit the bottom, so cautious dollar-cost averaging may be an excellent way to exploit cheaper prices.

More on dollar-cost averaging in the next section below 👇

For more Howard Marks, check out our interviews with him on We Study Billionaires episode 378 and Richer, Wiser, Happier episode 2.

Dollar-Cost Averaging

Dollar-cost averaging refers to frequent, small investments or purchases over time rather than putting in all of your investable money at once.

For example, let’s say you receive a $10,000 end-of-year, after-tax bonus you want to invest.

You could spread that investment out over five months with $1,000 contributions every two weeks to an index fund. The primary advantage is that you smooth out your investing journey which may make it easier to stay invested longer.

Large lump sum investments can be intimidating and have a layer of market prediction in them, as you’ll be tempted to try and pick the perfect time to invest.

This could excessively delay your wealth compounding process as you wait for the right moment or position you precariously into buying at a market high before a downturn.

Both of these are undesirable, so a frequent and recurring investment contribution plan is often utilized to reduce market risk and the likelihood of emotional reactions to marketmovements.

See You Next Time!

That’s it for today on We Study Markets!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.

Have a great rest of your day!

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!