The Truth About Growth Stocks

29 July 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Wow. What a week it’s been!

Our heads are spinning 🤯 The U.S. economy declined for a second quarter in a row, a common definition of recession, yet stocks notched decent gains.

Amazon (AMZN) has popped over 12% in after-hours trading after second-quarter revenue exceeded expectations, and Apple (AAPL) reported an almost 11% decline in profits due to supply constraints and shutdowns in China.

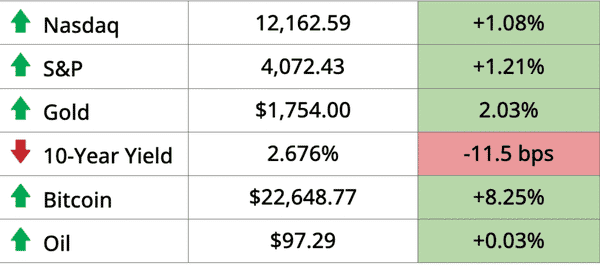

*As of 4pm EST on prior day’s close

Today, we’ll discuss China’s property woes, the real cost of market timing, Bitcoin price action, and value investing 3.0. All this, and more, in just 5 minutes to read.

Let’s get it going!

IN THE NEWS

🚨 China’s Central Bank Bails Out Troubled Real Estate Sector (FT)

Explained:

- The Chinese economy is uniquely sensitive to its real estate sector, as for years spurious building projects and speculations have fueled domestic GDP growth, yet increasingly introduced fragility into the financial system. Now, a property downturn, first made famous by the massive and now bankrupt property developer China Evergrande, is threatening the Communist Party’s economic plans.

- The People’s Bank of China will issue up to $148 billion in cheap loans to state-sponsored banks intended to help these banks refinance stalled real estate projects. The Chinese government is getting a crash course on managing moral hazard here, that is, balancing social costs associated with financial losses and not incentivizing reckless speculation, since it’s believed that higher returns can be earned with greater risk while the government will intervene with bailouts should losses become extreme.

What to know:

- One Chinese bank estimates that around eight million homes and apartments have been stalled or abandoned across the country, leading to serious concerns of social turmoil and financial contagion. In a political system where the government maintains intimate influence over its population, such matters are not taken lightly.

- Many Chinese citizens have been left holding mortgages on properties that were never completed, as development companies sold the residencies in advance, yet were so leveraged and sensitive to changes in credit conditions, they lacked proper financing to continue operating.

🛢️ Exxon Posts Record-Breaking Second Quarter Profit (Reuters)

Explained:

- Exxon Mobil (XOM) is the United States’ top oil producer, and with soaring energy costs, the company reported a $17.9 billion second-quarter net income, which is nearly four times higher than its reported earnings from just a year ago.

- While many hope for a world less reliant on fossil fuels, Russia’s invasion of Ukraine and struggle with the West has made the matter an important geopolitical issue, and oil and gas companies have undoubtedly benefited from the affair. President Biden has been quick to criticize the industry’s profits as immorally benefiting from supply shortages during a time of war.

What to know:

- For years, oil companies have been beaten down, and shareholders have been punished for owning these carbon-emitting stocks. Yet, now, perhaps more than ever, it’s clear that their services are still extremely valuable, as alternative energy sources have not developed enough to offset energy demand amidst significant global uncertainty and strained output.

- To the U.S. government’s chagrin, rather than reinvesting in more production to alleviate supply shortages, companies like Exxon are generally paying down debts, buying back shares, and issuing dividends to shareholders.

- These are politically unsavory moves, but companies like Exxon are private and international operations that are not necessarily obligated to make sacrifices in the national interest. This will continue to be a hot-button topic and your opinion will likely differ tremendously depending on your perspective, whether as just a consumer, a government official, or a shareholder of these companies.

📈 Bitcoin Rips Higher On Fed Hike (Fortune)

Explained:

- Bitcoin was up nearly 10% yesterday following a widely expected 75-basis point Fed rate hike, along with news that the U.S. economy shrank for the second straight month. At the time of writing, it is currently trading at $24,046. Bitcoin is down 65% from the all-time high of $68,000 in November of 2021. The 2013 and 2017 cycles found a bottom with drawdowns of 84.82% and 83.47% respectively from their all-time highs.

What to know:

- Bitcoin gains for July could top 20%. Does Bitcoin have more room to fall in this cycle though? The Bitcoin bulls may not be out of the woods yet, and some think this is a typical bitcoin bear market rally. Is the recent pump just be a head fake? As the old adage says, “Don’t Fight the Fed,” still holds true.

- An 80% retracement would mark the bottom for Bitcoin at $13,600. As anyone knows that’s been involved with Bitcoin, anything is possible. Stay safe out there!

Tweet about this:

FEATURED SPONSOR

Inflation keeping you awake at night? Sleep well tonight by knowing you invest in one of the best inflation-hedged investments there is — real estate.

DIVE DEEPER: VALUE INVESTING 3.0

Traditional value investors have balked at the pricey valuations of Amazon, Alphabet, and many of the other technology darlings, but they’ve missed out on owning some the best-performing stocks of the past twenty years.

Adam Seessel’s book, “Where the Money Is: Value Investing in the Digital Age,” proposes a few new caveats to traditional value investing methods. Bill Ackman and Joel Greenblatt have both said it’s one of the best books on investing they’ve read in years. Adam is the founder of Gravity Capital Management and graduated summa cum laude from Dartmouth College with a BA in Religion. His first career was as an investigative journalist, and he contributes to both Barron’s and Fortune regularly.

Mr. Seessel entered the world of finance as an oil-and-gas analyst as the internet boom took hold and investors developed an “irrational exuberance” about dot-com companies. While unheard of (and unsustainable) gains were being enjoyed, Adam was a value investor looking for companies trading at low valuations. When the bubble burst in 2001, his career took off, and in 2003, he started his own value-oriented firm.

In his book, he writes that his funds experienced a “wretched period of underperformance” in the mid-2010s. His method of value investing wasn’t working and watching the value of tech stocks soar felt incredibly frustrating. He decided then that he needed to either change his approach or “consign myself and my clients to a future of dismal performance.”

For someone who studied religion and was familiar with transformational experiences, what happened next was his own version of a financial conversion. He bought shares of Google, then Amazon, then Intuit, and more until his portfolio was loaded with tech stocks. As he says, he unwillingly changed his tune and gave up his faith in traditional value investing with some reluctance, but he did it because he could no longer ignore the returns tech investors were enjoying.

So What?

How good was it for tech investors? Seessel estimates roughly two-thirds of U.S. market gains have come from the information technology and related sectors since 2016.

If Benjamin Graham’s style of buying cigar butts with a few puffs left is Value 1.0, and Value 2.0 is Warren Buffet’s focus on buying quality businesses at a fair price, then the systematic framework Mr. Seessel has developed is Value 3.0 which focuses on business quality, management ability, and price (BMP as he calls it). He writes, “it just so happened that when I overlaid this template on companies I was studying in the early twenty-first century, 90% that fit the framework turned out to be tech.”

As Seessel says in his excellent interview with TIP’s Clay Finck, “my system of looking for low PE, low price-to-book stocks just stopped working. And so I was forced with a sort of fork in the road. Either I stick with this system or I say, “Well, maybe some of the metrics are broken.” Ten years ago, only two of the top ten companies by market cap in the world were tech, and today eight are.

He continues, “so I decided that value investing needs to evolve, to widen its aperture, to increase its scope, to include these new economy companies.” Historically, value investing has worked and reversion to the mean could be relied upon, but Seessel questions whether in today’s tech economy, if an industry like brick and mortar retail can be counted on to revert to the mean or has something fundamentally changed by the entrance of Amazon (AMZN)?

As Warren Buffet has said “growth is a necessary component of value. Buying stuff with low PEs and low price-to-book ratio does not constitute a value purchase, nor does buying stuff with a high PE and a high price-to-book constitute a bad investment. It all depends.”

Mr. Seessel says the reason he wrote the book is that tech stocks are value stocks in the sense that they are valuable, but they just don’t look valuable on traditional metrics. Why then, have they gone up so much in the last decade? Has it all been a hoax or is there something that the numbers aren’t showing us?

Adam urges his readers to ask themselves, “Who can outcompete these guys?” Do they have an endurable moat that others have tried to take on and failed? For example, Microsoft spent $15 billion on Bing to try to outcompete Google and failed. That’s an enduring business for further consideration.

What distinguishes his Value Investing 3.0 approach comes down to accounting. Tech stocks require a different analysis of their financial statements because they look so different from old-economy stocks. Most tech companies have little in the way of assets and they spend large amounts on research and development and new customer acquisition. This makes tech stocks look incredibly expensive when measured by traditional metrics like price-to-earnings or price-to-book ratios.

Instead, value investors in tech stocks need to discern what Seessel calls earnings power which is “a digital company’s latent, underlying ability to generate profits.” Amazon is a perfect example of this. The company’s valuation has averaged ten times higher than the market, but it has also outperformed the market by a factor of 300. This is due to Amazon plowing profits back into research and development or new customer acquisition.

It will be interesting to see how Seessel’s method of value investing plays out given how ncompatible it is with the old orthodoxy. As he says, “either the market is wrong and we’re in for another tech wreck, or many of the traditional yardsticks for measuring value are broken.”

Since the publication of the book, tech stocks have been hammered across the board, but maybe now is the time to utilize some of these ideas and search for value amidst the tech fallout? What are your thoughts? If you are a traditional value investor, are technology companies amongst your considerations for investment given their high valuations based on traditional metrics? We’d love to hear your thoughts.

You can also check out Trey Lockerbie’s interview with Adam here for another great discussion.

Tweet about this:

THE REAL COST OF MARKET TIMING

While the U.S. stock market has historically offered generous returns, it’s common for investors, particularly beginners, to feel as though they could juice their earnings even further by effectively selling stocks at their top, and buying back in later at lower prices.

We’ve all felt this instinct before, and self-confidence biases tempt us to play our hand at this speculative game.

So what’s the truth – is it possible to nimbly jump in and out of markets during volatile swings upward and downwards to amplify your returns?

The short answer, is that for the vast majority of investors, acting on musings about market directions is probably a bad idea. While it’s one thing to thoroughly calculate a stock’s intrinsic value and trade around that, it’s another thing entirely to do so with respect to the broader markets. As they say, “markets can irrational longer than you can stay solvent.”

Show me the data

From 1970 through March 2020, a nice round 50 years, a $1,000 investment would have grown to $121,353. Had you been on the sidelines though for just five days each year, assuming those were the five best trading days, your final amount would drop to $77,056. And if you missed the 25 best trading days each year, you’d be left with just $26,989.

Sure, you’re unlikely to consistently miss the best days of the year each year over time like this, but why take that gamble when just a few days in an entire year can make or break your total returns?

What’s the point?

Perhaps you’re not a day trader making active bets in the market, but market timing may still impact you. The cost of market timing is essentially your opportunity cost in not being fully invested whenever possible.

For example, maybe you get your end-of-year bonus, and think, I’m going to wait a few months until stocks start going down again before I invest this. This is market timing, and research has shown that investing spare cash (that is, cash which is intended for your investments and not being used for life expenses) as soon as possible is far better than a wait-and-see approach.

This is not necessarily said to discourage dollar-cost-averaging, which is an investment allocation plan built around consistent and recurring fixed investment contributions that has been shown to provide behavioral advantages in maximizing returns over time. But rather, the point is that for long-term investors, it’s preferable to put your available money to work sooner, rather than trying to time the ideal entry point.

What do you think – is it worth trying to time the market? Hit reply to this email to share your experiences with us.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.