Vanishing Equity

30 November 2022

Hi, The Investor’s Podcast Network Community!

🇪🇺 The European Union has threatened to ban Twitter unless the platform maintains strict content moderation rules.

Meanwhile, the U.S. government is considering investigating Elon Musk’s purchase of the company to see whether foreign investment in the deal poses national security risks.

At the same time, Musk has highlighted alleged threats from Apple that it may remove Twitter from its app store.

Markets were more concerned with remarks from Fed Chairman Jerome Powell, though. He eased tensions by implying that the next Fed rate hike will be smaller in magnitude.

This was more than enough to send stocks dramatically higher 🚀

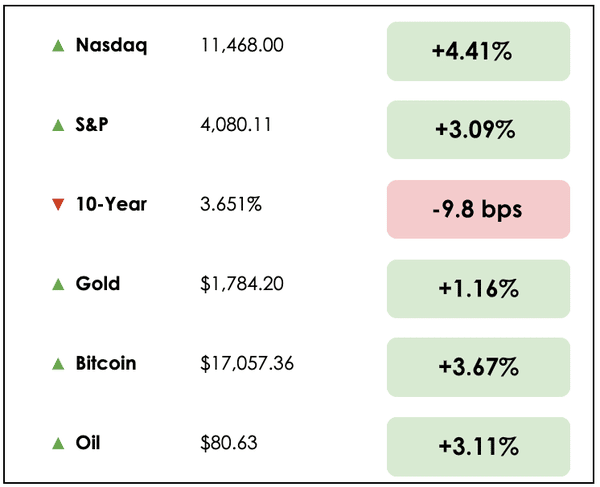

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Airbnb’s ambitious new business endeavor, and inflation figures in the Eurozone finally deliver some hope, plus our main story on how over $1 trillion in housing equity was wiped out in just a few months.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🏢 Airbnb Switches Up Its Business Model (WSJ)

Explained:

- In a new service, Airbnb (ABNB) will feature rental apartments in 175 buildings managed by some of the biggest landlords in the country. The aim is to expand its offerings in multifamily buildings where owners have typically shunned short-term rentals.

- Its platform will now include rental apartment listings similar to Zillow or Apartments.com, but only units eligible for short-term sublets will be included, with subleasing lasting up to 180 days.

- To entice landlords to approve these arrangements in their buildings, Airbnb will share roughly 20% of revenues with them from sublets booked on its site.

Why it matters:

- This novel business expansion creates additional income sources for both Airbnb and partner landlords while making it easier for renters to sublet their apartments, especially on a short-term basis.

- A third of U.S. households rent their homes, but apartments in large rental buildings only accounted for about 14% of Airbnb’s listings as recently as October, and that figure has been declining.

- Although most landlords don’t allow tenants to sublet their apartments on Airbnb or similar sites, by sharing the wealth in this new initiative, rental markets may fundamentally change.

📉 Eurozone Inflations Falls More Than Expected (FT)

Explained:

- For the first time in 17 months, inflation rates have fallen in the eurozone, lending hope that central banks may finally turn the tide in the fight against inflation.

- Moderating services and energy prices helped tamp down inflation month-over-month, though inflation figures are still 10% higher than last November.

- The U.S. is a bit ahead, with price inflation falling for several months already after surging this summer.

Why it matters:

- While it’s just one data point, given how dramatically central banks have raised rates globally this year, any improvements in inflation data may enable lower incremental rate hikes.

- The European Central Bank (ECB) is now eyeing a 0.5% rate hike in December instead of its previous 0.75% raises.

- There are concerns that since a recession could naturally cool inflation, raising interest rates in an already difficult economic environment only worsens things. The ECB, like the Fed, will probably take a more moderate approach going forward, where they hike rates more slowly but keep them higher for longer.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

WHAT ELSE WE’RE INTO

📺 WATCH: What to know about a de-globalizing world, an overview from geopolitical strategist Peter Zeihan.

👂 LISTEN: The various crises in crypto, explained by Dylan LeClair on Bitcoin Fundamentals.

📖 READ: How to get over “financial perfectionism,” from Katie Gatti.

THE MAIN STORY: VANISHING HOME EQUITY

Overview

Is it over for the decade-long housing boom in the U.S.?

The market has gone eerily quiet in many places. Buyers are exiting the stage and so are sellers.

The real estate agents who served them during the pandemic housing frenzy are now left scrambling for listings or even searching for new careers as deal flow plummets.

What’s going on?

Existing home sales have fallen for nine straight months. The supply of single-family homes is growing, and with interest rates hovering at 7%, many experts predict a large-scale housing slowdown.

As intended, the Federal Reserve has crushed demand by aggressively raising rates.

While analysts are calling this housing downturn a correction, most still don’t expect an outright bust similar to the Great Recession in 2008.

Most homeowners who bought in recent years have locked in rock-bottom fixed rates, making their payments affordable.

That means a surge in defaults and foreclosures, like the ones that crashed the U.S. housing market in 2008, are unlikely.

What to know

The housing landscape is very different than it was after the 2008 crisis. Most of today’s homeowners are flush with equity from the decade-long increase in values.

And 30-year, fixed-rate mortgages are the norm, allowing borrowers to ride out volatility in interest rates.

In 2008, homeowners weren’t locked into low rates. In fact, many took out adjustable-rate mortgages with little money down.

They had no skin in the game. As rates rose, their monthly payments were pushed up, and many couldn’t afford to keep their homes.

Why it matters

Today’s typical home is only affordable to households earning over $100,000. Brokers are struggling to find buyers. And good luck trying to convince a homeowner to sell, especially if it means trading in a 3% mortgage for a much more expensive one.

For the logjam to break, affordability has to improve, which means either a significant drop in prices or interest rates. Borrowing costs have come down after crossing 7% a few weeks ago, but it’s unlikely they will fall much more in the short term.

Sellers could potentially remain on the sidelines for years if they need to, keeping the real estate market frozen and stuck.

Crash coming?

Gone are the days when sellers could name a price, and buyers would pay or even pay above the list price. Now, the housing market is returning back to earth, with more homes selling below their listed price and staying on the market longer before selling.

Rather than a real estate crash, it’s much more accurate to call what’s happening a correction. The buying frenzy during the pandemic was a “historically unusual” situation, said Nicole Bachaud, senior economist at Zillow. She expects the market to revert to pre-pandemic trends.

Vanishing equity

As housing prices have returned to more realistic levels, a staggering $1.37 trillion of home owner’s equity evaporated in the third quarter, according to calculations performed by mortgage technology firm Black Knight.

This is the biggest single-quarter decline since 2000 by dollar value. On a percentage basis, it’s the steepest drop since 2009.

Keep in mind that the real estate market is location-dependent. The cities with the largest drops in equity include San Jose (24%), Seattle (21%), and San Francisco (20%).

More than half of the decline in national home equity was due to falling prices in California.

What’s Next?

Further declines in home prices are likely headed our way. But an outright collapse in prices is unlikely, according to most analysts.

Still, lower housing prices of any kind will be a welcome relief to frustrated, would-be buyers.

Folks that bought homes in 2021 or this year are most at risk of ending up “underwater” on their mortgage — owing more than the house is worth. That’s a precarious place, as those who remember the Great Recession know.

According to Bachaud, “We’re not going to see these steep price declines because we just don’t have the inventory that would allow something like that to happen.”

What’s the real estate market like in your area? Do you agree with the assessment that we’ll have a correction but not a 2008-like collapse?

Dive deeper

For more about the current state of the real estate market from an investor’s perspective, check out Robert Leonard’s interview with Neal Bawa on Real Estate 101.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.