Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

How the Economic Machine Works

By Rebecca Hotsko • Published: • 13 min read

Understanding how the economic machine works can be useful for anyone looking to make informed decisions when it comes to investing, entrepreneurship, or simply navigating the economy. One of the most successful investors of our time, Ray Dalio, the founder of Bridgewater Associates, has gained a reputation for his unique investing philosophy and his deep understanding of how the economic machine works.

In this article, we’ll take a closer look at Ray Dalio’s insights on the workings of the economic machine and explore how you can learn from successful investors like him to become more resilient and better equipped to navigate the challenges of the economy.

WHO IS RAY DALIO?

Ray Dalio is an American billionaire investor, and famously founded the hedge fund Bridgewater Associates, which is one of the world’s largest hedge funds and trades in almost every market around the world.

Ray started his career on Wall Street in the 1970s and quickly made a name for himself as a successful trader. Over the years, he has become well-known for his unique investment approach, which is based on principles such as radical transparency, systematic decision-making, and a deep understanding of the economic machine.

In January 2022, Ray Dalio appeared on the We Study Billionaires podcast where he shared his principles for navigating the changing world order and offered valuable insights for investors looking to succeed in an evolving global landscape.

WHAT IS BRIDGEWATER ASSOCIATES?

In 1975 Ray founded Bridgewater Associates from his two bedroom apartment in Manhattan. Over the years, the firm has grown to become one of the largest and most successful hedge funds in the world.

Since its inception in 1991, Dalio’s flagship Bridgewater Pure Alpha fund has outperformed the S&P 500 by an average of 4.7% per year which is an impressive feat given the volatility of the markets over this period. For instance, during the 2008 crisis, the US stock market was down -50%, while Dalio’s flagship Bridgewater Pure Alpha fund was up 9.4%.

In addition to its stellar performance, Bridgewater Associates is known for its unique investment approach, which is based on the principles of radical transparency, meritocracy, and systematic decision-making.

Ray Dalio’s unique investment philosophy has shaped the strategies and approaches of investors and fund managers worldwide. For more information on how to determine your own investment philosophy, check out our article on the topic.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

HOW THE ECONOMIC MACHINE WORKS

Ray Dalio is a student of history, studying past market cycles and looking at macro trends to inform his investment strategy and understand how markets work. The foundation of his investment strategy starts with his framework on how the economy works.

According to Dalio, the economy can be thought of as a machine that is made up of different parts, including credit, debt, and the central bank. When these parts are working together smoothly, the economy is in a healthy state. However, when imbalances occur, such as excessive debt or a sudden contraction of credit, the economy can experience a crisis.

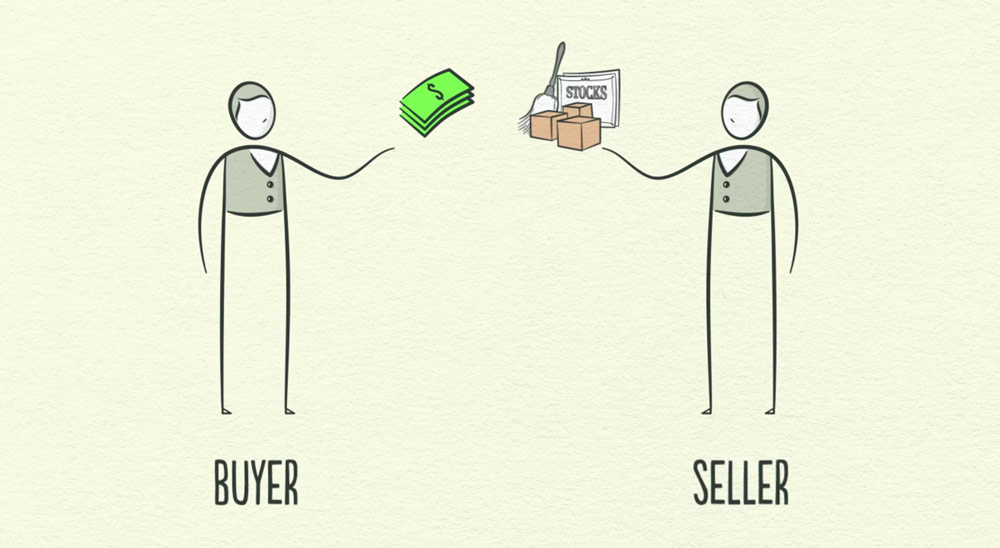

He explains that the economy is the sum of all the transactions carried out by people, businesses, banks, and the government in a society. All cycles and all forces in an economy are driven by transactions. So by understanding transactions, we can understand how the economy works.

Every transaction consists of a buyer that exchanges money or credit with a seller for goods, services, or financial assets.

The important thing to understand is that spending drives the economy, because one person’s spending is someone else’s income.

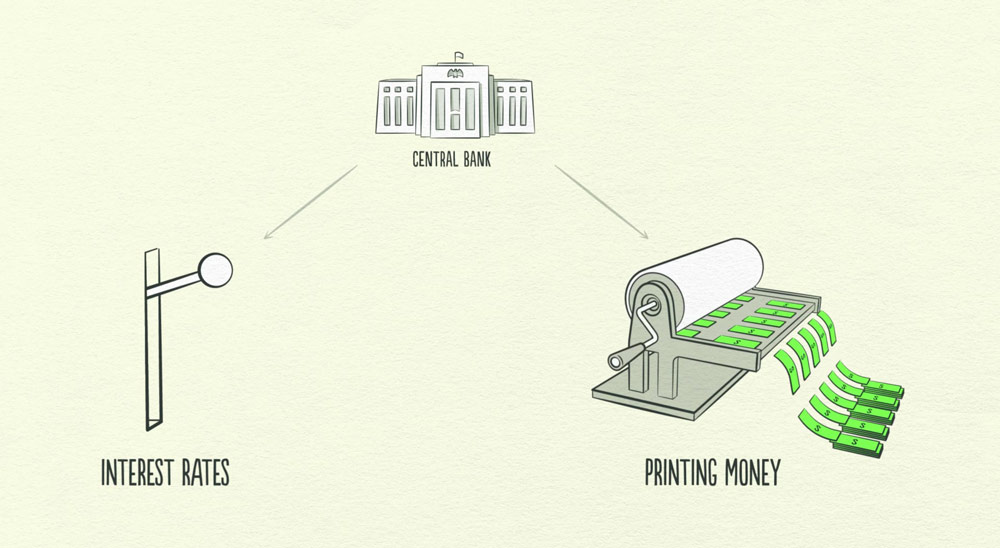

The government is the biggest spender, and is made up of the central government, which collects taxes and spends money, and the central bank, which controls the amount of money and credit in the economy through the use of interest rates and printing new money.

Because one person’s spending is another person’s income, one way an economy can grow is when people increase their productivity. This is because the more productive a person is, the more money they will earn, and the more they will spend, boosting the economy.

However, productivity isn’t the primary driver of economic growth in the short term, credit is. Credit plays a pivotal role in enabling an economy to grow. This is because credit allows people to increase their spending beyond their earnings. Credit essentially involves borrowing from one’s future self.

In an economy with no credit, the only way to increase your economy is to produce more. But in an economy with credit, you can also increase your economy by borrowing.

Credit can be beneficial for an economy when used for purchasing productive assets that increase productivity, but detrimental when used for unproductive assets that cannot be paid back in the future.

Additionally, too much credit can lead to inflation and eventually a recession. Inflation happens when spending and incomes grow faster than the production of goods, leading to an increase in prices and a decrease in purchasing power.

This is where the central bank comes in.

Central banks exist to make sure inflation stays within a targeted range of typically 2-3%. If inflation begins to climb above the 2-3% range, as we have experienced over the last couple of years, central banks respond by increasing the interest rates in the economy. This will make borrowing money more expensive, and deter people from spending more money today, which in turn, brings down inflation.

Dalio explains that the two other big forces in the economy to understand are the debt cycles.

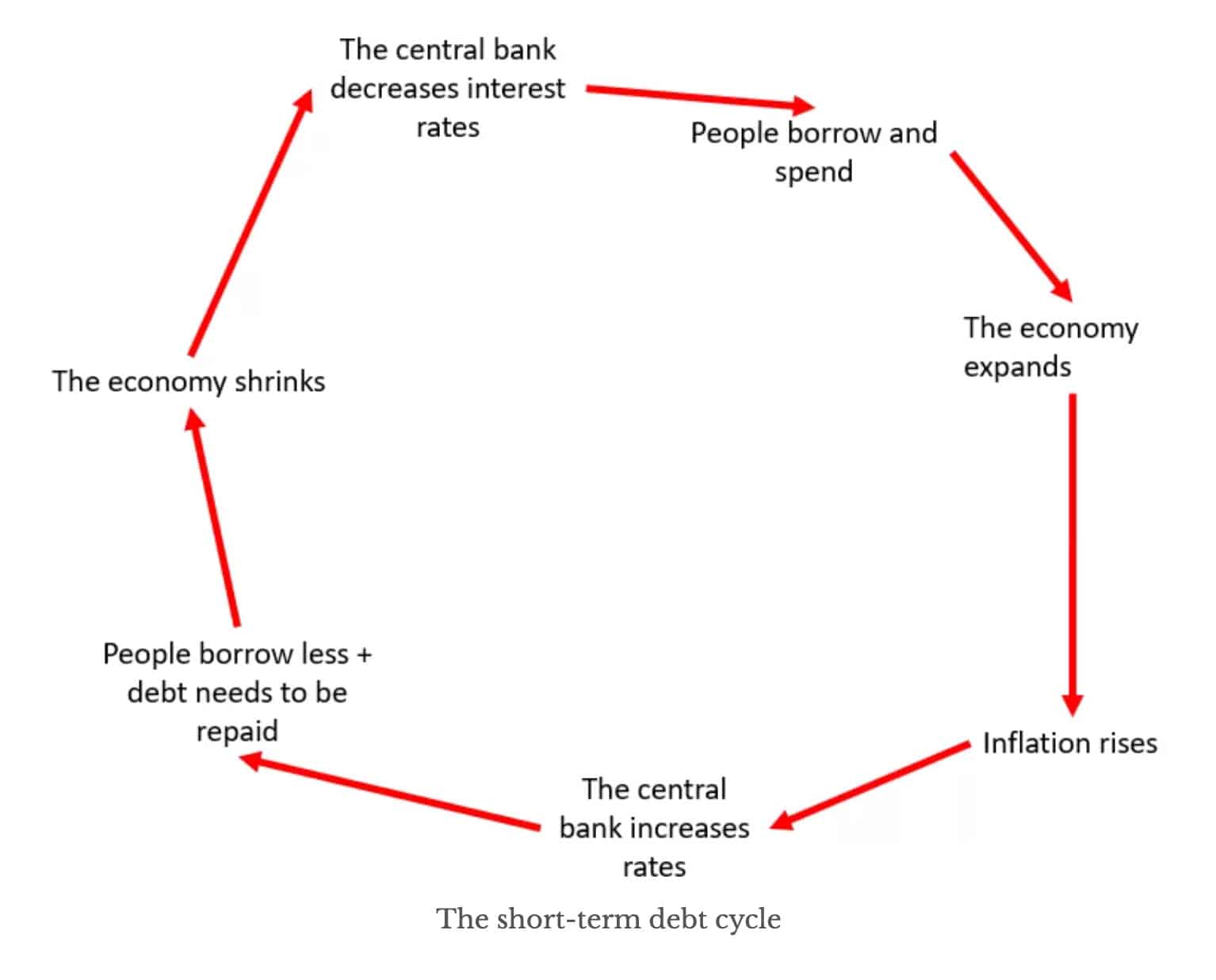

The first is the short term debt cycle, where spending is determined by the willingness of lenders and borrowers to provide and receive credit. When times are good, people are earning lots of money, then credit is easily available and the economy is expanding. When times are bad, people aren’t earning as much money, borrowers aren’t as willing to lend money to people in fear they won’t get repaid, credit dries up and the economy contracts.

This is the flow of the economic cycle that typically lasts five to eight years and happens over and over.

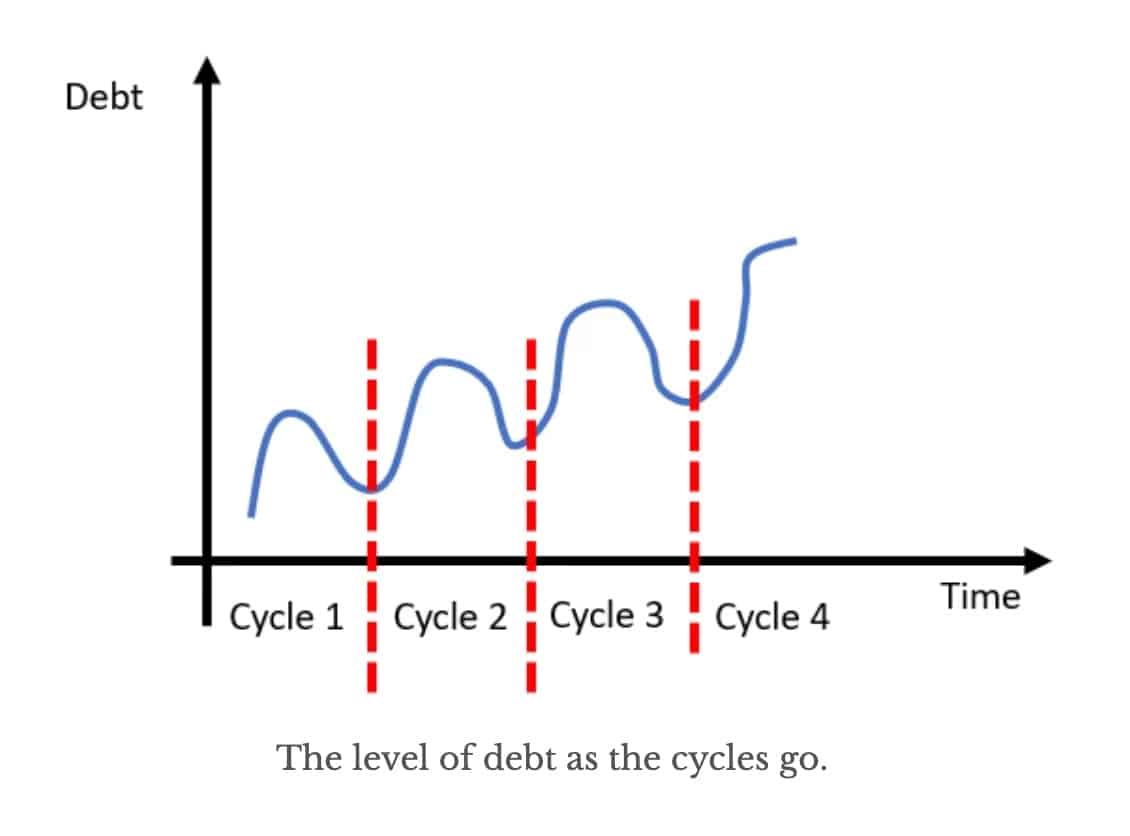

Each short term debt cycle finishes with more growth and debt than the previous cycle. This means that over the years, economies tend to have higher economic output, but also more debt.

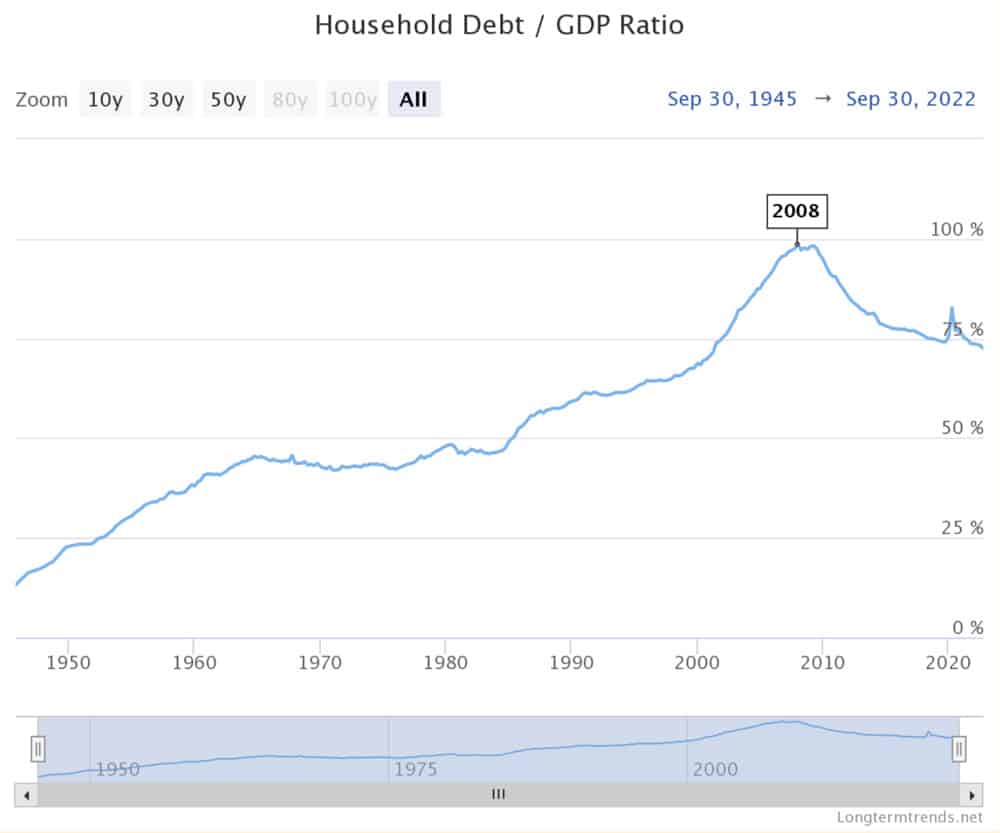

Because of this inclination for people to spend more than they earn over time, this creates the long term debt cycle, which happens when debts rise faster than income, creating a bubble.

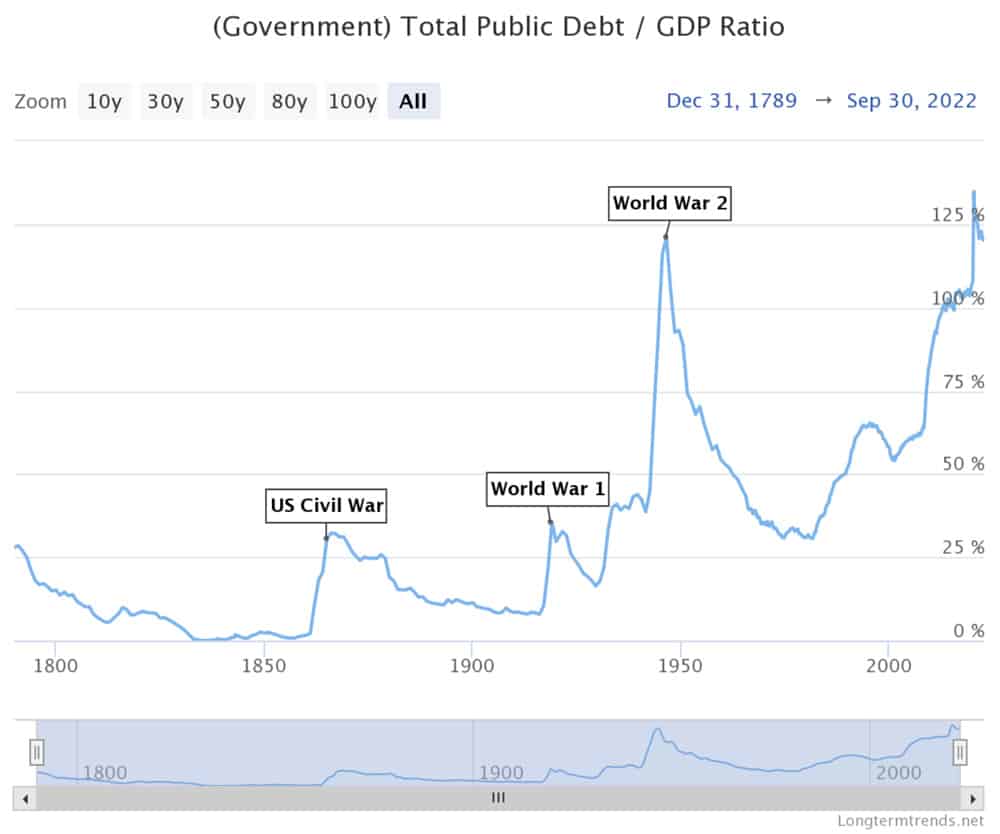

Today in the US, Total Public Debt/GDP is at its highest levels since World War 2.

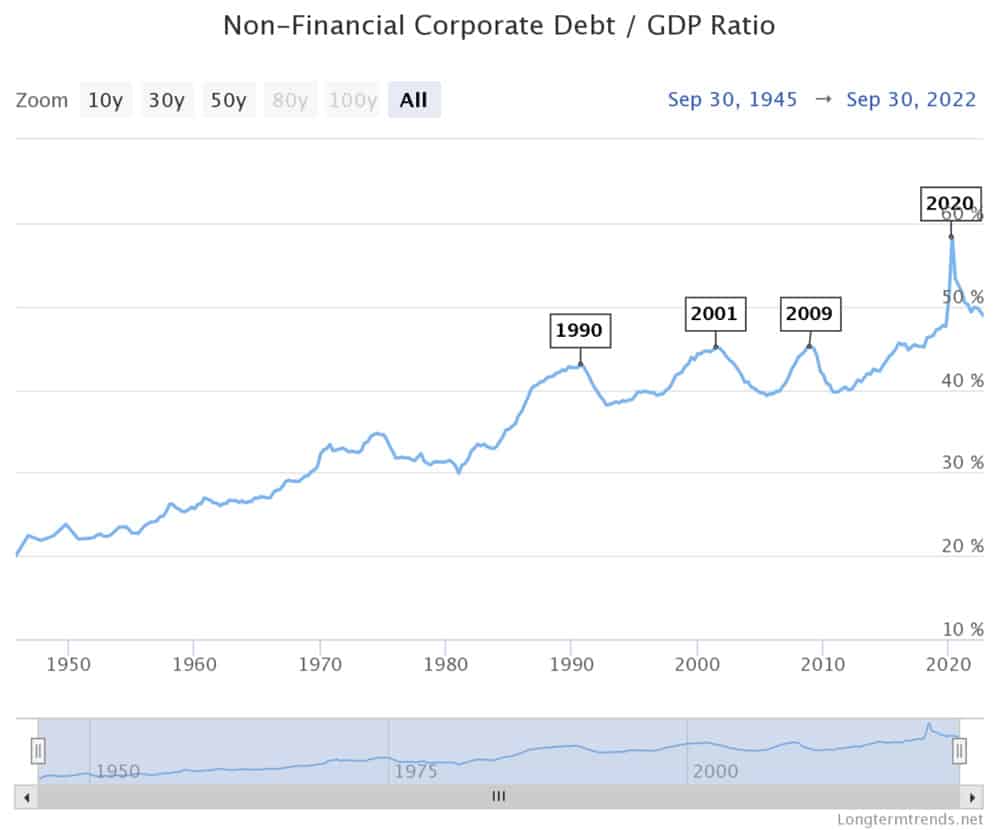

Corporate debt is near its highest levels in history, although down slightly from pre-pandemic highs.

Consumer debt is also very elevated, surging to a record $16.90 trillion in the fourth quarter of 2022, the sharpest increase in two decades. This is largely because of rising mortgage and credit card balances due to rising inflation and interest rates. Mortgage debt, which accounts for the bigger portion of total debt, increased by $254 billion to $11.92 trillion at the end of 2022 during the time when the Fed increased the average rate on a 30-year fixed mortgage above 7%, a level not seen since 2001. Credit cards increased by $61 billion, the most on record, as well as auto loan balances rose by $28 billion.

Despite the trend of economies becoming more indebted over time, because lenders are still willing to extend credit, people increasingly buy more with borrowed money, which leads to a bubble over time.

During the Millennial Investing podcast, I had a conversation with David Hay who expressed his belief that we are currently experiencing the largest financial bubble in history.

But, this can’t last forever, and at some point, debt repayments start growing faster than incomes, forcing people to spend less, incomes fall, credit disappears, asset prices drop, the stock and real estate markets decline and banks get squeezed.

Eventually this bubble pops.

For the US, Europe and much of the rest of the world, this happened in 2008 during the financial crisis. It also happened to Japan in 1989, and the US in 1929. There are some signs it is beginning to happen in 2023.

This is the point where the economy begins de-leveraging.

While this sounds like a recession, the difference in this scenario is that central banks can’t cut interest rates to help get the economy back in growth mode. This is because either, interest rates are already low, or credit has dried up as borrowers are unable to manage their debt burden at the current levels and lenders refuse to lend more.

In this scenario, the central bank can’t use its conventional tools in order to get the economy back on track. This means that the economy has to decrease its debt burden, which is a much harder feat and requires coordinated efforts from policy makers.

In the US, interest rates hit 0% in 2008 during the deleveraging of the economy and again in the 1930s.

The good news is that today, the Federal reserve does have the capacity to reduce interest rates to stimulate the economy as rates are currently sitting at 4.75%-5%, far from the zero band. That said, we are seeing credit dry up as borrowers are becoming more and more indebted, with incomes not rising fast enough.

On top of that, some experts think that the Fed won’t be quick to step in and save markets this time and instead Powell may be trying to break the well known Fed Put. If this is the case, we could potentially see many defaults, restructuring from businesses with some disappearing all together, which would help reduce the debt load. However, this would also cause asset values to decline because debt restructuring causes income and asset values to disappear faster, causing the debt burden to get worse.

This is where the everything bubble really begins to pop.

This impacts the central government because lower incomes and less employment means the government collects fewer taxes, but it also means it needs to increase spending to care for the unemployed and to create a stimulus plan. Governments’ budget deficits explode, and they need to find money somewhere.

They can do this by either increasing taxes on the rich and redistributing it to the less fortunate, or from the central bank printing money. By printing money, the central bank can make up for the disappearance of credit with an increase in the amount of money.

When the central bank prints new money, it uses it to buy financial assets and government bonds, which drives asset prices up and makes people (that own assets) more worthy of credit. With that money, governments can pay for social security and launch their stimulus plan. While this increases people’s income and lowers the economy’s total debt burden, it increases the country’s debt.

This is why situations of deleveraging require both central bank and fiscal coordination. Policymakers have to balance the different ways to bring the debt burdens down in the least economically harmful way. If balanced correctly, there can be a deleveraging where debts decline relative to income, real economic growth is positive and inflation isn’t a problem.

Deleveraging takes roughly a decade or more for debt burdens to fall and economic activity to get back to normal, hence the term “lost decade”. For example, the US experienced a “lost decade” for stocks from the ten year period of 1999-2009, where the S&P 500 generated an annualized total return of -.9% over the period. This was the second time that the market actually had a negative total return over a decade-long period. The other period was during the Great Depression in the 1930s.

In conclusion, the economic machine is a complex system that works through a short and long-term debt cycle, which consists of a period of debt expansion followed by a period of deleveraging. Hopefully now you understand how this cycle affects asset prices, interest rates, and economic growth, and where we might be in this long term debt cycle. By having a deep understanding of how the economic machine works, investors can make informed decisions that can help them navigate the cycles and achieve long-term success.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

About The Author

Rebecca Hotsko

Rebecca Hotsko is an investor and entrepreneur based in Canada. Most recently, she co-founded a luxury boat sharing club in Kelowna B.C. Rebecca graduated from the University of Saskatchewan with a bachelor’s degree in Economics and since has completed CFA level I and II. In prior years, Rebecca gained valuable experience working as an analyst for the Bank of Canada, the federal energy regulator and in investment management. Her passion for teaching others how to invest using time-tested strategies backed by empirical data also led her to create an investing blog in 2020.

Rebecca Hotsko

Rebecca Hotsko is an investor and entrepreneur based in Canada. Most recently, she co-founded a luxury boat sharing club in Kelowna B.C. Rebecca graduated from the University of Saskatchewan with a bachelor’s degree in Economics and since has completed CFA level I and II. In prior years, Rebecca gained valuable experience working as an analyst for the Bank of Canada, the federal energy regulator and in investment management. Her passion for teaching others how to invest using time-tested strategies backed by empirical data also led her to create an investing blog in 2020.