Intrinsic Value Assessment Of Big Lots (BIG)

By Robert Leonard From The Investor’s Podcast Network | 02 April 2021

INTRODUCTION

Big Lots, Inc. (“Big Lots”) (Ticker: BIG) is a traditional brick and mortar discount retailer who offers a range of products from food to furniture to electronics and everything in between. Approximately one-third of its stores are in California, Texas, Ohio, and Florida, with the remaining of its stores being spread across 47 total US states. Its store count peaked in 2015 at just under 1,450 stores when management made a conscious decision to shut down underperforming stores, dropping the store count to a recent low of just over 1,400 stores in 2018. Since 2018, the store count has slowly risen to where it is today.

While management hasn’t been completely transparent with details of its ecommerce operations, they do exist — in addition to its physical stores, Big Lots also offers an ecommerce platform.

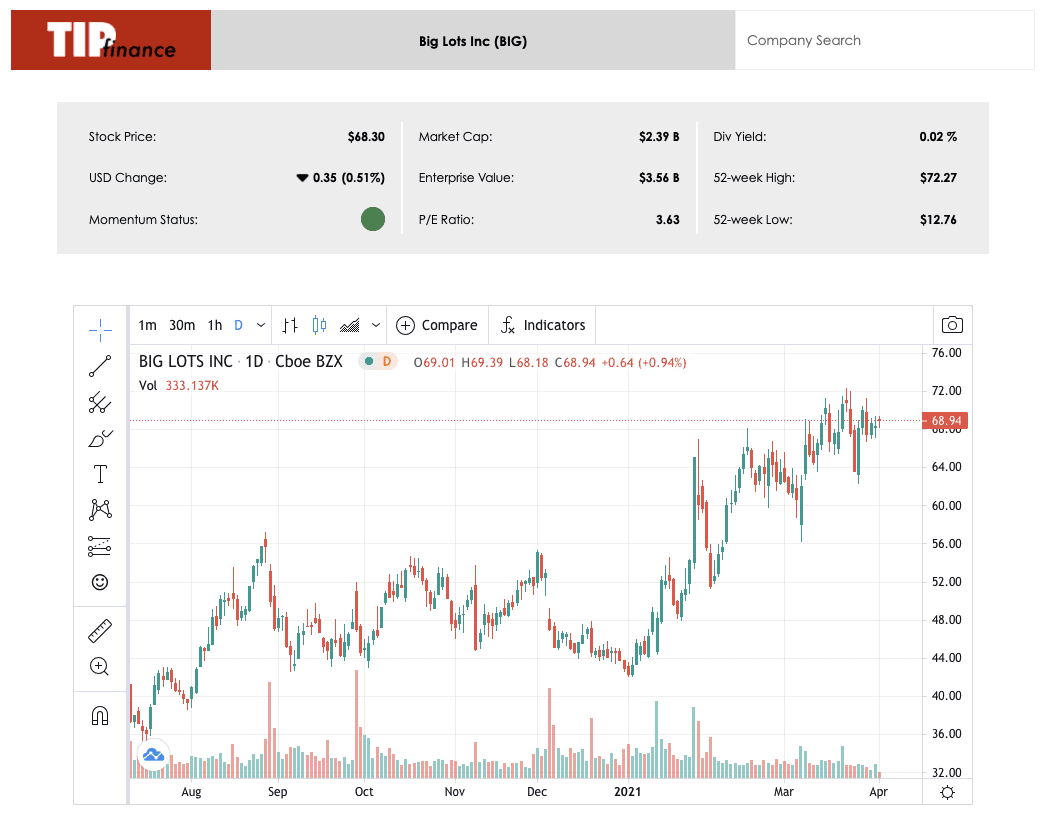

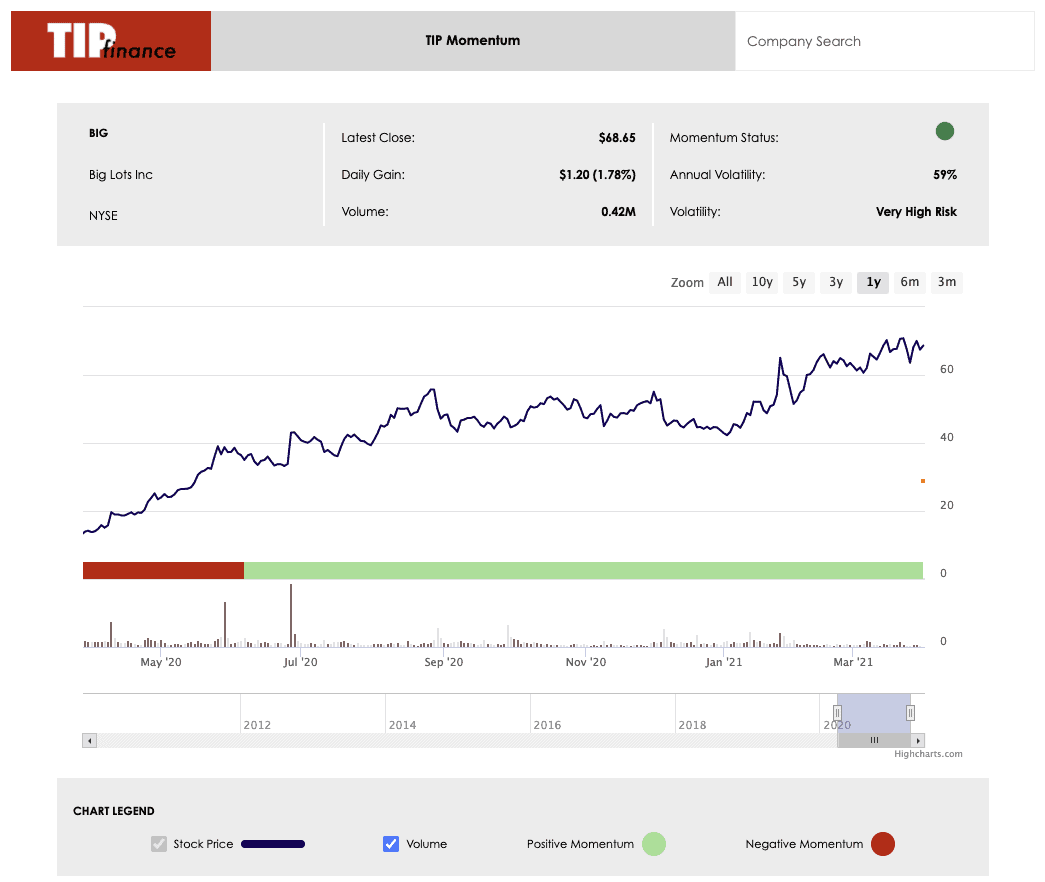

At the time of writing, Big Lots’ market capitalization is about $2.39 billion and its revenue and cash flows for the 2020 fiscal year were $6.2 billion and $0.9 billion, respectively. Currently trading at $68.30, the stock has hit a 52-week low of $12.76 and a 52-week high of $72.27.

Similar to Autozone and Whirlpool, Big Lots stood out to me in the TIP Filter function in the TIP Finance tool because I am familiar with the company and have even shopped at its stores. One of my favorite investing strategies is that popularized by Peter Lynch, causing me to often analyze business and look for investment ideas in companies such as Big Lots.

As I researched for potential investment ideas, this week looking at Mid Cap companies, I came across Big Lots trading at an attractive TIP Multiple, TIP Median Multiple, and a satisfactory Potential Yield, all with a green Momentum Status.

Now the question is, at today’s price of $68.30, is Big Lot’s stock undervalued?

INTRINSIC VALUE OF BIG LOTS

The business of Big Lots and the investment opportunity it presents investments is about as classic of a value play as you can find in today’s market. Rather than being a high-growth technology company looking to disrupt an industry, as many companies that have investor’s focus currently are, Big Lots is an older, more stable company with relatively consistent results. Both of these investment strategies can work, but they’re very different.

In the analysis about Square, I wrote, “DCF models are often associated with value investing because they can be great to value a more mature company, which, historically, has been the focus of value investors. However, in the case of a company like Square, which is still growing rapidly and far from maturity, DCF models are far less useful. As investors, we must be a bit more creative in our valuations to accurately model these types of companies.

In the case of Square, it is a relatively early-stage company, making it difficult to use historical data, as well as traditional profitability numbers, to forecast its future results.”

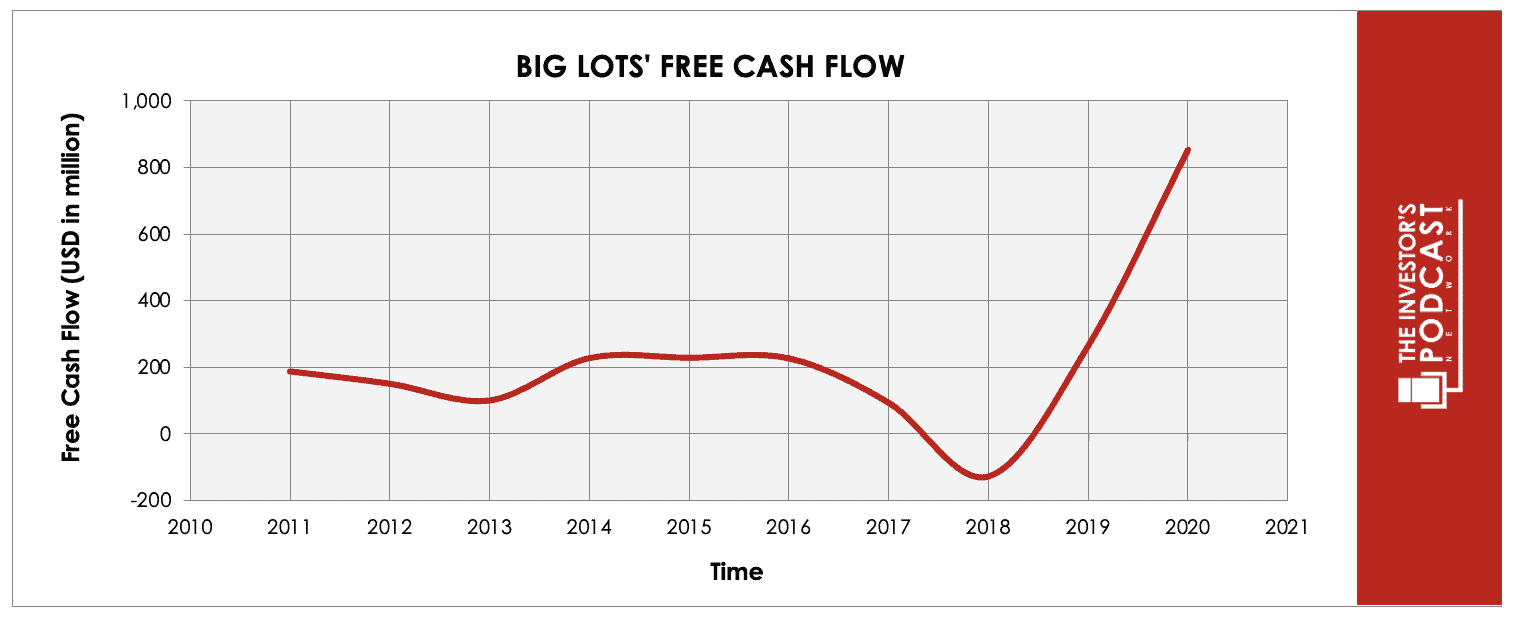

Opposite of Square, Big Lots fits nearly perfectly into the “box” for using a DCF model. In the below image, we can see how relatively stable Whirlpool’s positive Free Cash Flow generation has been.

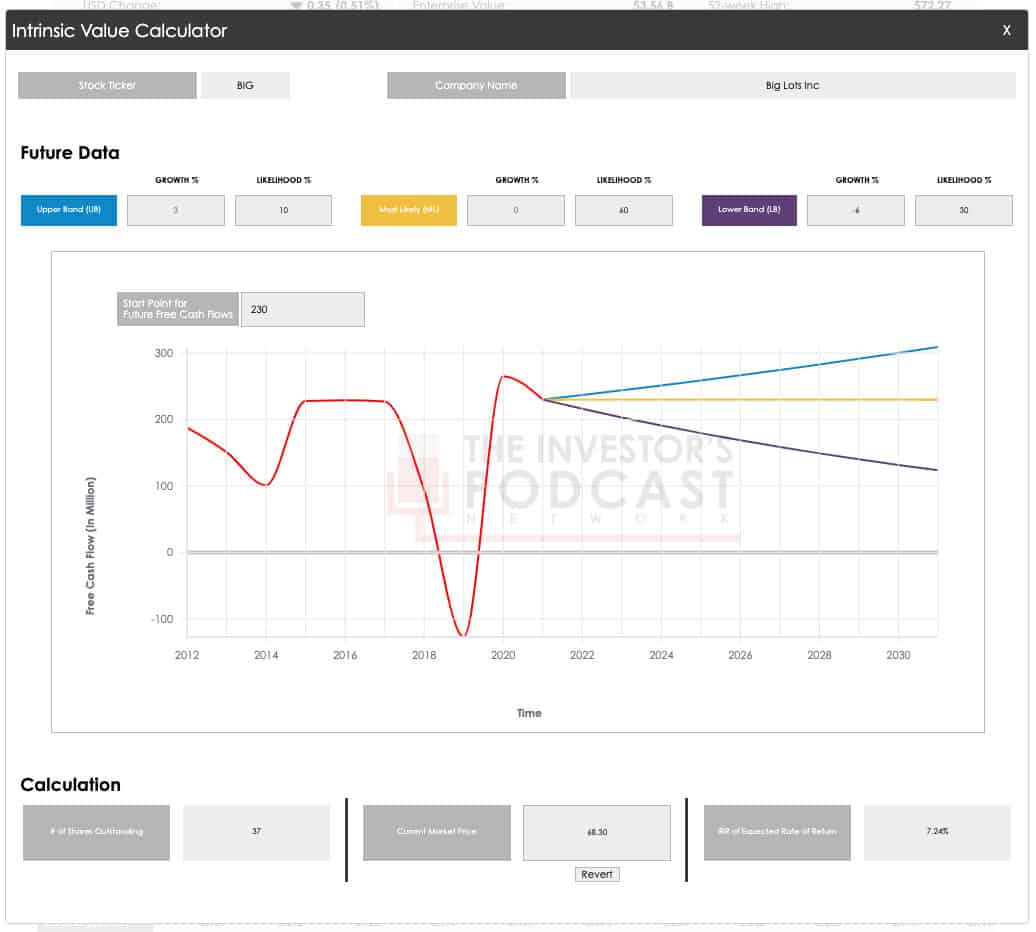

In this analysis, I want to run through three different DCF models. The first is how I truly analyze the business and consider it for an investment for my own portfolio. The second is going to illustrate a common mistake I see investors make — one that I always made when I first started investing. The third is going to illustrate how important price is to your investments.

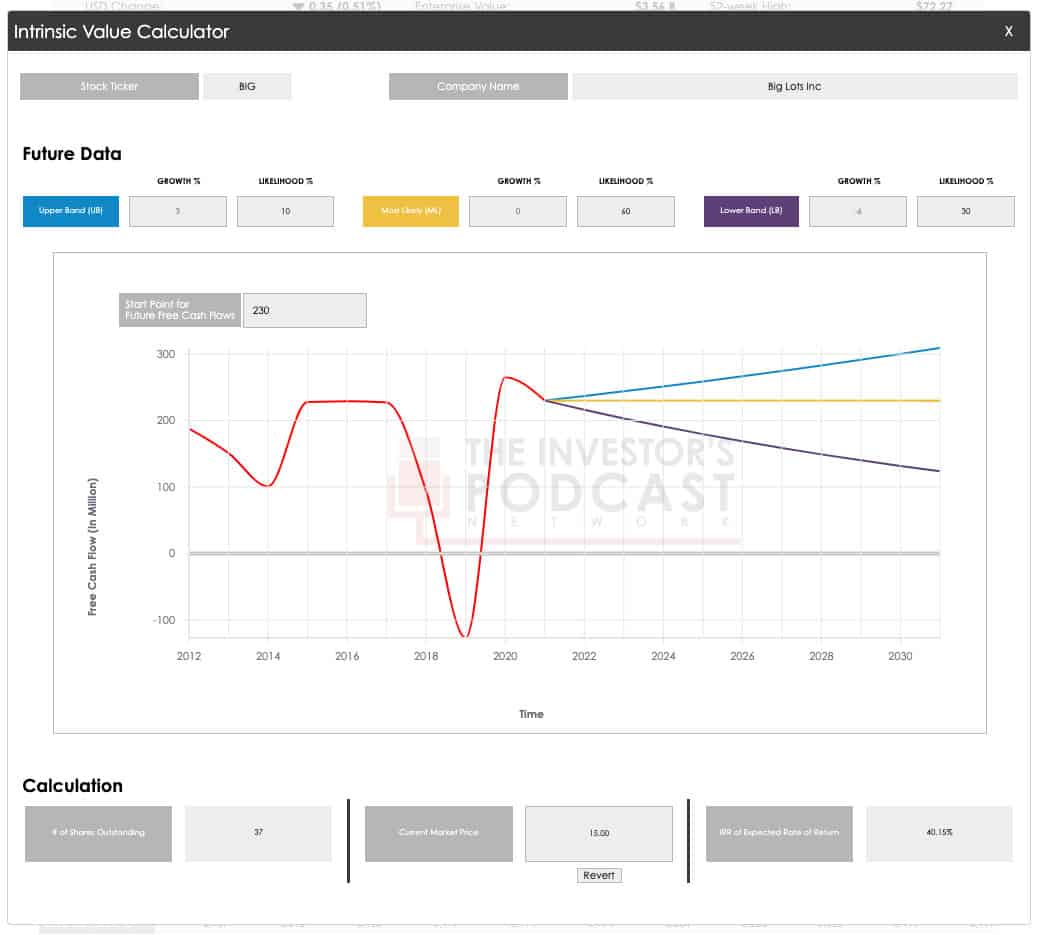

This DCF model was run in our TIP Finance tool with three potential outcomes for Big Lots’ free cash flow being modeled. Given a spike in Big Lots’ free cash flow generation in 2020 due to COVID-19, I have adjusted my starting down to a more historical norm of $230 million. Each free cash flow outcome was modeled with an independent percent chance of occurring, which was used to arrive at the expected annual rate of return over the next 10 years at today’s price. For the Upper Band (“UB”), a 3% growth rate was assumed with a 10% chance of occurring. For the Most Likely (“ML”), a 0% growth rate was assumed with a 60% chance of occurring. For the Lower Band (“LB”), a -6% growth rate was assumed with a 30% chance of occurring. At today’s price, that results in an expected annual rate of return over the next 10 years of 7.24%.

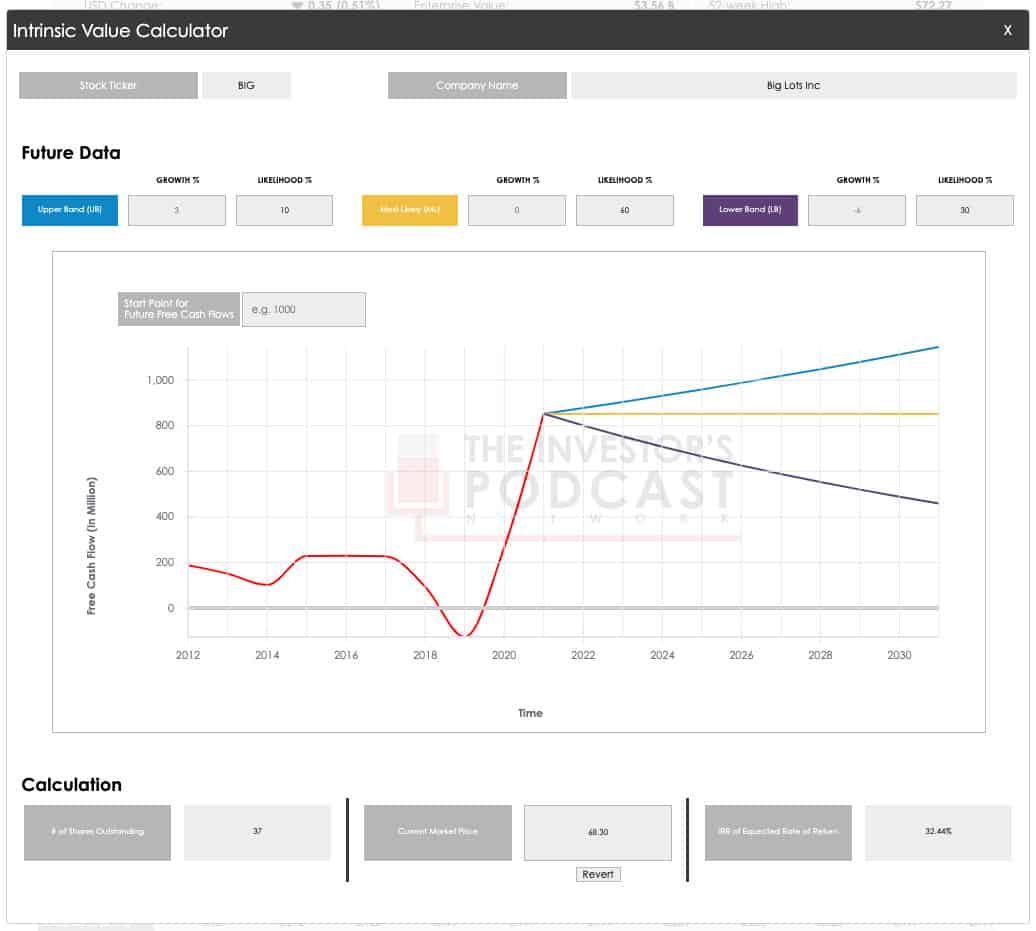

In the second DCF model, I am going to keep the growth rates and likelihood ratios steady from our previous model, but I am not going to adjust the starting point for the free cash flows. In our previous model, I adjusted our starting point from $852 million, which was fiscal year 2020’s results, down to $230 million. In this model, we are going to leave the starting point at $852 million. Keeping all other assumptions constant, the expected annual rate of return over the next 10 years jumps to 32.44%, as compared to the 7.24% in our previous model.

Changing your starting point from $852 million to $230 million is a big change in terms of dollar amounts, but in regard to your analysis process, it is a relatively easy step to miss on accident. This is all too common of a mistake for investors, specifically new investors. When I was first starting out investing, I made this mistake all the time. Just because a company has one good break out year, that doesn’t necessarily mean that the future results will continue to grow from there. Rather, it is often more likely that the company will revert to historical norms.

When you input your growth percentages into the DCF model, let’s take the 3% growth rate for example, without adjusting the starting point, you’re telling the model to grow year 2’s cash flows by 3% from unadjusted (likely inflated) free cash flow number. This results in too high of a figure in year 2, as well as all subsequent years. As we saw from the jump in the expected annual return, this almost always leads investors to believing a stock is worth significantly more than it truly is.

In the third model, we will review how price impacts returns, and why price is so important. We will circle back to this at the end of the research report in the Summary section below.

In this model, we held all assumptions constant from the first model, including the adjustment for the starting cash flow figure. However, rather than keeping the purchase price constant, at the current market price of $68.30, we’re going to adjust our purchase price to $15, approximately the price you could have purchased Big Lots’ stock at during March 2020.

In our initial model, our calculated expected annual return was 7.24% at today’s market price. When we adjust the purchase price to $15, the expected annual return jumps to 40.15%! The expected annual return changes more by adjusting the price than it did to nearly 4x the free cash flow number, as we saw in the second model.

You might be saying, “well, hindsight is 20-20”. If you are, you’re right in a sense, but also wrong. Sure, we can now see that Big Lots had a fantastic fiscal year in 2020 due to the pandemic, which no one could’ve predicted with certainty at the very beginning of the pandemic. However, we adjusted our starting free cash flow number down to historical norms of $230 million, which means we’re ignoring the abnormal year in 2020. That said, we could’ve likely ran this same analysis in March of 2020, using only historical data, not knowing 2020’s results, and still came to this conclusion. Had we done so, the purchase price would’ve been between $12-$20 per share, rather than $68.

BIG LOTS’ COMPETITIVE ADVANTAGES AND OPPORTUNITIES

When it comes to competitive advantages and opportunities, this is where Big Lots falls short for me. They exist, but I would argue they’re relatively weak in comparison to other company’s competitive advantages. However, three competitive advantages for Big Lots currently are:

- Closeout formula. Overall, Big Lots does a great job with closeouts and providing customers with a treasure hunt-type experience. Over the years, closeouts have been decreasing a percentage of Big Lots’ overall inventory, currently consisting of less than 10% of its inventory, but the inventory that does exist is executed well.

- Financial strength. From a financial perspective, Big Lots growth is not all that exciting. However, value can come from a lack of excitement and in stability. Growth on its income statement is relatively lackluster, but its balance sheet is quite strong. Thanks to a strong fiscal year in 2020, it has very little debt and a lot of cash on its balance sheet. It does have significant capital leases, but that is to be expected given its shift towards selling its distribution centers.

- Management. The management team has done a successful job of managing the headwinds its industry and business has faced over the previous decade. With a lower quality management team in place over the past decade, Big Lots likely would’ve gone by the wayside, similar to other narrow-moat businesses in competitive industries. Big Lots has a few opportunities ahead, as we will discuss below, but it won’t be without its fair share of challenges. That said, it is going to be facing those challenges with a strong management team at the helm.

The competitive advantages above are real advantages Big Lots holds, although they are relatively weak. These weak competitive advantages could be offset, or made less worrisome by large opportunities ahead. However, that also is what I see for the future of Big Lots. That’s not to say it doesn’t have any opportunities, as it does have a few that we’ll talk about below, but they’re not business- or future-changing opportunities.

- Doubling down on what works. A lot of successful business leaders talk and write about how important it is for businesses to double down on what works — put more time, energy, and money into what is actually working. We even talk about this a lot internally here at TIP. This is an opportunity for Big Lots, that the management team appears to be focusing on. They have a business that has been around for a long-time that is working well. To put it simply, they need to continue doing what they’ve been doing, and continue trying to do it even better. We’ve seen margins expand as Big Lots management team shifts its focus to a slightly higher margin product mix. Over the last decade, we’ve seen profitability and free cash flow generation remain mostly steady, despite stagnating, or declining, sales. This illustrates this idea. Management is focusing on what they’re doing well and trying to do it better by improving its margins. This is an opportunity for the business, and investors, as management finds ways to continue to make the business more efficient and profitable.

- Acquisitions. Big Lots isn’t known to be a serial acquirer, but it does make acquisitions from time to time. Recently, in line with management’s increased focus on its furniture products, Big Lots acquired Broyhill. Management expects Broyhill to become a billion dollar brand for or Big Lots. As Big Lots’ management team looks for more avenues to grow, future acquisitions could prove to be a viable option.

- Furniture. Management has talked about its shift to focus on higher margin products, such as furniture. This is not only illustrated by its acquisition of Broyhill, but also its rearrangement of its stores and other initiatives it has put in place recently. An area where online-focused retailers, think Amazon, struggle is with large, bulky, heavy items, such as furniture. If Big Lots is able to solve this problem by providing a cost-conscious solution and products that fit its customer’s needs, there could be a large opportunity for Big Lots to not only grow, but survive the threats of Amazon and other ecommerce stores, by leaning on furniture.

- Financial engineering. Financial engineering isn’t so much an opportunity for the business itself, rather it’s an opportunity for investors in Big Lots to potentially benefit from. Over the last decade, one financial engineering lever Big Lots has pulled is that it has bought back about 43.5% of its stock. Many successful investors have spoken publicly about what this means for investors, but in general, if a company buys its stock back at too high a price, that is eroding shareholder value, whereas if it is purchased back at a discount to its intrinsic value, it can increase shareholder value.

- Dividends. Depending on the price of the stock on any given day, Big Lots’ dividend yield hovers around 1.75-2%, currently at 1.74%, and a recent high of nearly 10% in March 2020. Big Lots’ management team has demonstrated its focus and priority on maintaining and growing its dividend. It is a profitable and cash generating machine that can afford its dividend payment, which can provide some comfort to investors that worry about a dividend cut. While a focus on high-dividend companies isn’t the right strategy for every investor, for those who do prefer this approach, Big Lots may be a great option.

RISK FACTORS

Although Big Lots has competitive advantages and opportunities ahead, it is not without risks that could negatively impact the company and/or prove our financial models to be inaccurate. The major risks for Big Lots going forward are:

- Competition. The risk of competition is one of my two biggest concerns about the company. This is a risk many market participants are likely aware of — it’s no surprise that there are other major retailers in the industry trying to take market share from Big Lots. There are ways for Big Lots to defend itself against competition, and even beat its competitors, but there is significant competition and I wouldn’t be surprised if physical retail continues to struggle.

- Cyclical and recession. Big Lots’ business, and the retail industry as a whole, is very susceptible to cyclical trends. Not only is it cyclical, but it’s also quite tightly correlated to recessions. While Big Lots does sell items that customers need to buy regardless of the economic environment, it does also rely heavily on discretionary items that people don’t necessarily have to buy in poor economic conditions. In recessionary times, people generally don’t splurge on new furniture or other high-ticket, high-margin items, which would negatively impact Big Lots’ business.

- Pandemic subsiding. On the surface, this almost seems backwards. When the pandemic first hit, most people, myself included, thought physical retail would be crushed. However, Big Lots thrived and had its best year by far in over a decade. That said, if the pandemic subsides, it could hurt Big Lots business and return it to its historically normal and lackluster operating results.

SUMMARY

Big Lots is a traditional brick and mortar discount retailer who offers a range of products from food to furniture to electronics and everything in between. It is a relatively stable company that generates strong cash flows, profits, and has a healthy balance sheet, but it does not come without risks. It is possible that Big Lots successfully doubles down on what works, improves margins and profitability, a growth-igniting acquisition occurs, its furniture business takes the company to new heights, management continues to create shareholder value through financial engineering, and shareholders receive cash flow from consistent dividends. However, it is also possible that Big Lots’ competition significantly erodes its market share, a recession hits the US, and the COVID-19 pandemic finally begins to subside. This is why investing is difficult, and more often an art, than a science.

After reading this investment report, you’re probably wondering – do I buy Big Lots stock? Well, it’s not quite that simple, and of course, I cannot give specific investing advice, but I will walk you through how I am personally thinking about Big Lots as an investment.

I was so wrongly approaching value investing when I first got started. I thought I was a value investor by strictly buying companies that looked “cheap” based on my DCF models. I assumed, if my DCF models said the stock was cheap, it was a buy, and I was buying an “undervalued company”. I quickly learned this was not true value investing and that just because I input my assumptions into the DCF model, that didn’t mean they were right or that the market would agree with me.

I also made the crucial mistake of not adjusting financial results that were abnormal. If I was analyzing Big Lots when I was first starting to invest, I would’ve ran my DCF model as we did in the second model in the Intrinsic Value section above. I would not have adjusted the free cash flow starting point from $852 million to $230 million, which would’ve caused me to think the stock was worth significantly more than it truly was, and I would’ve likely bought in.

Another mistake I often made as a new investor was that I didn’t take into account the momentum of the stock I was considering. If it seemed undervalued, oftentimes due to the two mistakes I just mentioned, then I would start a position. I thought the stock was cheap and likely wouldn’t fall anymore, but it almost always did. The stock would continue to fall after I bought it., with negative momentum indicators having been clear. I missed the clear negative indicators because I didn’t understand momentum and was purely focused on a “value” approach. This caused me to buy into many “falling knife” situations. Since then, I’ve learned to combine momentum investing with value investing in hopes of avoiding such situations.

As I analyzed Big Lots, it brought me back to those days in my investing career. From a purely quantitative perspective, you may argue that Big Lots seems undervalued and looks like a potentially great investment. If you input certain growth numbers into your DCF models, make certain adjustments to your free cash flow starting point, or even just buy at a different price, Big Lots can even look significantly undervalued.

But remember, that is purely quantitative and does not take into consideration the future of the business and its qualitative aspects. What I did wrong early in my investing career was exactly that — I did not look at non-financial aspects of the business, nor did I try to think logically about the future of the company and its industry.

Having learned from those experiences and growing as an investor over the past eight years, I am now cautious when considering a business like Big Lots. Quantitatively, I don’t have many reservations about the company, but qualitatively, I am far more skeptical about the future of its industry, as well as the macro environment as a whole.

In addition, it is not enough to simply analyze a company in a vacuum and make an investment decision. Investors must compare their expected return of one investment to that of another option available. Your dollar can only be invested in one place at a time — choosing the optimal place for that dollar to be invested is equally as important, if not more important.

According to our TIP Finance Momentum tool, Big Lots is currently green, meaning it currently has positive momentum. This helps alleviate, but not fully remove, my concern for a potential falling knife situation. However, from a qualitative perspective, I am not convinced that Big Lots will be able to continue to thrive in this industry, nor am I convinced that Big Lots is the best place to invest my dollar at this point in the cycle.

Nearly all companies have a price in which it is a good buying opportunity. With Big Lots being a cyclical business, it is possible that the valuation of the company will swing drastically in the other direction and be, in my opinion, significantly undervalued. If you recall from our previous discuss of the third DCF model, had shares been purchased at $15 during March 2020, our calculated expected annual returns would’ve been significantly higher than they would’ve been at today’s prices. If the stock were to pull back again to levels that provide a similar expected rate of return, without any deterioration to the business, Big Lots may be worth a deeper look and consideration for investment.

The bottom line is that Big Lots operates in a declining industry that is very competitive. It has a good management team, a strong balance sheet to weather a storm, and it has even carved out a small niche that it operates well in. It won’t grow significantly like today’s tech companies, nor will it revolutionize industries, but my best guess is that it will continue to do about $4.5-$5 billion in sales at a 40% gross margin, with about $150-$225 million in net profit, pay a $1-$1.50 dividend per share, continue to buy back stock, and produce $175-$250 million per year in free cash flow. Given the strength of its balance sheet and minimal debt, there is a relatively high floor, and at the right price, Big Lots may be interesting.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclosure: The author, Robert Leonard, as of this writing, of the companies mentioned, only holds a long position in Square, Inc. (SQ), with no intentions of initiating a position in any other company mentioned in this article within the next 72 hours. The article was written himself, and it expresses his own opinions. He is not receiving compensation for it (other than from The Investor’s Podcast Network). He has no business relationships with any company whose stock is mentioned in this article. The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. Robert is not a financial advisor. Please always do further research and do your own due diligence before making any investments.