Intrinsic Value Assessment Of Square, Inc. (SQ)

By Robert Leonard From The Investor’s Podcast Network | 10 February 2021

INTRODUCTION

Square, Inc. (“Square”) (Ticker: SQ) is a vertically integrated fintech company creating a financial services ecosystem by offering various tools in its two-sided network. Its business was initially founded by providing small businesses with, at the time, a revolutionary way to accept in-person credit card payments. This created what is known as Square’s “Seller” side of its business model today. Square now breaks down its Seller business model into the following categories: Square for Restaurants, Square for Retail, Customer Engagement, Payroll, Invoices, Appointments, Capital, E-Commerce, Square Card, Virtual Terminal, and Developer Platform (API).

After creating its Seller business model, Square recognized the opportunity of expanding to the other side of the transaction – the consumer side – and Cash App was born. Square now breaks down its Cash App business model into the following categories: Cash Card, Boost, Stocks, Direct Deposit, and Bitcoin.

While these business model breakdowns describe Squares business currently, it is always rapidly evolving. Nearly every quarter, Square innovates, becomes more vertically integrated, and expands its ecosystem into additional products and services that further entrench its customers, such as expanding into tax preparation via its acquisition of Credit Karma Tax from Intuit.

At the time of writing, Square’s market capitalization is about $108.4 billion and its revenue and cash flows for the 2019 fiscal year were $4.7 billion and $403 million, respectively. Currently trading at $240.38, the stock has hit a 52-week low of $32.33 and a 52-week high of $246.49. At today’s price of $240.38, is Square’s stock undervalued?

INTRINSIC VALUE OF SQUARE, INC.

If you’re here reading this analysis as a long-time fan of TIP’s, you likely consider yourself mostly a value investor. If you’re just finding TIP from this analysis, it’s important for you to understand that here at TIP, we typically view investing and analyzing companies from the viewpoint of a value investor – following the likes of Warren Buffett, Benjamin Graham, and Phil Fisher.

That said, in my early days of investing, one of the biggest mistakes I made as a “value investor,” or so I thought, was that I purely looked at companies quantitatively. I assumed that if my discounted cash flow (“DCF”) model returned a result such that the security appeared undervalued, I should buy it, and the market would eventually agree with my assumptions. It had worked for Benjamin Graham back in the 1930s; why wouldn’t it work for me?

What I didn’t realize was that Graham was investing in a different stock market than we are today. You might be wondering, but what about Buffett? Doesn’t he invest just like Graham? Well, he did in his early days, but as he partnered with and learned from Charlie Munger, he realized that there was a better way – rather than just buying fair companies that were cheap (“cigar butts”), he could achieve better returns by buying great companies at a fair price. Graham’s stock market was much less efficient than the market we have today, as he wasn’t competing with super-computers, and individual investors didn’t have access to the markets like they do today. Any significant undervaluation that may exist in the markets based on purely quantitative numbers is almost always immediately arbitraged away from large firms with super-computers and trading algorithms. Buffett realized this before many others and began finding companies that were undervalued not purely based on fundamentals but also utilizing qualitative aspects of the business.

Why did I tell you this story about my mistakes as an investor, how Buffett’s investing has changed over time, and how today’s stock market is arguably different than previous decades? Because that’s where I believe Square comes in.

Value investing is typically defined and accepted as buying a security that is deemed “undervalued.” But isn’t that the goal for all investors? Don’t growth investors want to buy securities that they think are undervalued, too? Then, inherently, isn’t all investing “value investing?”? If this is true, and a company, in this case, Square, is trading below what we believe its intrinsic value to be, isn’t it a value pick, regardless of how fast it’s growing?

Despite this, you’d be hard-pressed to find anyone that would argue Square is a “value pick,” and generally, for a good reason. Square is a high-growth company trading at what appears, on the surface, to be lofty valuations, which goes against what is generally accepted as value investing.

If you run a DCF model, which has been done below in our TIP Finance tool, or you look at the company purely based on fundamentals, many would argue its overvalued and not expected to provide satisfactory returns (2.01% annually over the next ten years, to be precise, if our already-optimistic assumptions in the DCF model prove true).

But remember, this is purely quantitative and only one way, of many, to value a company. If we were investing like Graham, Square wouldn’t even be considered, but if we look at it from the viewpoint of “buying great companies at a fair price,” Square might just work.

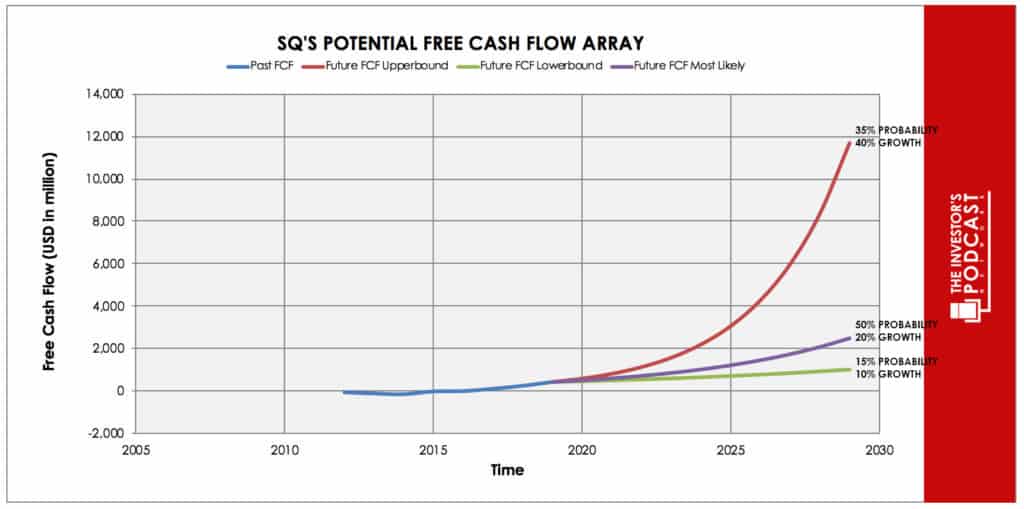

In the below DCF model, three potential outcomes for Square’s Free Cash Flow were modeled, each with a different percent chance of occurring, to arrive at the expected annual rate of return over the next ten years at today’s price. For the Upper Band (“UB”), a 40% growth rate was assumed with a 35% chance of occurring. For the Most Likely (“ML”), a 20% growth rate was assumed with a 50% chance of occurring. For the Lower Band (“LB”), a 10% growth rate was assumed with a 15% chance of occurring. At today’s price, that results in an expected annual rate of return over the next ten years of 2.01%.

DCF models are often associated with value investing because they can be great to value a more mature company, which, historically, has been the focus of value investors. However, in the case of a company like Square, which is still growing rapidly and far from maturity, DCF models are far less useful. As investors, we must be a bit more creative in our valuations to accurately model these types of companies.

In the case of Square, it is a relatively early-stage company, making it difficult to use historical data, as well as traditional profitability numbers, to forecast its future results. As an alternative, we can use revenue numbers and Square’s more mature competitor’s results as benchmarks and input assumptions in our models.

As we will discuss in more detail in the Risk Factors section below, Square’s total revenue numbers cannot be taken at face value due to its idiosyncratic accounting methods related to Bitcoin. Therefore, the first step in our valuation model is to forecast out Bitcoin Revenue independently from Total Revenue ex. Bitcoin in 2025, that way, we can adjust our models to reflect the accounting treatment of Bitcoin Revenue.

In 2019, Square’s Bitcoin Revenue, Bitcoin Gross Profit, and Bitcoin Take Rate were $516 million, $8 million, and 1.55%, respectively. In 2025, it is forecasted that Bitcoin Revenue, Bitcoin Gross Profit, and Bitcoin Take Rate will be $10 billion, $125 million, and 1.25%, respectively. In 2019, Total Revenue ex. Bitcoin was $4.2 billion, while it is forecasted to be $30.6 billion in 2025. With an EBITDA Margin of 30% and an EV/EBITDA Multiple of 15, Square’s Enterprise Value is expected to be $139.6 billion in 2025. Adding Square’s expected Cash and Cash Equivalents and subtracting its expected Long-Term Debt from its Enterprise Value, the expected Market Capitalization in 2025 is $149.6 billion. With no reduction or dilution in the current share count, this equates to an expected stock price of $345.55 in 2025, or an annual rate of return of 6.2% from today’s price.

SQUARE, INC’S COMPETITIVE ADVANTAGES AND OPPORTUNITIES

In order for companies to not only maintain their market share but also grow it, they must have durable competitive advantages. In the case of Square, there are five main competitive advantages that will allow them to continue to grow over the next five to ten years:

- Network effects. Cash App’s peer-to-peer (“P2P”) platform inherently requires network effects to scale and be successful. If you are using Cash App, but none of your friends are, it’s not very valuable in terms of transferring money between one another – it has a weak network effect. However, as Cash App’s user base grows and all your friends/family are using it, it becomes far more valuable, and you’re incentivized to use it, too – illustrating a strong network effect. While Square still has more room to grow in this respect – its network effects are stronger in the Southern US than in the Northern US, following unbanked trends, for example – it has already gained over 30 million users, giving it a significant competitive advantage over competitors, such as traditional banks and private bank startups.

- Ecosystem – stickiness and switching costs. Through its ability to grow its ecosystem, both on the Seller side and on the Cash App side, Square is creating a competitive advantage through its product’s stickiness and high switching costs. First, let’s look at the Seller side of the business. Let’s assume you’re a small business owner that uses Square as your POS system/in-person credit card processing. That by itself is relatively easy and low-cost to switch from. However, once you layer in Square’s other products and services, such as its payroll processing (According to Jefferies, Square Payroll is the second most popular payroll software in the US small- and medium-business space), tax preparation, invoices, appointment scheduling, loans from Square Capital, and more, it becomes costly and difficult to switch from Square. Plus, as a business owner, it’s significantly easier to set up all these services through one provider rather than going through multiple.

On the Cash App side of the business, a user who simply transfers money between themselves and friends/family is not inherently invested in Cash App. However, similar to the Seller side, once you layer in other products and services, such as the Cash Card, Boost, Stocks, Bitcoin, and arguably most important, direct deposit, Cash App suddenly becomes sticky and costly to switch for users as well. Through firsthand experience and research, I have witnessed how important financial institutions believe direct deposit is. Many traditional financial institutions (think banks and credit unions) offer interest rate discounts on loans, higher interest rates on savings, waive monthly fees, or even offer additional products and services, all just for having direct deposit. They wouldn’t do this if it didn’t provide more value to them than it is costing them. For Square, it’s the same value proposition. Once a user is receiving direct deposit into the Cash App, it is less likely they will stop using Cash App, and it is more likely they’ll use additional products and services.

If you’re a user receiving your direct deposit into your Cash App account, you’ll need a way to easily access that money, outside of just transferring the money in the app – insert Square’s Cash Card. Cash Card holders are incentivized to use the card for purchases through Square Boost – a rewards program.

You already have your money going into your Cash App account through direct deposit, so instead of opening an additional account at a different brokerage and then transferring money there each time you want to invest it, you can easily invest in stocks and bitcoin directly through the Cash App.

As you can probably tell, direct deposit is a big deal for Cash App, and therefore, I want to circle back on two more powerful ways Square is able to leverage its ecosystem, using direct deposit, to make its overall business stronger. The first is by combining its two-sided network. Remember how we talked about Square Payroll earlier in the Seller side of the business? Well, if a business is using Square Payroll and the employees have a Cash App account, the employee can get paid instantly from the employer. Some employees have even reported that because their employer can simply transfer the money to them via Cash App, they can get paid ad-hoc, on occasion, if they have an emergency and need the money before payday (with the employer’s approval, of course). This creates a nearly infinite feedback loop and/or sales channel on both sides of Square’s business. If an employer is using Square Payroll, they are incentivized to promote Cash App to its employees, and vice versa – if enough employees are using Cash App, they can discuss the business potentially using Square Payroll.

The second is by combining its brand competitive advantage, which we’ll talk about in just a minute, with its ecosystem, and specifically, direct deposit. As discussed in more detail below, Square’s brand tends to attract a younger demographic. This is important because if you can get a young user, who may be getting their first job or their first career-level job out of college, you can lock them in as customers for a long time, increasing their LTV for Square. A BankRate study reported that once a bank account has been chosen, Americans stick with it for, on average, 16 years.

Square already has a successful ecosystem competitive advantage before even considering the future opportunities it has for additional products and services that we’ll discuss.

- Data. It is said that data is the new gold, and well, Square has a lot of it. With its two-sided network, Square has data from the businesses, as well as the consumers, which is a dynamic that arguably no other company has. This is extremely valuable and provides a competitive advantage because it gives Square massive optionality. Let’s look at a few of the main ways Square can use this data to differentiate itself from its competitors.

First, Square can incentivize Cash App users to shop at Square Sellers by offering them rewards and discounts via its Boost program and Cash Card. This, in turn, provides more sales opportunities for Square Sellers. On the other side, Square can partner with Square Sellers to promote their business specifically, likely for a fee, to Cash App users in their area. Square can go to merchants and say something like, “we have 100,000 Cash App users within 10 miles of your business location. For X dollars, we can promote your business to all 100,000 Cash App users and drive traffic to your stores.” This can incentivize individuals to join Cash App for the Boost program at local stores, as well as incentivizing businesses to join Square as a Seller.

An excerpt from an article written by an ARK Investing analyst further illustrates how this dynamic can be so valuable. Friedrich of ARK Investing wrote, “If [Square] were to cut out the middlemen and facilitate payments directly between [S]ellers and Cash App users, Square could leave pricing unchanged and almost triple its net take-rate or lower pricing and undercut most competitors. In the latter scenario, Square sellers would have an incentive to maximize the number of Cash App transactions and minimize the number of other card transactions, effectively becoming sales agents for Cash App. Square also could incentivize them to become Cash App sales agents with access to an advertising platform and to millions of consumers with everyday discounts via Boosts.”

Another area where Square can utilize its data is through its lending – both with Square Capital for businesses and, eventually, for consumer loans. All of the data Square receives, on both sides, can be fed into its AI-driven lending algorithm, allowing it to offer more flexible loan products with underwriting that is more informed. On top of this, Sellers are able to use innovative payment methods to repay the loans, such as paying automatically using their daily card sales from Square’s POS system. For Cash App users, this means, eventually, Square will be able to use its data to offer loan products to a wider range of credit scores than is currently accepted by most institutions, without taking on too much additional risk. This opens up its pool of potential customers.

- Brand. We briefly discussed Square’s brand when analyzing its ecosystem’s competitive advantage, but let’s provide a bit more context here. Historically, financial institutions are very “professional,” and often intimidating. Square has built its brand to be far more appealing and inviting, which has allowed it to acquire and retain customers in a younger demographic more easily than its traditional competitors. Square wasn’t built by a financier – rather, it was built by a team of marketers, engineers, and designers who knew little about the financial world. In this case, it has allowed Square to build a brand that is unconventional while being a competitive advantage for the company.

- Profitable marketing tool/customer acquisition strategy. There are few companies that have a marketing tool and customer acquisition strategy that actually pays them – Square is one of those companies. As much as bitcoin is an asset that can be purchased inside the Cash App, it is a marketing tool that Square can use to acquire customers. The best part is, when Square acquires Cash App customers who buy bitcoin, they’re actually making a margin off that transaction. This, of course, doesn’t take into consideration the actual marketing costs to promote bitcoin as an option within Cash App, but even still, it reduces Square’s customer acquisition costs (“CAC”) from the Bitcoin Margin it earns. This dynamic, by itself, is not so much a competitive advantage, as other companies offer bitcoin trading as well, but when combined with the other four competitive advantages discussed above, it adds an additional “layer” to Square’s competitive advantages.

Having competitive advantages is critical for any business to have sustainable success. In the case of Square, it is the five main ideas we just discussed previously. However, competitive advantages are not a set-it-and-forget strategy — they are something that must be deepened by continuing to innovate and successfully implementing new growth opportunities. Without future growth opportunities, a company’s competitive advantage is likely going to be something of the past. For Square, there are five major opportunities that exist for it to continue to expand and grow:

- Additional products and services. We discussed, at length, above the competitive advantages Square has from its current ecosystem of products and services. However, Square isn’t done yet – not even close. It has numerous opportunities to add additional products and services on both sides of its business. It has the opportunity to provide insurance products to both businesses and individuals (home, life, and car insurance), retail loans such as mortgages and car loans, and additional account types like FSAs and HSAs. Every additional product and service Square successfully implements further cements its ecosystem competitive advantage and makes it more costly and sticky for customers to leave.

- Bitcoin. For Square, bitcoin is both an opportunity and a risk. We will discuss bitcoin here as it relates to the opportunity for Square, and below, in the Risk Factors section, we will walk-through how it can also be a risk. Cryptocurrencies, and specifically bitcoin, have been gaining significant momentum over the past few years, from individual investors to drawing significant investments from professional money managers, and even some corporate CEOs allocating a portion of their balance sheet to bitcoin. Albeit at a small margin, as the bitcoin transaction volume grows in Cash App, Square will benefit. As bitcoin’s popularity grows, the transaction volume in Cash App should grow as well.

- International. Currently, Square is already in Canada, Japan, UK, and Australia, but it still has significant opportunities to expand within these countries. In addition to fully capturing the opportunities in its existing international markets, Square has opportunities to expand into other international markets. There has been speculation that Square will make a push into Africa due to Dorsey’s interest in moving there.

- Increased ARPU. An important variable in our financial model is ARPU – Average Revenue Per User. ARK Investing’s annual ARPU number of $880 was maintained in my financial model. However, there is the opportunity for this number to grow significantly, which would dramatically increase the value of Square’s stock. The $880 ARPU figure was based on a benchmark from traditional banks. The potential issue is that traditional banking relationships tend to be fragmented, with individuals having relationships with multiple institutions. While this is possible with Square customers as well, it is also equally likely, if not more likely, for Square’s customers to have more financial products with it due to its ecosystem and network effects. If this proves to be the case, $880 annual ARPU for Square could be understated, which in turn understates its current valuation.

- Large market opportunity. According to Square’s investor reports, management sees its Total Addressable Market (“TAM”) as a $160+ billion opportunity, that Square only currently has a 3% share of. As Square continues to execute on innovation and offering new products and services, it is expected to earn a significantly higher percentage of the market share.

RISK FACTORS

Although Square has strong competitive advantages and opportunities ahead, it is not without risks that could negatively impact the company and/or prove our financial model to be inaccurate. The major risks for Square going forward are:

- Bitcoin. It is no secret that Square’s CEO Jack Dorsey is a big fan of cryptocurrencies, specifically bitcoin, and is positioning it as a strategic focus for the company. Many analysts and research reports tout this as a major risk to Square if bitcoin itself turns out to be nothing more than a fad. Outside of just Square’s ability to earn a gross profit (margin) from its bitcoin transactions, it has also leveraged bitcoin as a customer acquisition tool. If bitcoin were to no longer exist in 2025 or be significantly less relevant than it is today, Square would lose an estimated $125 million in 2025 gross profit and a major custom acquisition tool.

- Bitcoin revenue accounting. As touched upon in the Intrinsic Value section above, Square currently includes the amount of bitcoin its customers purchase, plus a small fee, as part of its revenue. The Bitcoin Gross Profit is the difference between the amount of bitcoin purchased, plus the fee, and the cost for Square to buy the bitcoin on behalf of its customers. This dynamic itself is not a risk for the company. However, the risk comes from how investors perceive Square’s results because of the way Bitcoin Revenue is accounted for. In the third quarter of 2020, nearly 80% of Square’s Cash App revenue was from just bitcoin. This led third quarter revenue to increase year-over-year by 140%, mainly driven by a 1,100% year-over-year increase in Bitcoin Revenue. For investors who buy and sell based on headlines and don’t have a deep understanding of the business, they see a 140% year-over-year increase in revenue and assume the company is doing amazing, causing them to buy more and drive the stock price up (which is exactly what happened after Square reported its third quarter results). However, in reality, Bitcoin Revenue is very low margin, meaning there is very little positive impact from a cash flow and profitability perspective. It is just masking the true results of the real operating business. This can cause the price of Square’s stock to become disconnected from the reality of the underlying business, as well as increasing volatility.

- Valuation. Despite a positive expected annual return, at today’s prices, over the next five years in the valuation model we previously discussed, the current valuation of the stock is a risk because it is priced for exponential growth without missing a beat. Rarely does a company continue growing at high double digits without any bumps along the way. At this point, when bumps are met, stocks with elevated valuation metrics tend to pull back significantly. Also, in our valuation model, there are three major input variables (EBITDA Margin %, EV/EBITDA Multiple, and Share Count Reduction/Increase %) that the future valuation is highly sensitive to. If our assumptions prove too optimistic for these input variables, it would have a materially negative impact on the future valuation of the stock.

- Competition. There is no shortage of competition for Square, in nearly every product market it is in. PayPal, Stripe, Clover, First Data, JPMorgan Chase, Quick Accept, Zelle, nearly all stock and crypto brokerages, Intuit, Bank of America, H&R Block, Apple Pay, Google Pay, and Shopify, just to name a few. As for any company with competition, it can squeeze margins, stagnate growth, and in extreme cases, even cause business to fail. All three of these problems are possibilities for Square and a risk for investors.

- Relatively expensive product. Senior Equity Analyst at Morningstar, Brett Horn, CFA, believes, “Square is merely a narrow-moat niche operator in the Seller business and is not a true disrupter. Square’s market share is limited on the Seller side by its relatively high pricing and its long-term margins being constrained by a relative lack of scale.” It is argued that because Square is “not a true disrupter,” it should not be able to charge its higher-than-average prices on the Seller side, which will cause the business to struggle when trying to continue to scale. For investors, there is a risk that the market validates Horn’s thesis by proving that Square is not a disruptor and cannot charge premium prices for its products and services.

- COVID-19. Albeit hopefully a short-term risk, as with other payment processors and fintech companies, Square has been negatively affected on its Seller side of the business from the COVID-19 pandemic. There is no plausible way to accurately estimate the length in which COVID-19 will remain. There is a risk for investors in Square that the COVID-19 pandemic could persist longer than anticipated, or it could more severely impact Square’s Seller business than expected.

- Jack Dorsey. As with any eccentric CEO or business leader, there is the possibility their eccentricity eventually works against them – whether it be individually, impacting their ability to lead the organization successfully, or at the company level, leading it down the wrong path while trying to be unconventional and innovative. Also, while it’s no secret that Dorsey’s time is split as he is the CEO of both Square and Twitter, it is a risk for investors in Square.

SUMMARY

Square is a vertically integrated fintech company creating a financial services ecosystem by offering various tools in its two-sided network. It is a high-growth company with large opportunities ahead, but it does not come without risk. It is possible that Square successfully launches additional products and services, its bitcoin bet and expansion internationally pays off, increases ARPU, and steals market share from its competitors. It is also possible that its bitcoin strategy fails, investors realize how Bitcoin Revenue is accounted for, resulting in the valuation contracting significantly, competitors successfully stopping Square from gaining market share, Sellers no longer believing Square’s value is worth its relatively high prices, COVID-19 persists and negatively impacts the business, or Dorsey does something to cause the company to fail. This is why investing is difficult. This is why investing is often more an art than a science.

After reading all of this information, you’re probably wondering – so, do I buy Square stock? Well, it’s not quite that simple, and of course, I cannot give specific investing advice, but I will walk you through how I am personally approaching Square at today’s price.

The expected annual rate of return of 6.2% from today’s price is not overly attractive. That said, I strongly believe in the company and that its opportunities outweigh its risks. It’s also very possible Square could outperform the assumptions made in our valuation model, or its multiples continue to expand. For those reasons, I am not trimming my current position in Square (it is my largest individual investment), but I am focusing on my asset allocation strategy by also not adding to it significantly at today’s prices. I do believe in the approach of “adding to your winners,” taught to me by David Gardner, so I will likely continue to dollar-cost-average (“DCA”) into Square until a better buying opportunity presents itself. Square is a stock that is highly volatile and can provide great buying opportunities if given enough time to do so. I have email alerts setup in our TIP Finance tool to let me know when the momentum has changed in Square’s stock. After a decline in price, the TIP Momentum tool will notify me when Square’s momentum has turned a corner and is heading in a positive direction again – at which point I will highly consider stopping my DCA and start adding heavily to my position in Square again.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclosure: The author, Robert Leonard, as of this writing, holds positions in multiple companies mentioned in this article. Those companies are SQ, PYPL, AAPL, GOOG, and SHOP. The article was written himself, and it expresses his own opinions. He is not receiving compensation for it (other than from The Investor’s Podcast Network). He has no business relationships with any company whose stock is mentioned in this article. The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. Robert is not a financial advisor. Please always do further research and do your own due diligence before making any investments.