TIP Academy

Stock Investing Tools & Online Stock Brokers

By Stig Brodersen

Often we’re asked which tools we use to pick stocks, and how we use them, so we challenged ourselves to list down the tools we find most valuable.

Stock Investing Tools & Online Stock Brokers

By Stig Brodersen

Often we’re asked which tools we use to pick stocks, and how we use them, so we challenged ourselves to list down the tools we find most valuable.

STOCK INVESTMENT TOOLS TO USE IN PICKING STOCKS

Mastermind Group

Perhaps my favorite stock investing “tool” is my Mastermind Group. My Mastermind group surely is not a tool, but I’m including it because as investors we’re prone to all kinds of biases in our investing process. A very effective way for me to avoid that is to speak to people much smarter than me and get feedback on my stock pick. I meet up with my friends, Tobias Carlisle, Hari Ramachandra, and Preston Pysh once a quarter, and we all provide feedback on each other’s picks.

Here is an example of a Mastermind Discussion where I pitch Spotify and Preston is pitching eBay. You may also want to check out our recent mastermind discussions where we talk about various topics such as investing long/short in value stocks, utilize 13 forms in your investment strategy, investing in gold miners and more.

If you would like to form your own mastermind group, I encourage you to visit our Free Forum and look for potential members of your new group.

Stock Picker Tools

1. Dataroma

Pick stocks Warren Buffet has recently picked, through Dataroma. The layout of the site might not be much to look at, but the completely free site is packed with information on current stock picks of the best value investors including Warren Buffet, Howard Marks, Guy Spier, Mohnish Pabrai, and Bill Miller.

2. GuruFocus Free Version

One drawback to the Dataroma site is that you can’t easily see how much the investor paid to enter a position in that specific quarter. To find that I also use GuruFocus’ free version to complement the features of Dataroma.

Best Free Stock Screener

Paid tools are not a requirement to pick stocks. The free versions are usually not as detailed but they are typically 80% as good as the paid resources.

Finviz

If you are going to use a Stock Screener, the best free screener used to be Google Finance. You can check out Preston’s video of how to use the stock screener here. However, Google Finance is no longer available.

The best free screener is now Finviz. Fizviz is an advanced tool that allows you to track and filter stocks based on multiple criteria.

Best Paid Stock Screener

TIP Finance Tool

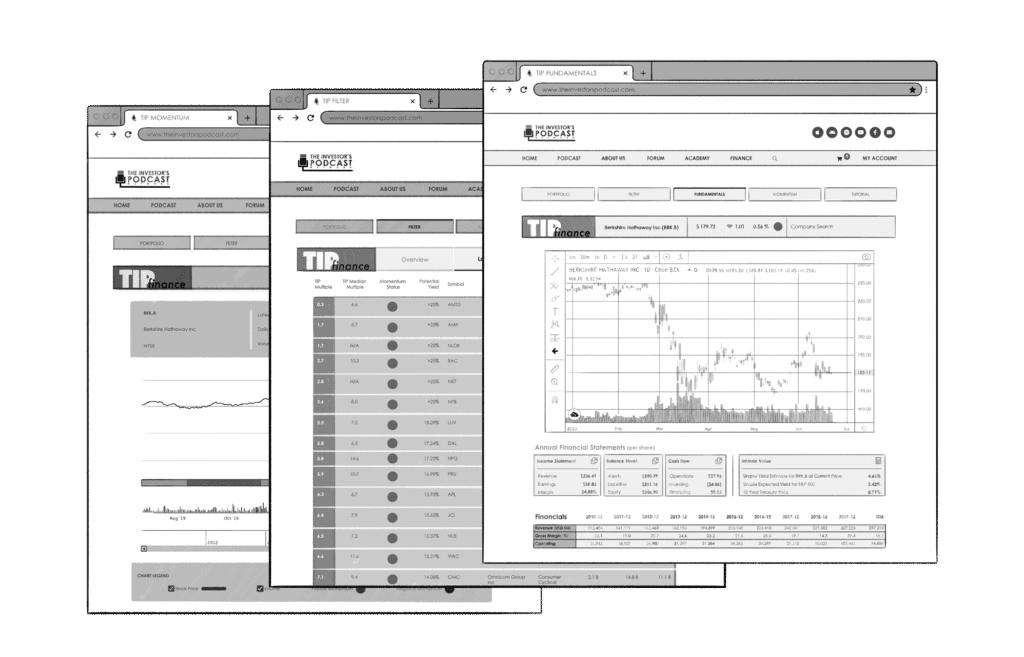

Like many other value investors, I was frustrated about not having all the tools in one place. I used one service tracking my portfolio, another tool filtering all stocks ranking the cheapest first, and even going to another website to find the key ratios for each stock pick. This is why I recommend TIP Finance. We also wanted a tool that could track the momentum of the stock in our portfolio and have an overview of which international markets to invest in.

We knew it was a tall order, so together with Preston, we decided to build a web application for fellow value investors that did just that. Below are the tools included in TIP Finance:

1. TIP Portfolio Tool

This portfolio management and analysis tool helps you monitor and evaluate the performance of your investments. The tool shows you how correlated your active positions are so you can mitigate your overall portfolio volatility. It also keeps you informed of momentum and stock price changes via email alert notifications.

2. TIP Filter Tool

The TIP Filter Tool analyzes the financial data of all U.S. public companies and uses a proprietary method for organizing them into a prioritized list of value investing opportunities.

3. TIP Fundamentals Tool

The TIP Fundamentals Tool delivers core financial data in an easy-to-understand snapshot. The tool provides ten years worth of data and interactive graphic tools to conduct various methods of analyzing the finer details of a company’s past performance.

4. TIP Momentum Tool

TIP Momentum Tool analyzes the momentum of U.S. public companies and provides positive and negative momentum trends for avoiding falling knives. The tool provides stop limits and buy thresholds to assist investors in knowing when momentum trends have reached a statistical change. The tool also keeps track of historical trend recommendations so users can gauge the performance and accuracy of recommendations.

5. TIP International Tool

The TIP International Tool analyzes the current valuation measures of different countries and organizes them into a prioritized list of value investing opportunities.

See the tools in action through our free Intrinsic Value Assessments. We have several subscription plans you can choose from, check them out and see what’s best for you.

GuruFocus

The best paid screener is GuruFocus which is more detailed than Finviz. It has all the criteria I use when I start my research for stocks. If you are using GuruFocus’ stock screener, these are the recommended factors to consider when choosing a stock:

- Market Cap > $500 Million

- P/E Ratio < 15

- Current Ratio > 1.5

- Return on Equity (5Y median %) > 8

- Interest Coverage > 6.0

- 5Y Net Income Growth Rate (%) > 5

- 10Y Revenue Growth Rate (%) > 5

- 10Y EPS Growth Rate (%) > 5

Business and Stock Investing Books

When I’m asked about my favorite stock investing tools, people often expect me to recommend a stock screener or a piece of software that is programmed to generate only the very best stocks. They are surely very useful, but if there is one thing I always go back to and recommend, it would be books. Listening to audiobooks is a great way to maximize your time by educating yourself while doing other chores.

Being a stock investor is also being a businessman. I learn as much from business books not related to stock investing, as I do from stock investing books. With a solid understanding of business, you get a better understanding of the financial statements, and more importantly, you learn to evaluate what matters that you can’t put numbers on.

Here are our range of book resources on investing, business, and life principles that you may want to check out.

Since we started The Investor’s Podcast, Preston and I have used Audible to read most of the books we had on the show. I’m still amazed of how much knowledge you can gain for the price of a simple book which is between $10-15 depending on your plan. You can collect your first audiobook for free here. If you need the inspiration of which books to read first Preston and I compiled a list of our Top 10 books.

Another cool service is Blinkist. It summarizes books in as little as 15 minutes. To me it’s mostly useful for rereading books – I still like the lengthy format whether it’s efficient or not for books I haven’t read before. But rereading through Blinkist is very helpful as I typically only take away 2-4 good points from each book and it’s a good reminder of knowledge I once acquired, and do not want to forget. You can get access to a trial for free here.

WHICH STOCK BROKER TO USE?

A stockbroker is nothing more than a company that conducts trades on your behalf. I encourage people to separate their research tools from their broker. I personally find the recommendations from stockbrokers to be grossly plagued by self-interest. Not only because a broker has an interest in selling you on their company’s mutual funds or highest commission products. But because they would typically always encourage you to buy a security one way or the other, and when you buy something you will eventually need to sell it again thereby doubling the stockbroker’s commission.

Here on The Investor’s Podcast, we tested the top online stockbrokers. Below are their strengths, fees and charges.

A stockbroker is nothing more than a company that conducts trades on your behalf. I encourage people to separate their research tools from their broker. I personally find the recommendations from stockbrokers to be grossly plagued by self-interest. Not only because a broker has an interest in selling you on their company’s mutual funds or highest commission products. But because they would typically always encourage you to buy a security one way or the other, and when you buy something you will eventually need to sell it again thereby doubling the stockbroker’s commission.

Here on The Investor’s Podcast, we tested the top online stockbrokers. Below are their strengths, fees and charges.

Online Brokerage | Strengths | Promotion | Account & Commissions |

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online Brokerage | Strengths | Promotion | Account & Commissions |

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What is the Best Online Stock Broker?

After reviewing the top online stock brokers, we strongly recommend Ally Invest (called TradeKing before 2017). Ally Invest works well for me is because I want my cost to be an absolute minimum. Brokers are not too different, and I don’t use their tools anyway, so rather than this being a personal endorsement of Ally Invest, it’s simply the broker that offered the cheapest trades in our test.

Although I don’t conduct a lot of trades a year (usually about 20 a year), those costs can really add up. Since most brokers charge about $10 a trade, that means I would spend $200 a year just on trading costs. Now, let’s imagine you’re like most investors and you trade a lot more than I do. For example, the typical day trader might buy and sell once a day during the 252 trading days in the year. That means they would conduct 504 trades in a year. Without much analysis, you can see that this behavior would cost the “investor” $5,040! That’s a lot of money. It’s very difficult to have any kind of returns when all the money is going to the broker.

Ally Invest’s personal trading accounts have no set-up fees. No annual fees, and they only charge $4.95 per trade. They’ll even refund you $150 for fees associated with switching-over to their service if you use this link. So in short, I only spend about $99 a year conducting all of my trades. For the day trader, they would save about $2,545.20 a year with Ally Invest if they were making 1 trade a day.

Best Online International Stock Broker

The best online international stock broker is Firstrade in terms of combination of low fees and easiest set-up. Since I live in the US, I do not have an account with Firstrade, but I am highlighting them for international investors. Firstrade is compatible for most international investors, and their fee is only $6.95 per trade. There’s no start up fees, annual fees, or costs when you wire your funds. We recommend Firstrade for new investors as there is $0 minimum deposit, and you have access to a free live support chat to guide you through the process.

Countries being catered to by Firstrade:

- Australia

- Belgium

- China

- France

- Germany

- Hong Kong

- Ireland

- Israel

- Italy

- Japan

- Korea, Republic of

- Macau

- Mexico

- New Zealand

- Poland

- Singapore

- Spain

- Taiwan

- United Kingdom

- Australia

- Belgium

- China

- France

- Germany

- Hong Kong

- Ireland

- Israel

- Italy

- Japan

- Korea, Republic of

- Macau

- Mexico

- New Zealand

- Poland

- Singapore

- Spain

- Taiwan

- United Kingdom

OTHER RESOURCES

Read our article on How to Invest in Stocks: The Ultimate Guide for Beginners.

Get the right insurance and coverage for you, your family, and your business.