How to Invest in Stocks: The Ultimate Guide for Beginners

The stock market has been the best tool in lasting wealth creation for generations of investors. If you’ve come looking for a guide on how to invest in stocks, you’re likely aware of this fundamental truth.

Getting started is often the hardest part. Stocks may invoke flashy Wall Street depictions that seem daunting. However, with this guide, you’ll learn what’s necessary to not just beat the pros but how to build a better financial future.

You might find it surprising to learn that your investment performance will typically correlate less with your mastery of financial markets and more so with merely sticking to a principled plan over time.

As legendary investor Warren Buffett has said, “The most important quality for an investor is temperament, not intellect.”

With the approaches outlined in this guide and across The Investor’s Podcast Network’s wide collection of educational resources, you can succeed in both the stock market and in building wealth long-term.

Let’s investigate.

I. INVESTING IN STOCKS: OVERVIEW

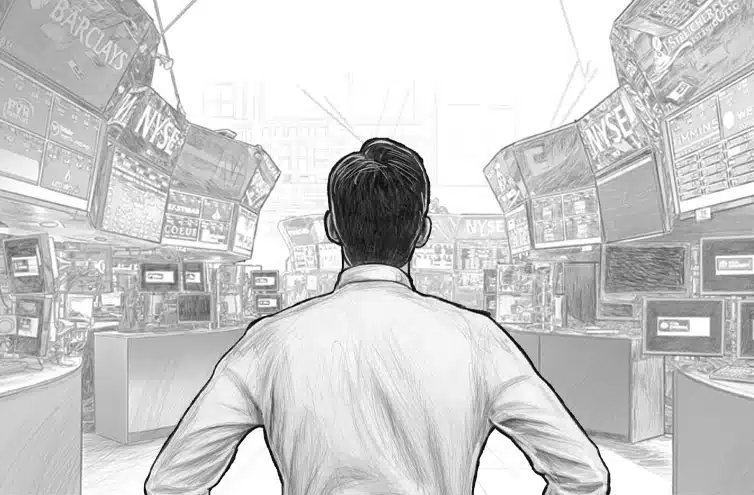

Compounding your wealth

Your goal should be to maximize compound interest.

What is compound interest? It is a mathematical principle so effective that Albert Einstein called it the “8th wonder of the world.”

The idea: by investing your money in growing and profitable companies, you’ll see the value of those holdings correspondingly increase. As a shareholder (stock owner) in profitable companies, you’ll routinely receive cash dividend payments that can then be reinvested in buying more ownership shares of the business.

This effect allows you to ~compound~ your wealth since you’ll earn increasingly larger cash dividends with more shares.

If that already sounds a bit technical, let the great Benjamin Franklin break down the concept more simply: “Money makes money. And the money that money makes, makes money.”

All you really need to know is that if you consistently buy stock in great businesses and hold those stocks for many years, the rest will take care of itself. It’s not rocket science, but it’s the absolute key to investing well.

Chart 1. Sample computation of compounding interest

Before diving into stock-picking mechanics, let’s review the various tools available for maximizing compound interest.

II. CHOOSING YOUR INVESTING APPROACH

a. Investing in your employer’s 401K

The simplest and arguably best approach to investing is through participating in a 401(k) plan.

What’s a 401(k) and what’s in it for you?

According to the IRS, a 401(k) is, “a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts.” 401(k) plans are available to most Americans employed at for-profit companies, while their sister 403(b) plans are available to Americans working at non-profit organizations like public schools or charities.

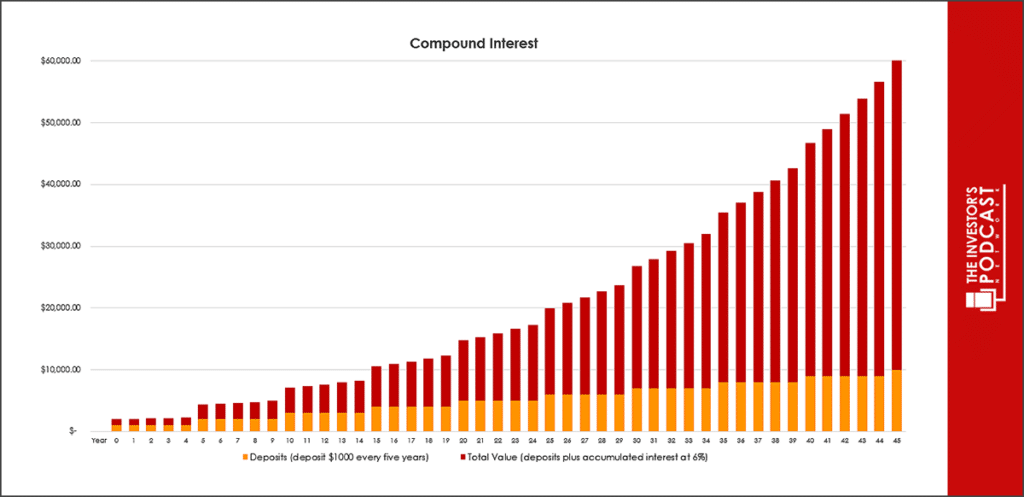

The 401(k) is an amazing tool for retirement saving, as it allows your investments to grow without ever having to pay taxes on your profits (capital gains), so long as you wait until at least the age of 59 ½ to begin withdrawals. And this is hugely beneficial because taxes can be expensive over time. See sample computation below.

Chart 2. Effects of taxes on investment growth

Because of this, you should prioritize contributions to tax-advantaged plans like a 401(k) before investing elsewhere.

In 2022, the maximum annual contribution is $20,500, but beyond the tax benefits, the employer match feature is a common and quite valuable aspect. Per Fidelity, the average employer contribution rate as a percentage of salary in the U.S. is 4.7% or $1,780 in total.

This is a guaranteed 100% return on your investment up to the point the match ends without any risk. By not participating, you may be missing out on thousands of dollars towards your retirement.

Whether you currently have a 401(k) plan or will have access to one in the future, understanding the two types is crucial.

Roth vs traditional retirement accounts

Choosing between them may seem arbitrary, but in reality, this decision can have very significant tax consequences. Luckily, the breakdown is quite simple:

- Roth plans are known as ‘post-tax’ meaning that contributions are not deducted from your taxable income today, so your total tax bill will be higher at present.

- Traditional plans defer this tax liability, so they’re referred to as being ‘pre-tax’ because their contributions are deducted from your taxable income, leaving you with a lower tax bill today but a potentially larger one in the future.

The strategy essentially boils down to your age and your expectations of a rising income. Here are two basic scenarios:

- If you’re young and anticipate your income to continue growing in the future, it’ll be best to utilize a Roth 401(k), which enables you to pay your taxes today based on a lower income and therefore lower tax rate, while receiving payouts in retirement tax-free.

- For higher-income earners who expect to make or live off less in retirement than you do today, a Traditional plan is preferable, so that you can defer tax payments on the money withdrawn, until retirement when your taxable income is lower.

Consult with a financial advisor for more details relative to your specific situation. What if you don’t have access to either a 401(k) or 403(b) plan? Or you do have access but want to save more? Then you can still save via an IRA.

b. Investing in Individual Retirements Accounts (IRAs)

Individual retirement accounts are valuable retirement savings vehicles without the employer contribution. The Roth versus Traditional plans comparison above also applies to IRAs.

In 2022, the annual contribution limit to a Roth IRA is $6,000 ($7,000 if 50 or older) with the qualification that you must earn an income greater than what you contribute. So, don’t contribute more to an IRA than you make in a given year, which for most people isn’t a problem, though for young adults and students this may be something to be mindful of.

Unfortunately for high-income earners, you may be ineligible to use Roth IRAs (this income qualification doesn’t apply to Roth 401(k) plans), though Traditional IRAs are still available to you. Check out the IRS’guide on Roth IRAs income contribution restrictions for 2022.

If you don’t have access to either a 401(k) or 403(b) plan, an IRA represents your best tool for retirement saving so contribute up to the limit if you can. And if you do have an employer-sponsored plan, at least contribute enough to fully capture your employer’s match before allocating to an IRA. Meaning that, if your employer has a match up to 6% of your salary, you’ll want to contribute at least 6% to collect all of the money available to you, and at that point, you could choose to allocate to an IRA.

Why would someone want to contribute to an IRA instead of solely sticking with a 401(k)?

Well, in an ideal world you would maximize contributions to both your 401(k) and an IRA at the same time. A noticeable difference between IRAs and 401(k) plans is that you’ll have considerably more flexibility in choosing your investments in an IRA, as employer-sponsored plans tend to confine you to a few preset allocations or otherwise limited choices.

For some, the stock-picking freedom associated with an IRA will be an exciting opportunity to try your hand at, while for others it’ll be quite intimidating.

Let’s go through the basics and additional tips you’ll need to know in personalizing your portfolio.

III. ACTIVE VS PASSIVE INVESTING

There are two main approaches to stock investing, and the sides are split between ‘Active’ and ‘Passive’ styles:

- Passive investing methods are simpler, as investors choose to allocate money to index funds that are broadly based and defined by fundamental rules. For example, a passive investor may choose to invest in a mutual fund or ETF (exchange-traded fund) that holds all publicly traded companies in the U.S. This would be a type of index fund, and the advantage is that you now own a small slice of every American stock without making any specific bets. Not so bad, huh?

- Active investing requires investors to make well-researched or algorithmic stock bets. The S&P 500’s performance is their benchmark to beat. This index is arguably the most famous, since it represents the returns of approximately the largest 500 U.S. public companies. And from hedge fund managers to amateur stock enthusiasts, these active investors frequently design unique tactics to beat the stock market averages.

Under the passive methodology, your wealth grows as America’s best companies grow, and if companies in the index go bankrupt or lose value, the direct cost will be greatly minimized. For most people, this is the best approach to stock investing, with a combination of index funds capturing the U.S. and international markets.

Why is passive investing the best approach to investing?

Many like the idea of investing but are unwilling to do the work necessary to pick stocks, so passive strategies are a perfect compromise.

By not putting ‘all your eggs in one basket’, you’ll be more likely to navigate tumultuous and uncertain times effectively, especially when there are headlines on the news flashing emergency warnings for the markets.

Passive investing is effective and extremely low cost.

For instance, there are at least four ETFs that track the S&P 500 with less than 0.1% in fees. Because these funds do all the backend work, they require a small annual compensation known as the management fee. This is a fair arrangement, especially since most brokers have eliminated trading costs, meaning it’s generally free to buy and sell stocks at your discretion.

Betting on the market broadly via index funds has been a much better choice than pouring money into funds that actively try to pick stocks. On average, half of these money managers will perform worse than the market benchmark, and the rest will charge fees so high that you still end up doing worse than a simple index fund.

This is a well-documented reality proven true by decades of research. Warren Buffett famously bet on this once, challenging the entire hedge fund industry to outperform the S&P 500.

Surely, this is a task the most esteemed investors on Wall Street can achieve, right? Surprisingly, no.

Protégé Partners LLC entered into a $1 million charitable wager with Buffett, selecting five hedge funds that from 2008 to 2017 they expected to perform better than the market benchmark. Despite the crash from the Great Recession, the S&P 500 index fund dominated with returns of 85.4% versus the 22% hedge fund average.

Despite skilled management, robust trading systems, and advanced algorithms, simply ‘buying the market’ was a much better decision for you than these hedge funds.

Don’t be fooled by marketing. Whenever investing in mutual funds / ETFs, make sure to investigate the fee structure which should be clearly stated. Wall Street loves to package investment products in shiny wrapping with fancy language to coax you into paying more for something you may not need.

If management fees are greater than 0.5%, you should be skeptical, and for most investors, any fund with fees greater than 0.75% should be ruled out.

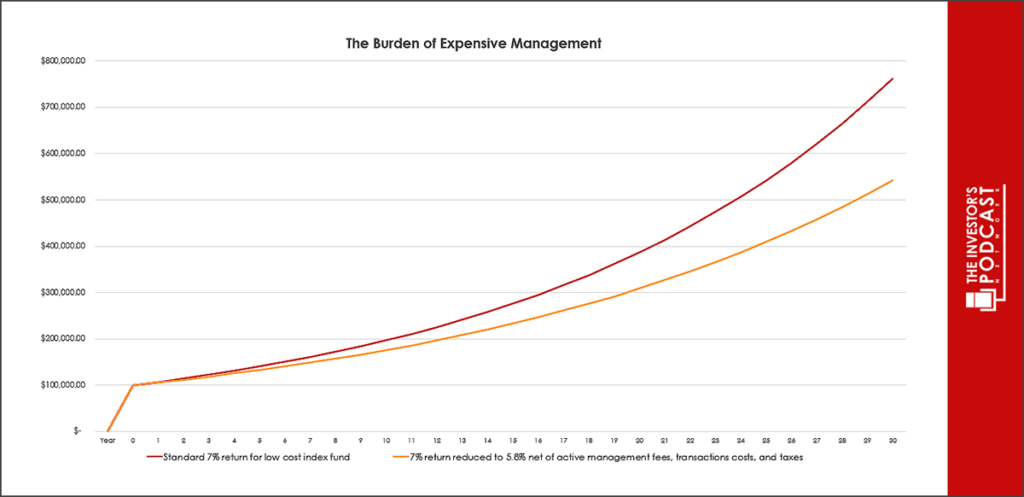

The amount you pay in fees is solely up to you, so don’t get tripped up by a product that sounds sophisticated, but in reality, is eating away at your wealth compounding over many years. See below for how high fees can hinder returns over time.

Chart 3. The Burden of Expensive Management

A good rule of thumb is to utilize Vanguard’s mutual funds and ETFs. Vanguard’s John Bogle redefined asset management on Wall Street by dramatically undercutting its competition on fees. Vanguard’s fund costs will serve as at least a good reference point.

If you want to invest in a U.S. real estate fund, and the fund you’re considering has 2x, 3x, 4x, or even 5x Vanguard’s equivalent product’s management fee, there better be a very good reason for choosing it. If not, keep things simple and save money by sticking with the lowest cost option.

So how to choose between mutual funds and exchange-traded funds (ETFs)?

Mutual funds are companies with pools of investors’ money that have managers to choose investments and allow you to access a broad range of stocks and bonds in a single product.

An ETF is a type of pooled fund that trades like an individual stock throughout the day and tends to have fewer costs than regular mutual funds which are less tax-efficient and only trade at the end of the day. You can find all of the details about a mutual fund or ETF in the prospectus, which is a document highlighting its investment strategy, performance history, fees, etc.

ETFs are sort of the new technology disrupting the asset management world, while mutual fund’s advantages stem from being around longer, so there’s a wider variety of mutual fund strategies and greater active management. Mutual funds also offer more investor services but may have sizable minimum investments and greater embedded fees.

Increasingly, mutual funds struggle to compete with ETFs and for good reason, so for most readers, ETFs will prove more accessible, affordable, and understandable.

To learn more, check out our course on How To Invest in ETFs by Stig Brodersen.

IV. HOW TO PICK STOCKS

What to look for in stocks

If broad market index funds speak to you, feel free to skip to the next section on opening investment accounts.

For those not sold on passive investing strategies, or those who seek to combine both passive index funds with their picks, let’s run through the basics.

a. Intrinsic Value

The key to effective stock investing is purchasing stock below its intrinsic value.

If a company is worth $20 per share, and you buy it for $15, you received a 25% discount. And the larger the discount, the higher your margin of safety which hedges your risk of being wrong and reduces your potential losses. Always remember that price is what you pay, while the intrinsic value is what you get.

Discerning a company’s intrinsic value is the hardest part here, but we do have a free intrinsic value guide for you to employ. Watch the video below for further explanation.

You can also check out our free collection of multiple companies’ intrinsic value assessments.

As a shareholder, you’re entitled to the company’s equity value. So, once all of the company’s debts are paid off, whatever’s left belongs to you, at a value proportional to your ownership share. If the company’s equity is worth $100, and you hold 1 share out of 100, you’re entitled to $1. But that doesn’t mean the shares are only worth $1, because that company isn’t likely to sell all of its assets (i.e. real estate, equipment, factories, patents, etc.). Rather, companies seek to continue operating profitably so that equity value will rise in the future.

This means that the intrinsic value equals the current equity value plus the expected future increases in equity value discounted to today.

The reason those future increases (cash flows) to equity are discounted is due to the time value of money. A dollar today is worth more than a dollar in a year from now, partially because of inflation and also because you could invest a dollar today to have more than a dollar in a year. The discount rate is the degree to which you complete this reconciliation by converting future dollars into a value relevant to you in the present.

Higher discount rates applied to future dollars equates to lower present values, and the minimum value you should use as a discount rate is that of U.S. Treasury debt, usually 10-year Treasury bonds (currently approximately between 1 and 2%), plus 4–5% for the extra risk associated with stocks. If that seems a bit complicated, a default discount range of 5.5–9% can be applied with higher discount rates for less certain and therefore riskier companies.

While this process may sound like a science, it’s really an art. Fortunately, The Investor’s Podcast Network has tools for mathematically estimating a range of per-share intrinsic values.

Principles of stock-picking

When looking to buy stocks, what you must understand is that you’re securing ownership shares in a company. Wall Street may seem distant, and stock tickers may look like only letters on a screen, but the principles are the same as going out tomorrow and buying a local business or an apartment to rent out.

a. Mr. Market

If you buy a McDonald’s franchise, you’re not going to be concerned by the daily and even hour-to-hour price that you can sell it for. Warren Buffett personifies this irrationality through a salesman he calls Mr. Market, who comes to your door every day offering a different price for stocks despite the underlying businesses mostly staying unchanged.

Rather than reacting with alarm to the prices Mr. Market quotes, use low offers as a chance to buy your favorite businesses at a discount. Treat your stocks like businesses you want to keep over many years and ignore hysterical financial media and speculators.

b. Competitive Moat

Good businesses to own will have a strong competitive moat, or in other words, their ‘X’ factor in beating out competition. You’ll hear many successful stock-pickers reference this concept, as it underscores a company’s ability to survive long-term.

For example, a farmer selling corn has no real competitive moat, as all other corn farmers produce a nearly identical good. If he tries to raise profits by increasing prices arbitrarily, customers will purchase their corn elsewhere. But Coca-Cola’s secret formula and devout customer loyalty? That’s an extremely strong competitive moat, and if you’re entering the soda industry, you’ll need a very compelling advantage to survive.

If a stock has no clear competitive advantage, you shouldn’t own it, plain and simple.

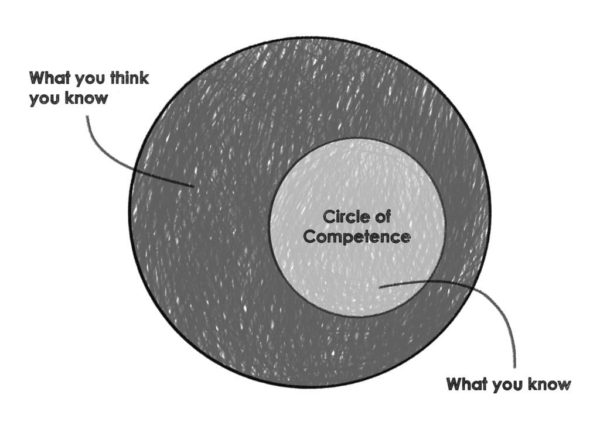

c. Circle of Competence

This brings us to a relevant concept: circle of competence. To beat Wall Street, you have to ask yourself, what does Wall Street not understand as well as I do? If the answer is nothing, then stick to index funds.

Perhaps though, you’re a doctor or nurse, and you understand healthcare companies better than professional investors and could have an advantage in picking those types of stocks. Maybe you’re a software engineer, and that gives you the confidence to invest in a company you believe has a lasting technological competitive moat.

Whatever your background is, be honest with yourself about whether you have any unique knowledge or expertise, and if you do, focus on exploiting it. This is what it means to invest within your circle of competence, and you’d be wise not to stray too far from it.

Check out this podcast episode on Warren Buffett Value Investing to learn more about Warren Buffet’s approaches to stock-picking using these concepts.

d. The Four Rules

Let’s provide a few quantifiable traits to evaluate stocks with, and we’ll go to none other than the legendary Benjamin Graham. Graham, author of the famous book The Intelligent Investor and mentor to Warren Buffett, has four rules:

- Diversify your portfolio between at least 10-30 stocks.

- Filter for large companies with low amounts of debt.

- Companies should have a record of dividend payments, preferably 20+ years.

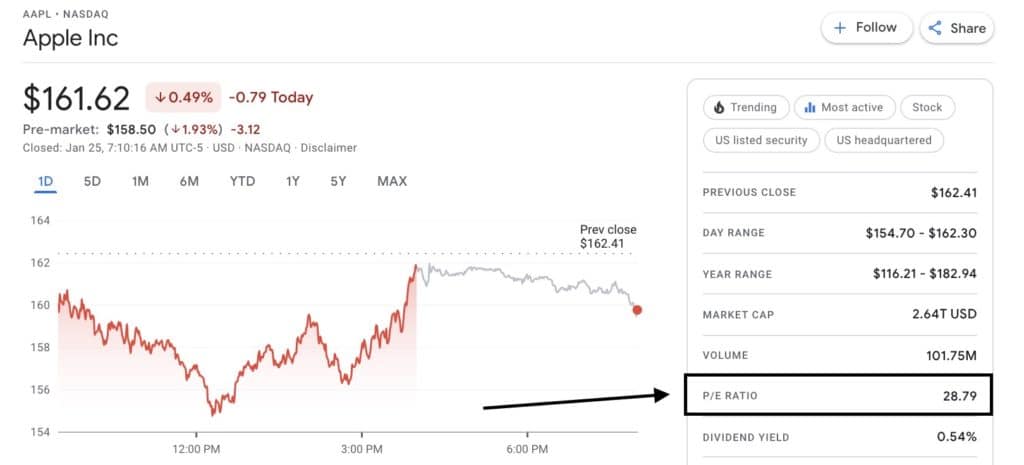

- Good investments shouldn’t be too expensive. Look for bargain stocks with a price-to-earnings (7-year average) ratio of less than 25.

The first rule here warns against not having all your money in a few stocks while also suggesting against picking too many given the difficulty of properly vetting and tracking them. Finding 10-30 quality long-term investments may take years to do, but it’s the sweet spot for diversification.

The second and third rules emphasize companies that are proven, for these businesses will be the best stewards of your money. If a company is at risk of not paying off its debts, you’re at risk as a shareholder.

The dividend rule may seem a bit extreme and outdated, but the point is to invest, not gamble. Maybe 20+ years is too high, ultimately it’s up to you which rules to follow, but your framework should highlight a company’s lasting profitability, which decades of dividends, and even better dividend growth, shows. It’s okay to deviate from this rule, as not every great company will even pay a dividend, but do so at your own risk and with even greater attention to detail.

And lastly, the price-to-earnings (P/E) ratio is a common metric for investors which simply captures the underlying income relative to the current share price. A higher ratio indicates you’re paying more money per share for a dollar of the stock’s net income than you would for one with a lower ratio. At a P/E of 25, this means you’re paying $25 per share for $1 of net income (also known as earnings), so a lower ratio is typically desirable.

P/E ratios can be found easily and are calculated for stocks with positive net income through sources like Google Finance and Yahoo Finance, and try using Finviz to help with screening (filtering down) your stocks of interest.

Image 1. Apple Inc from Google Finance.

Check out our course on The Intelligent Investor to learn more about Benjamin Graham’s strategies.

V. TYPES OF INVESTMENT ACCOUNTS:

HOW TO CHOOSE AND OPEN YOUR OWN INVESTMENT ACCOUNT

So, you understand the tax savings associated with retirement accounts, the benefits of diversification and passive investing, and the tenets of fruitful stock-picking. It’s time to consider how and where to open the accounts that will facilitate these ambitions.

a. Brokerage Accounts

These are your standard investment accounts as they offer no special benefits like retirement, health care, or education savings, so you’ll have to pay taxes on profits you earn upon selling. Some will offer more complex securities than others, but they should all enable purchasing exchange-listed common stocks and funds.

How to open a brokerage account

To start, you’ll need to provide identifying information to become registered and approved, and then link your bank account. This is the same for opening an IRA, and most major brokers will offer both.

Charles Schwab and Fidelity represent excellent full-service brokers that will afford you tremendous flexibility in picking your investments or in sourcing their advisors for support, in addition to supplementary services from interest on cash, to charitable giving assistance, to mortgage loans, and home equity lines of credit. Robinhood offers more limited services but provides a full spectrum of potential investments.

Beginner-friendly brokers (i.e. Acorns) are very useful, as they easily facilitate automatic contributions and remove all the stress of investment picking with pre-built portfolios, while M1 Finance provides similar functionality but empowers you to also choose specific investments.

Make sure to utilize our following guide for investing tools and picking the best online stockbroker.

b. Robo-advisors

While a robo-advisor isn’t commonly eligible to help with 401(k) plans, they’re great for IRAs and brokerage accounts. These services are useful in providing low-cost access to professional expertise.

How to start investing with a robo-advisor

Simply outline your experience level, risk tolerance, and time horizon, and an automated advisor will help you allocate to an appropriate portfolio with automatic rebalancing. Excellent robo-advisors are offered through the likes of Betterment, Wealthfront, Charles Schwab, Ally, Fidelity, and many others.

c. 401(k) / 403(b) / Thrift Savings Plan

How to start a 401(k) or 403(b) plan

Your employer should directly provide the tools to enroll here, and normally there may be a service provider managing your company’s plan offering the option to hire a financial advisor. Advisors can be expensive though, so individuals with high salaries, large accounts, or nearing retirement prefer them. If your retirement is decades away, picking a few basic funds to suffice should be quite simple.

Younger investors will want greater allocations to stocks, while those closer to retirement may find a higher ratio of stocks to bonds too risky. Fortunately, target-date funds are frequently available in employer-sponsored retirement plans, and they’re extremely simple. Pick the fund with a target year closest to the year when you expect to retire, and the fund will shift from higher risk and higher return investments to an increasingly conservative structure over time.

d. 529 Plans

These plans facilitate college savings, and every state offers its own plan. While you can participate in any state’s 529 plan, the majority will provide state income tax deductions if you participate in your state’s plan.

How to open a 529 plan

Here’s a great resource for directly enrolling, and full-service brokers like Charles Schwab will facilitate this for you as well. Contributions aren’t deductible for federal income taxes, but the gains and withdrawals made towards qualifying education expenses are tax-free.

In parent-owned 529 plans, any family member can contribute towards the children’s education. While there are maximum cumulative contribution limits, they tend to be high, so most will want to focus in the short-term more on not exceeding the annual gifting limit. This isn’t a major issue but will begin to affect your lifetime estate and gift tax exemption for gifts over $15,000 in a given year ($30,000 for a couple) per child. There are workarounds to gifting more than this in a year on a lump sum basis though.

Your application will include the parent’s and child’s basic information. Once approved, you can set your contribution rate and frequency from your bank account, as well as select your investment strategy. Like a target-date retirement fund, you may be able to select an age-based portfolio appropriate for your child or select basic aggressive/moderate/conservative strategies. You’ll want to be pretty aggressive early on (meaning more stocks), and as expected college expenses approach, become more conservative. Learn more here.

e. HSAs

A health savings account, or HSA, is another type of tax-advantaged account that allows individuals to save for medical expenses not covered by health plans with high deductibles (the amount you pay before insurance kicks in). HSAs can be complex, so you’ll need to check whether your health care plan qualifies for opening one.

How to open an HSA account

If you’re eligible, individuals can contribute up to $3,650 annually in 2022 with no taxes on contributions, investment gains, and withdrawals for qualifying medical expenses. Services such as The HealthSavings Administrators will allow you to easily create an account, invest in Vanguard passive funds, and provide a debit card to directly spend your funds when needed. If interested, please take the time to learn more about HSAs here and here.

Which investment account should you open?

The type of account you open will vary depending on your current place in life.

While almost everyone can benefit from investing in an IRA, only currently employed workers can contribute to employer-sponsored plans such as the 401(k), and 529 plans may not be relevant to those without children or not expecting major education expenses, and HSAs offer perhaps the best tax advantages but can only be utilized by those with qualifying high deductible health care plans.

For investors who’ve maximized their retirement savings contributions and considered whether they’d like to contribute to the other tax-advantaged accounts we’ve outlined, it may then become appropriate to open a taxable brokerage account to supplement their investments. Or if your stock trading endeavors are short-term and speculative, maybe you want to fund a brokerage account regardless of maximizing tax-advantaged accounts.

Let’s discuss further how much to invest and how to decide which of these accounts to allocate towards.

VI. DETERMINING HOW MUCH TO INVEST

This can either be a rather complex decision or incredibly simple. The simple answer?

Invest as much as you can, as frequently as you can, in the accounts or areas that provide the most direct financial and personal benefit.

This inclination towards effective saving and investing is instrumental to building lasting wealth and financial independence.

For someone with underlying health issues, perhaps contributions to stock funds in a health savings account should be your top priority. For working parents with kids, finding a balance between employer-sponsored retirement plans (and IRAs as well) and 529 college savings for your children could be your key decision point. For young adults and college students, you may want to contribute the max to an IRA and then anything else to a taxable brokerage account of stocks.

How much money should you invest in stocks?

Reflect on your current situation, intermediate and long-term goals, adjust as needed and contribute accordingly. A good principle, no matter which type of account it goes into, is to never invest more than you can afford to lose.

In any given year or several-year period, one’s stock holdings could lose over 50%. This is something to take seriously, don’t be the foolish person who expects to get rich overnight from stock investing and ultimately quits when this fails to happen.

A great strategy to hedge against our propensity for greed and fear is known as dollar-cost-averaging.

Dollar-cost averaging investments

Dollar-cost averaging investments refers to frequent small contributions over time rather than putting in all of your investable money at once.

For example, you receive a $10,000 end-of-year bonus you want to invest. Ignoring taxes, you could spread that investment out over 5 months with $1,000 bi-monthly contributions to an index fund. The primary advantage is that you smooth out your investing journey which may make it easier to stay invested longer.

Large lump sum investments can be intimidating and have a layer of market prediction in them, as you’ll be tempted to try and pick the perfect time to invest. This could excessively delay your wealth compounding process as you wait for the right moment or position you precariously into buying at a market high before a downturn.

Both of these are undesirable, so a frequent and recurring investment contribution plan is best at reducing market price risk and the likelihood of overreaction.

In asking how much to invest, review your budget and see how much you can contribute daily, weekly, or monthly. IRAs and taxable brokerage accounts will have the best flexibility for this, but in most accounts, there’s some degree of discretion in determining contribution frequency.

Check out our resource on personal finance for more insights on managing your finances.

VII. HOW TO BUY A STOCK (STEP-BY-STEP PROCESS)

For those planning on picking stocks, index funds, or other securities for their investments, let’s go through what that process may look like. Remember, 529s, 401(k) plans, HSAs, etc. will usually have a few preset allocations to choose from. If you’re using a taxable brokerage account or an IRA to invest, this’ll be useful in showing what it looks like to purchase stock directly.

Note, this is just a general overview.

1. Select a broker and complete identity verification: Our favorites are Charles Schwab, TD Ameritrade, Ally, E*Trade, and Fidelity.

a. There are so many great brokers today, so don’t waste too much time on this as a beginner. Compare websites and apps, see if any speak to you, and ensure that they’re compatible with your bank. Charles Schwab is a great default given its educational resources, investment research, robust customer support systems, and robo-advisory services.

b. To get set up, you’ll need a valid email address, social security number, bank account info, etc.

2. Select your account features.

a. You may be asked your experience level so answer honestly.

b. You’ll also be able to clarify whether you’re opening a regular taxable brokerage account, an IRA, or both.

*If opening an IRA, review our section on the differences between Roth and Traditional accounts. Your broker should track and help ensure that you don’t exceed the legal contribution limits.

3. Once your account is approved and opened, fund it with cash.

a. Brokers like Schwab allow you to upload checks and paychecks directly or transfer from your linked bank account.

b. Depending on your broker, you may be able to begin trading immediately once a transfer is initiated, or you’ll have to wait a couple of days for the cash transfer to settle.

4. With cash in your account, you can now begin investing. Congratulations!

a. Stocks, ETFs, and other securities may have unique short identifiers known as tickers. All stocks trading on major exchanges should have them. Apple, maker of the iPhone, has the following ticker: AAPL on the Nasdaq exchange.

b. Your broker should have a search bar feature where you can input a company or fund’s name, and it’ll populate with the relevant choices and their tickers, but you can always use a quick google search to double-check the ticker.

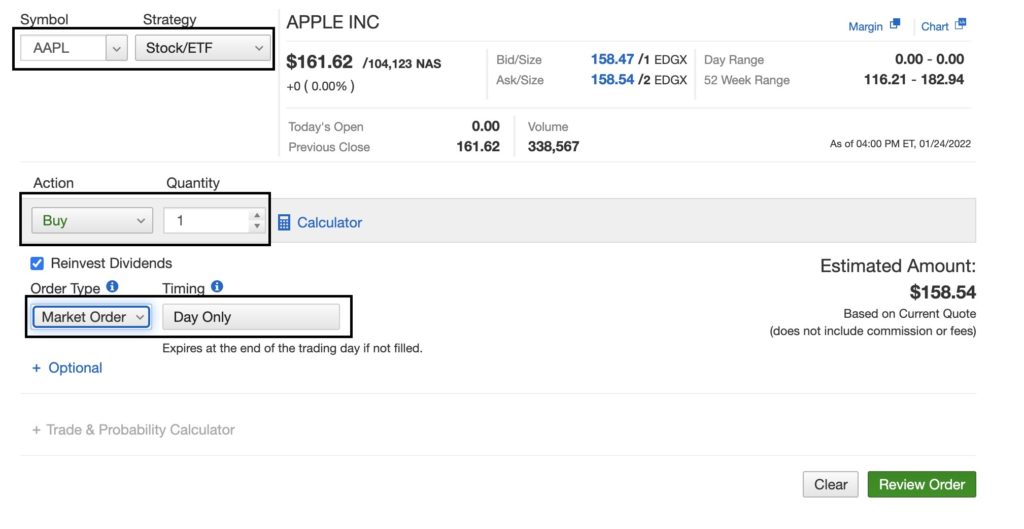

5. With a selected ticker, click to ‘BUY’, input the order quantity, and choose the order type.

a. The order quantity is important. For certain stocks, your broker may allow you to buy fractional shares, so you can invest with just a few dollars.

b. Your total expense should be the number of shares purchased times the cost per share (ignoring commission costs and fees which are most often zero today).

c. Another thing to know is that there are different types of buy orders an investor can place. Your broker may provide a default approach, but if not, the best option for a beginner is the market order. So if you’re buying, the broker will try and fill your order immediately with the seller offering the lowest price.

i. There are also stop and limit orders for more sophisticated investors that you might see as options. Ignore these for now, but they can be useful for investors with large orders or those looking to strategically enter/exit an investment at specific price levels.

ii. The timing aspect indicates how long you’re willing to wait for an order to be filled. Day only or good until canceled will suffice for beginners. Some brokers may not provide this option and will wait to fill the order unless you explicitly cancel.

Image 2. Sample process for purchasing a stock.

VIII. MONITORING YOUR INVESTMENT PORTFOLIO

As you build out your investments, you’ll certainly be tempted to track their performance. And this is important to do intermittently. However, there’s a difference between tracking for strategic purposes and obsessively checking out of fear or exuberant expectations.

The trick is to moderate your eagerness, in building wealth, the tortoise really does beat the hare; investing is a slow process built around a long-term mindset.

If you’re tormented over your portfolio’s daily performance or large drops, it’s best to move into lower-risk options by trimming the amount you have in individual stocks/stock funds, or you should fully outsource the process to a trusted advisor. A more conservative approach will handicap your returns over time, but it’s a better outcome than inflicting undue stress on yourself.

Studies show that counterintuitively, investors who check their portfolios the least (beyond a necessary threshold), actually perform far better than their more zealous counterparts. Again, this is because successful investing has more to do with temperament than wit, as the patient investor will be rewarded in due time. Staying in the game the longest is what matters for compounding, and the most active investors among us also have the highest propensity to commit sins that divorce themselves from their long-term goals.

Managing your rebalancing

For a responsible and diversified investor, rebalancing is a vital aspect of your financial management that’ll require an occasional review of your investments.

If you use a robo-advisor or a financial advisor, they’ll manage this part for you. For those hoping to manage a basic investment plan without the fees for any advisors, likely in an IRA or taxable account, let’s discuss more.

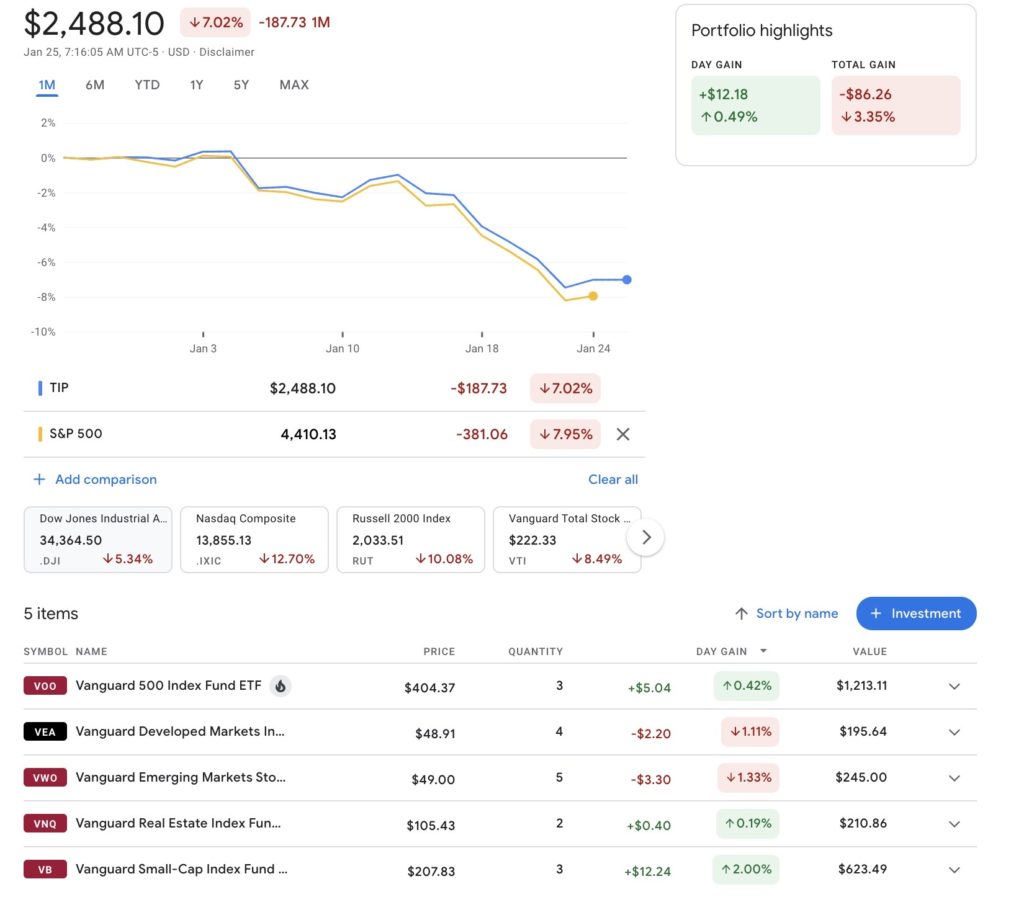

Let’s say you’re rather young and hoping to maximize your wealth in 30 plus years, you may hold the following portfolio (reminder, this is just an example, not advice!):

- 40% large U.S. company stock index ETF (example tickers: VOO, SPLG, SPY)

- 20% small and medium U.S. company stock index ETF (example tickers: VB, IJR, IWM)

- 15% real estate company stock ETF (example tickers: VNQ, SCHH, IYR)

- 15% international developed company stock ETF (example tickers: VEA, EFA, SCHF)

- 10% international emerging market company stock ETF (example tickers: VWO, IEMG, SCHE)

After doing thorough research, you decided on the above allocations as your passive index strategy for at least the next several years. To track this portfolio, your broker should provide a decent overview, though tools like Google Finance are also available to simulate how a custom portfolio would have performed over various periods, see below as a sample.

Image 3. Google Finance’s Custom Portfolio Tool.

If your real estate ETF has an exceptional year while your emerging market ETF doesn’t, you could see your real estate investment now comprise say 18% of your portfolio while the emerging market investment falls to 7%.

To reap diversification’s full benefits, rebalancing is necessary.

You’d either sell a bit of the real estate fund and use the proceeds to purchase more of the emerging market fund, or you could generally contribute more to the stock funds that have become a smaller slice of the pie than intended.

To keep tabs on your portfolio, you can also try our TIP Finance Tool to track your returns, measure diversification, and identify new opportunities.

Resources for rebalancing

If rebalancing seems tedious, difficult, or just plain confusing, this is a reminder that utilizing a robo-advisor may be valuable, or try basic brokers like M1 Finance and Acorns, who’ll help do this for you with less professional expertise but fewer fees than a robo-advisor. If you still want direct control over your investments, M1 Finance will be your better choice broker over Acorns for help with rebalancing.

For those opting to rebalance themselves, this should be a once-a-year activity, not something to try and manage every week. You’ll end up spending a lot of time and stress, and risk incurring taxes if in a regular brokerage account, to little benefit.

Pick a day every year, and make a habit of rigorously reviewing your investment strategy on that date and rebalancing accordingly. Even if you’re not the one rebalancing directly, an annual review is still a useful exercise, but any more frequently than that becomes increasingly unnecessary.

Keep things simple in all regards, and you’ll have a much more pleasant experience.

Paying taxes on investment income

In regular brokerage accounts, you’ll be taxed on capital gains whenever you sell a stock above what you paid for it (your cost basis) and on dividend income paid out to you as a shareholder. Your broker should make this process quite painless though, as they’ll track your cost basis and dividends accrued, in addition to providing the relevant tax forms.

Depending on how long you hold your investment before selling, you’ll be taxed differently on these profits, with the most favorable rates applied to investments held for over a year. These are called long-term capital gains, and for the vast majority of investors, they’ll be taxed at 15%.

Note, for individuals with incomes up to $40,400, you may face no taxes on long-term capital gains, while extremely high-income earners could pay as much as 20%.

The government also disincentivizes short-term trading and speculating by taxing gains on investments held for less than a year as ordinary income which tends to be significantly more costly. So if you do make large profits, if possible try and wait one year before selling. And if you ended up losing money investing in a year, you can use those losses to offset taxes owed on your regular income.

Check out the IRS’ resource on capital gains and losses here, or consult a tax professional.

IX. SUMMARY

As we know, the stock market is an incredibly powerful tool, and one can utilize our free and open financial market system to collect ownership in the best companies globally while saving towards a variety of goals.

Although many of the details touched on in this guide have more nuance associated with them, this is an excellent starting point to begin your lifelong journey in building wealth through savvy and pragmatic investing.

With a little work, patience, and willingness to learn, you can leverage stock ownership and tax-advantaged savings to tremendous personal gain without needing a genius-level IQ or Wall Street salesmen.

Check out The Investor’s Podcast Network’s educational resources below. And as Warren Buffett says, don’t ever forget, “Your best investment is yourself. There’s nothing that compares to it.”

RESOURCES

- Investing for Beginners video by the host of Millennial Investing, Robert Leonard.

- Videos from Warren Buffet, learn from the best directly!

- Asset Allocation free video course by Stig Brodersen.

- Investment and finance terms every investor should know.

- Intrinsic Value course.