Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Your Complete Guide to Dollar Cost Averaging

By Rebecca Hotsko • Published: • 11 min read

In this comprehensive guide, we will explore the concept of dollar cost averaging, understand its benefits and drawbacks, and provide insights on how to effectively implement this strategy to achieve your investment goals.

WHAT IS DOLLAR COST AVERAGING?

Dollar-cost averaging simply means investing the same fixed amount of money in the shares of an index fund or company at regular intervals (monthly, quarterly, etc). The magic happens when using this strategy to buy stocks in a declining market as investors are less likely to put all their money in the market at the wrong time. Everyone likes buying things for a discount, and buying stocks is no different. When you are a buyer and not a seller of a stock, buying into a downward market should actually be preferred by investors as this allows you to buy more of the company for less.

AN EXAMPLE OF HOW AND WHY IT WORKS

Suppose you decide to invest $500 per month in a broad market index fund over the course of a year. In the first month, the market is experiencing a dip, allowing you to purchase more shares with your $500. In the second month, the market rallies, and your $500 buys you fewer shares. However, as you continue this systematic investment approach, you average out your purchase prices over time. This means that you are not solely reliant on the market’s short-term performance, but rather benefit from its long-term growth potential.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

HOW TO DOLLAR COST AVERAGE

Let’s walk through a simple example to show you why this is the case.

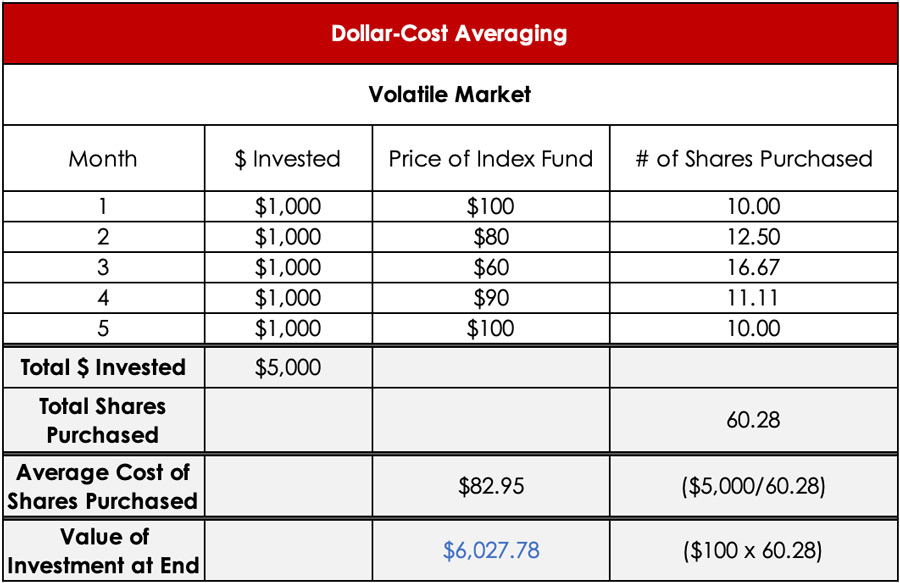

Scenario #1: The result of investing in a declining/volatile market

In this first scenario, an investor has a total of $5,000 to invest and decides to use dollar-cost averaging by evenly investing over a 5-month period because they are worried the price of the stock might go down in the near term, but also doesn’t want to lose out on the gains if it goes up. Immediately after investing the first $1,000, the stock price plunges 20% and continues to decline for three months, only recovering to the initial purchase price of $100 by month 5.

However, because the investor sticks to the strategy of buying $1,000 of the stock each month, they actually end up being able to buy more shares for less money! At the end of month 5, the total return of this investment is 20.5%, despite the price of the stock declining substantially for 3 out of the 5 months. This scenario illustrates why investing in a volatile market should not be feared by investors and that using dollar-cost averaging can allow you to make huge profits even if the stock price goes down for a period of time.

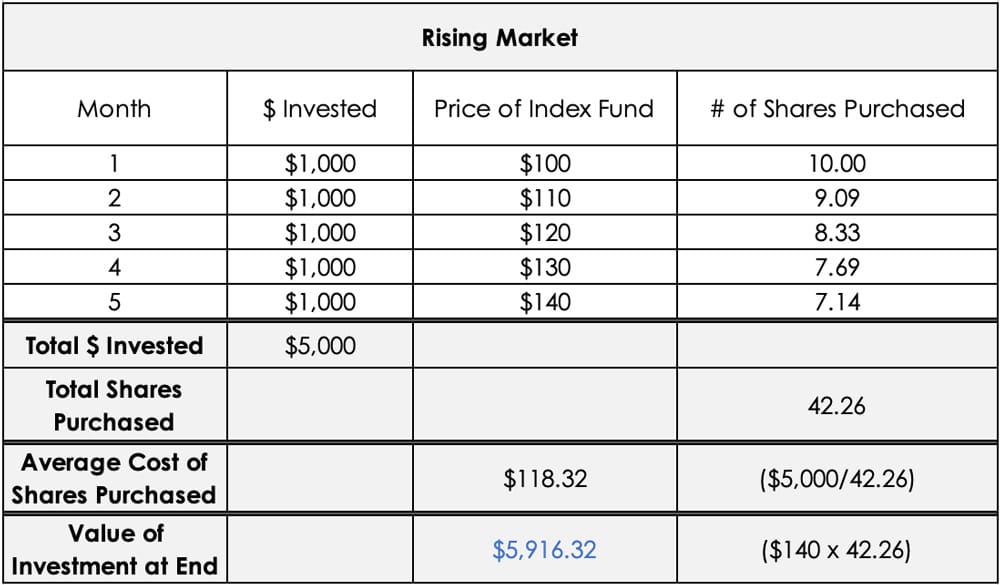

Scenario #2: The result of investing in a continuously increasing market

In this scenario, the investor also has $5,000 to invest and plans to invest the same fixed $1,000 increments in a stock over 5 months. However, this stock rises continuously over the course of the 5 months and ends up being 40% higher than what the investor initially purchased shares at. This investor is confused to see that despite this investment rising significantly over time, the return on this investment is only 18.3%, which is less than the 20.5% return achieved in a scenario where the price actually declined significantly for some time.

The investment in the declining stock scenario made more money than the stock that kept rising because the investor buying the stock that kept could buy less and less shares each month with the $1,000. Whereas the other investor was able to take advantage of the falling stock price over time and purchase more shares at a lower price.

So, even though the same $5,000 is invested in both cases, the investor who used dollar-cost averaging to buy shares of a stock that declined actually ended up with a higher return than the investor who used the same strategy to buy shares of a stock that never declined. This example illustrates the power that dollar-cost averaging has for protecting returns in a declining market and why a buyer of stocks should much prefer periods of declining prices over continuously rising ones.

DOLLAR COST AVERAGING VS LUMP SUM

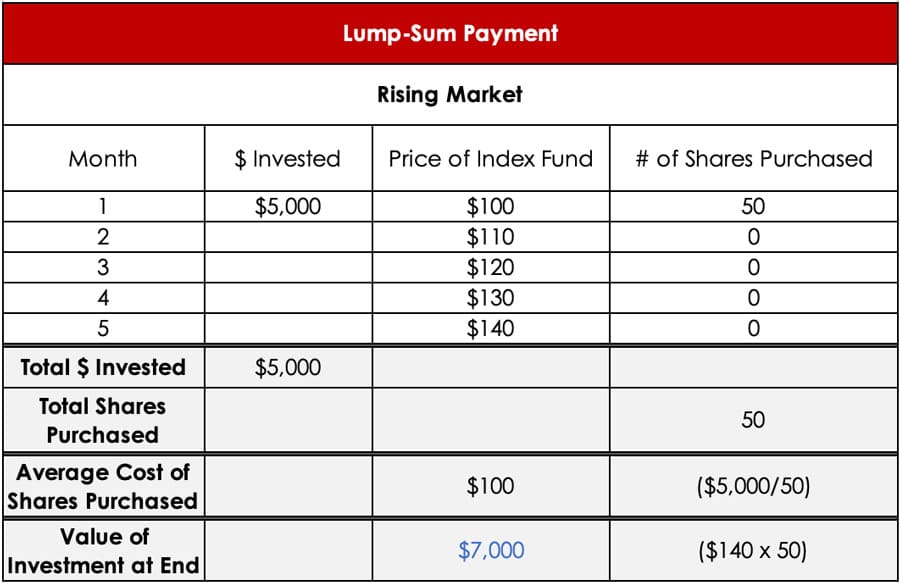

On the flip side, you should see that dollar-cost averaging is far less optimal if the stock price goes straight up for a long period of time as you would have been better off putting all your money in the stock at the beginning of the investment period when prices were the lowest.

If an investor instead purchased $5,000 worth of shares all in the first month in a stock that ends up rising for the entire 5 months, the investor’s total return on this investment is now a whopping 40%. We can see that putting more of your money in earlier leads to a way better outcome than the 20% gained by investing $1,000 over the 5 months when the stock price continuously rose.

However, this requires investors to have perfect foresight about the direction of the market or the stock price they are purchasing for a long period of time, which is not possible. So, during times of severe market uncertainty as we are experiencing today, dollar-cost averaging is a great strategy for investors to use to protect their stock returns from periods of declining prices. As example, some people may choose to invest a lump sum every year at the beginning of the year, but these investors should be aware of the January Effect, which indicates that this is typically the best performing month of the year.

The decision between dollar cost averaging and lump sum investing depends on several factors, including personal circumstances and market conditions. Lump sum investing involves deploying a significant sum of money into the market all at once. As mentioned, this approach can be advantageous when markets are expected to perform well for a period of time, which is hard to anticipate.

Dollar cost averaging, on the other hand, is a more conservative and disciplined approach. It mitigates the risk of making poor investment decisions based on short-term market fluctuations and provides the benefit of averaging out purchase prices over time.

MARKET TIMING VS DOLLAR COST AVERAGING

Dollar-cost-averaging can be a great strategy for investors who are fearful of putting their money in the market at the wrong time, or those that have been sitting on the sidelines, waiting for the stock market bottom not sure if it’s the right time to get in. It also reduces some of the risks of investing during a market downturn by ensuring that stocks are not purchased at temporarily inflated prices.

Long-term investors that can stomach some short-term volatility should use this downturn as a great opportunity to pick up more shares of their favorite stocks for less money. Remember that declining prices should be much preferred if you are a buyer and not a seller of stocks. These times of market turmoil provide the best opportunities to buy more of great companies for less, which means larger profits for you in the future.

Market timing, on the other hand, requires accurately predicting when to buy or sell assets based on anticipated market trends. However, research consistently shows that the vast majority of market timing attempts fall short. In contrast, dollar cost averaging embraces a more passive and disciplined approach. Instead of attempting to time the market, it disregards short-term market fluctuations and focuses on consistent investing. By removing the need to predict market movements, dollar cost averaging allows investors to maintain a long-term perspective and avoid emotional decision-making based on short-term noise.

WHO SHOULD USE DOLLAR COST AVERAGING?

Dollar cost averaging is a strategy suitable for various types of investors. It is particularly beneficial for individuals who prioritize consistency, discipline, and long-term wealth accumulation. If you are a new investor, dollar cost averaging provides an excellent entry point into the market without the need for a large upfront investment. It allows you to navigate market volatility with ease, ensuring that you are not overly influenced by short-term market fluctuations. Additionally, dollar cost averaging is well-suited for individuals with a regular income and those who prefer a passive investment approach.

By automating your investments at regular intervals, you can steadily build your portfolio over time and potentially benefit from the compounding effect of returns.

FREQUENTLY ASKED QUESTIONS ABOUT DOLLAR COST AVERAGING

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

About The Author

Rebecca Hotsko

Rebecca Hotsko is an investor and entrepreneur based in Canada. Most recently, she co-founded a luxury boat sharing club in Kelowna B.C. Rebecca graduated from the University of Saskatchewan with a bachelor’s degree in Economics and since has completed CFA level I and II. In prior years, Rebecca gained valuable experience working as an analyst for the Bank of Canada, the federal energy regulator and in investment management. Her passion for teaching others how to invest using time-tested strategies backed by empirical data also led her to create an investing blog in 2020.

Rebecca Hotsko

Rebecca Hotsko is an investor and entrepreneur based in Canada. Most recently, she co-founded a luxury boat sharing club in Kelowna B.C. Rebecca graduated from the University of Saskatchewan with a bachelor’s degree in Economics and since has completed CFA level I and II. In prior years, Rebecca gained valuable experience working as an analyst for the Bank of Canada, the federal energy regulator and in investment management. Her passion for teaching others how to invest using time-tested strategies backed by empirical data also led her to create an investing blog in 2020.