Intrinsic Value Assessment Of H&R BLOCK (HRB)

By Ladislao Zichy Thyssen From The Investor’s Podcast Network | 22 August 2020

INTRODUCTION

H&R Block is the largest US-based tax preparation company. Its shares trade at $14.62, implying a market capitalization of $2.8 billion. Over the past ten years, H&R Block has averaged over $200 million in yearly dividend payouts with close to $4 billion in total buybacks. The market is currently pricing in strong headwinds for H&R Block due to increased technological penetration in the tax preparation business as well as COVID-19 disruptions. However, the market is overestimating the pace of technological change in the industry and the efforts undertaken by H&R Block to mitigate these headwinds.

H&R Block is the largest tax preparation firm in the US by revenue and second-largest in regards to the number of tax files prepared. It has a market share of around 12.5% in the $21 billion industry. H&R Block is also the largest tax preparation firm in Canada, as well as in Australia.

H&R Block tends to be profitable only one quarter a year during the tax filing season. During the tax filing period, employee headcount increases from 3,500 to 80,000 to help H&R Block with the +23 million tax preparations they complete per year. H&R Block operates its tax preparation business through a mixture of 2,900 franchise locations and 6,500 corporate-run locations.

- Recent Developments

COVID-19 has had a profound impact on the US economy. As a result, the US government has pushed back the tax filing date from April to July. This extension caused H&R Block to report that their tax returns preparations were down 14% (YoY). H&R Block expects to gain some of these clients back during its first quarter (May through July). This will result in a solid fiscal year 2021. During its latest earnings call, H&R Block reported that annual revenue had declined from $3.1 billion to $2.6 billion. It reported a loss of $7.5 million compared to the previous year’s profit of $450 million. In the past ten years, revenue has fallen by 10%, but per-share revenue is up over 40% because of stock buybacks.

At the beginning of the pandemic, H&R Block decided to tap its full revolver credit worth $2 billion. It took out this money as a precautionary measure. It plans to continue paying out its dividend with this money and ensure that it can afford the $640 million in long term debt due this year. H&R Block will consequently experience an increase of $40 million in interest expense. As of April, it has over $2.6 billion in cash, comfortably covering its current liabilities.

H&R Block announced four new significant decisions that will impact the fiscal year 2021. The first is that they are renegotiating their leases with their landlords. They pay about $410 million in occupancy costs each year. Any reduction in rent would have a sizable impact on profits. Second, H&R Block will announce a deal with a new bank to lower the costs related to the financial products H&R Block provides its customers (more details will be provided in the next earnings call). Currently, H&R Block pays more than $56 million to its banking partners.

Finally, H&R Block announced that it wrote off $106 million of goodwill from its recent $408 million acquisition of Wave. Wave is a provider of software solutions designed to help small business owners manage their finances. Wave’s revenue sources include fees earned by providing payment processing, payroll services, and bookkeeping services. Small businesses have been the worst affected from the pandemic, so the write off is reasonable. Prior to the pandemic, Wave generated around $36 million in revenue while growing between 30% to 40% annually.

THE INTRINSIC VALUE OF H&R BLOCK

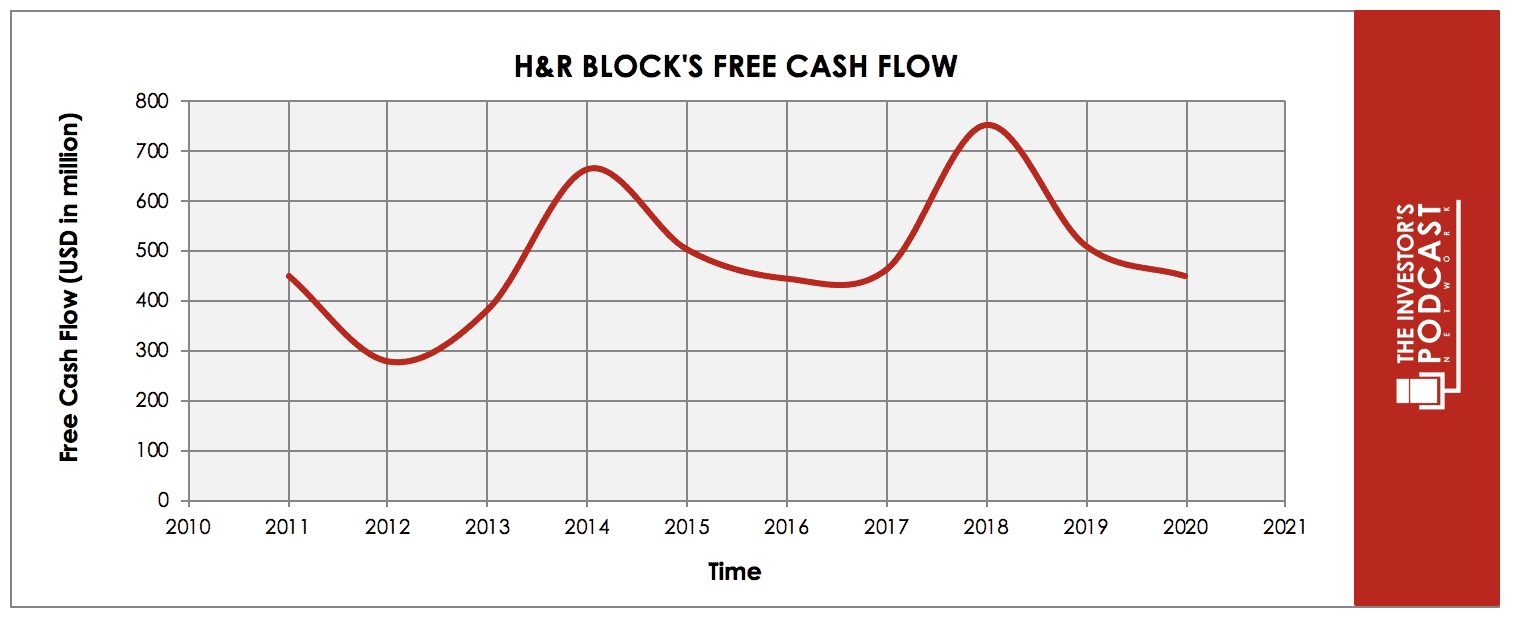

A rudimentary way to calculate the value of a business is to calculate the projected free cash flow it will generate over its life. Below is a graph detailing the free cash flow of H&R Block over the past ten years. There are two things to note. One, H&R Block, has an unorthodox financial calendar year ending in April after tax filing season. The other is that the free cash flow for the most recent year is around $20 million. In the graph below, it is stated as 450 million so as to normalize cash flows given the disruption that the postponement of the tax filing day has caused (its roughly the 5-year average free cash flow).

As one can see from the graph above, the company reported yearly positive free cash flows for the past ten years. As previously mentioned, H&R Block has used its free cash flow to buy back around $4 billion worth of shares while paying out yearly dividends of $200 million. Its’ highly stable business allows it to return significant capital to shareholders.

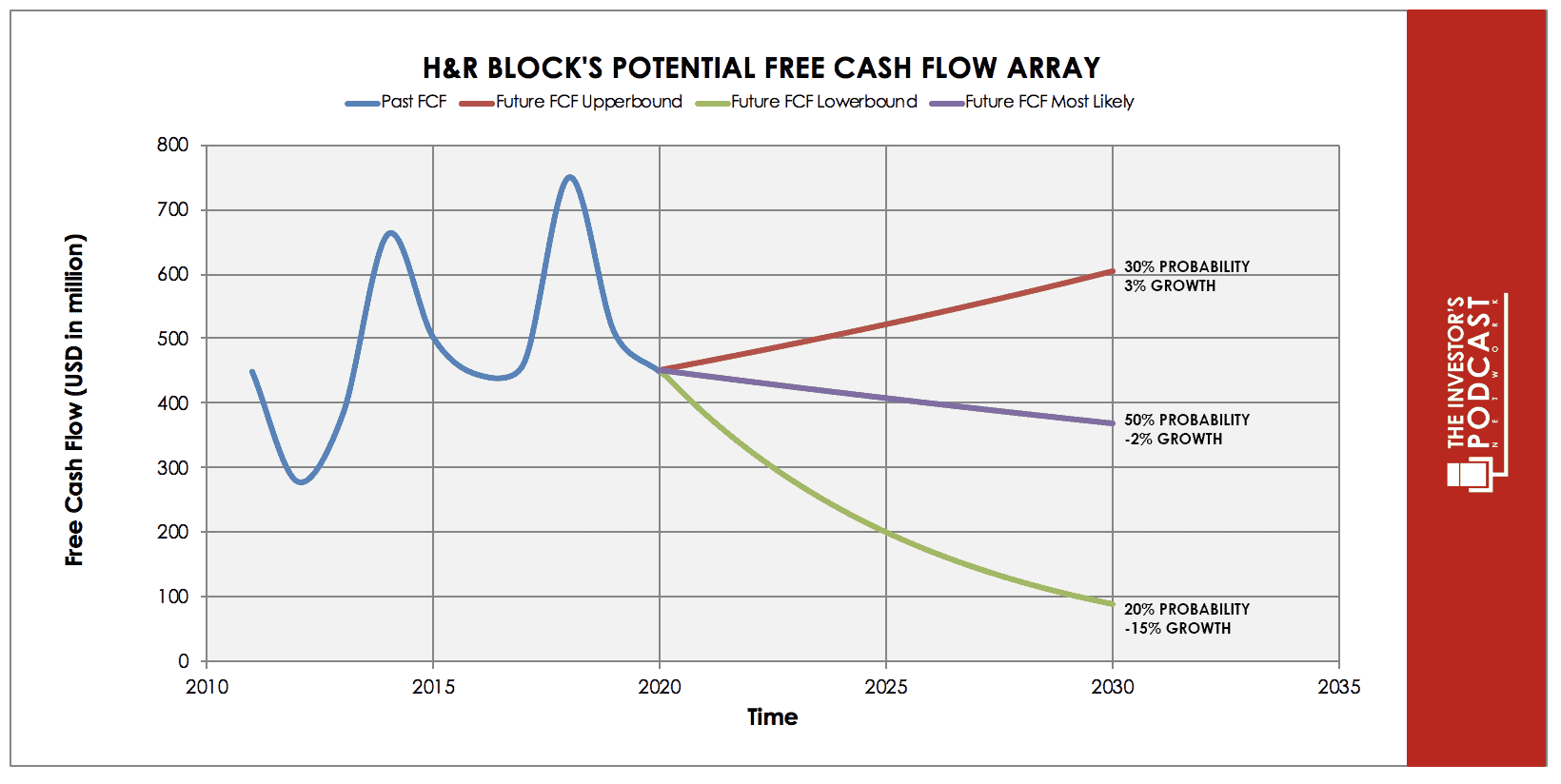

The graph above below the three different scenarios envisioned for H&R Block. In the worst-case scenario at a 20% probability, I assume H&R Block begins to descend toward obsolescence. Free cash flow would fall around 15% per year as more people file for free online and avoid in-store tax preparation. H&R Block would fail to scale down its store footprint fast enough, which would result in many offices being underutilized and thus unprofitable.

In the base case at a 50% probability, H&R Block would shrink by 2% per year. H&R Block would see revenue decline as people switch from higher revenue sources like assisted tax preparation to “Do it Yourself” services. Store closures would reduce the total footprint by 1% to 3% annually. Wave would grow at a much slower pace, thus having a limited impact on free cash flow. At the end of the decade, free cash flow would be around $90 million lower, but H&R Block would have adapted to the online tax preparation industry and maintained its second place in online tax preparation. H&R Block would also benefit from the projected increase in tax filers over the coming decade, which will grow by about 1% per year.

In the best case, at a 30% probability, free cash flow would increase around 3% per year. This would be achieved through massive cost-cutting as well as by growing market share. H&R Block would use its superior size and product offerings to increase cross-selling and drive up revenue. Wave would continue growing between 30% to 40% annually, eventually becoming an important profit center.

THE COMPETITIVE ADVANTAGE OF H&R BLOCK

H&R Block has various competitive advantages outlined below:

- LARGE SIZE

- H&R Block operates in an industry where there are over 100 thousand firms, most of which have a few employees. This gives H&R Block the ability to invest in digital tools and offerings that allow for automated tax filing, something its smaller peers can’t do. H&R Block’s renowned name and association with tax preparation enable it to spend less on customer acquisition costs than small tax preparation firms.

- PRODUCT OFFERING

- H&R Block offers many products other than tax preparation for its clients. It offers customers loans guaranteed by their tax refunds. It also owns the third-largest general use debit card with $9 billion in deposits (tax refunds can be directly deposited on these accounts). It offers services that protect clients against getting audited by the IRS. H&R Block also provides services to protect from tax identity theft. These revenue streams produced about $470 million of the $2.6 billion in revenue reported for the year.

RISK FACTORS

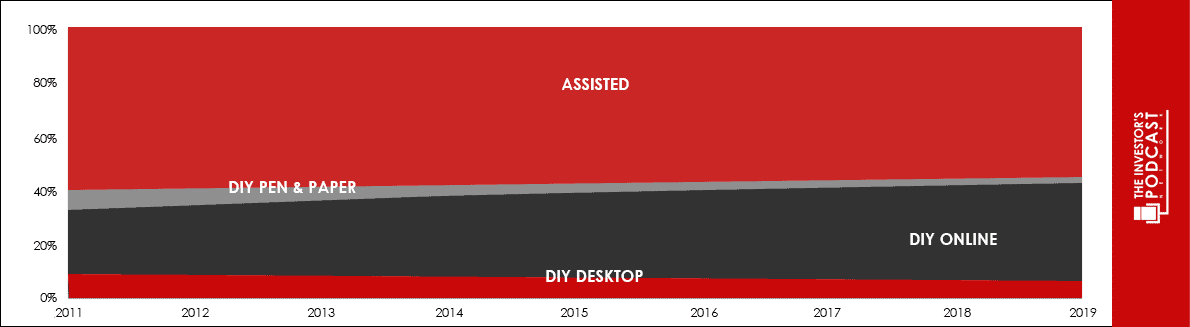

- Moving from Assisted to DIY

- Historically, people go to H&R Block with their documents so that H&R Block files their taxes and hopefully gets them a significant tax refund. This process is called “assisted.” Over the past decade, more people have begun filing their taxes online with services like Turbotax or doing it themselves. Online services tend to be significantly cheaper than assisted. For example, H&R Block charges around $210 per assisted customer versus $30 for DIY (do it yourself) customers. Furthermore, the government mandates that the private market create a website for people to file for free. The IRS’s mandated Free File helped file 2.9 million tax returns, which saw an increase of 28% year over year. These headwinds partially explain why H&R Block trades at such low multiples. However, H&R Block is the second-largest filler for DIY and has grown its business from 6 million preparations to 8.7 million in the last five years. This demonstrates that it is adapting to market changes.

- IRS Pre-Filing Peoples’ Taxes.

- Many countries, apart from the USA, have their tax agencies pre-file their citizens’ taxes. This job makes most of what H&R Block does obsolete. Currently, there is a law preventing the IRS from doing this; however, prominent members in the Democratic Party have called for this law to be repelled. It is unlikely that this will occur as the US has over 100 thousand firms that employ 300 thousand employees in this industry. Furthermore, the largest tax preparation firms have a strong lobbyist presence in Washington.

- Lawsuits and Fines from A Discontinued Business.

- H&R Block has a discontinued business called Sandy Canyon Corporation. It used to be a mortgage originator in the years leading up to the 2008 housing crisis. Although H&R Block settled with the SEC in 2012, it still lists this business as a risk. Potentially, claimants can go after H&R Block should Sandy Canyon Corporation’s liabilities be greater than its assets. It is unlikely that this will occur given the statute of limitations has passed; thus far, several court cases have affirmed this.

OPPORTUNITY COSTS

A proficient capital allocator must take note of the opportunity cost. At present, 10-year Treasuries yield 0.68%; if we take inflation into account, the real return is likely negative. The Shiller PE is 31.16, which would imply that annualized returns will be around 1.4% over the next decade. Currently, H&R Block has a dividend yield of about 7%. The model estimates that annual returns will be about 13.2% for the next decade. This is a seemingly more attractive investment than buying the S&P 500.

MACRO FACTORS

The Federal Reserve has cut interest rates to near-zero to help the US economy sustain the economic damage from the COVID19 shutdowns. The Federal Reserve began buying back government bonds as well as corporate bonds. This has brought down interest rates for most firms as investors are forced to move toward riskier assets to get “reasonable returns.” This will likely have a positive effect on H&R Block, which has over $1.4 billion in long term debt at rates between 4.1% to 5.5%. H&R Block has a BBB investment-grade credit rating, and recent offerings for such a grade are about 2.5%. H&R Block is also well suited to operate in a recession. The tax preparation business is recession-proof as people always need to file their taxes regardless of the economic situation.

SUMMARY

At its current valuation, H&R Block offers patient long-term investors annualized returns around the low teens. H&R Block has a fairly stable business with a strong commitment toward returning capital to shareholders. H&R Block is well-suited to continue being a dominant player in the tax preparation industry. So far, it has been able to adapt to the shift to online tax preparation. It holds the second largest market share and is gradually trimming the overall store counts. It is seemingly well-positioned to continue prospering in the coming decade.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.