Intrinsic Value Assessment Of Big 5 Sporting Goods (BGFV)

By Christoph Wolf From The Investor’s Podcast Network | 26 November 2019

INTRODUCTION

Big 5 Sporting Goods (BGFV) is a sports goods retailer operating in the western United States. The company’s product mix includes athletic shoes, apparel, and accessories, as well as a broad selection of outdoor and athletic equipment for team sports, fitness, camping, hunting, fishing, tennis, golf, winter and summer recreation, and roller sports.

While Big 5 Sporting Goods carries the products of multiple well-known brands such as Adidas, Nike, Under Armour, Asics, Shimano, or Everlast, in general, it focuses more on cost-conscious clients. While other competitors carry more high-end products, Big 5 Sporting Goods is the place to go if you want to buy a cheap product with good quality. This low-cost strategy gives the company a niche, but at the same time, its margins are lower than its competitors.

Like most other brick-and-mortar retailers, Big 5 Sporting Goods has experienced multiple challenges recently. The whole retail environment is in the middle of a dramatic shift due to increased online shopping and changed consumer behavior.

For Big 5 Sporting Goods, this is especially problematic since the company has been rather late to build its online platform, which was only launched in fiscal 2014. Also, its marketing strategy seems to be stuck in the past — most of its advertising is still done by weekly print advertisements.

As a result of these challenges, the stock has fallen from a high of almost $20 at the end of 2016 to a value of only $2.53 today. Is Big 5 Sporting Goods a buy or a value trap at this price?

THE INTRINSIC VALUE OF BIG 5 SPORTING GOODS

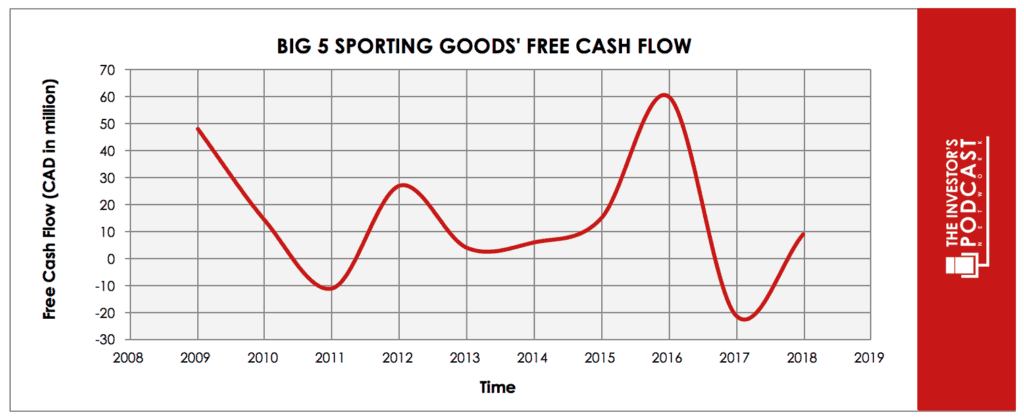

To determine the value of Big 5 Sporting Goods, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Big 5 Sporting Goods’ free cash flow over the past ten years.

As one can see, the results have been extremely volatile. The volatility is due to fluctuations in the operating and net margins – and not because of volatile revenue. In fact, revenue has remained almost unchanged throughout the last decade – today, sales are only about 10% higher compared to ten years ago.

Due to the high volatility and uncertainty, we will use a very conservative estimate of Big 5 Sporting Goods’ future cash flows.

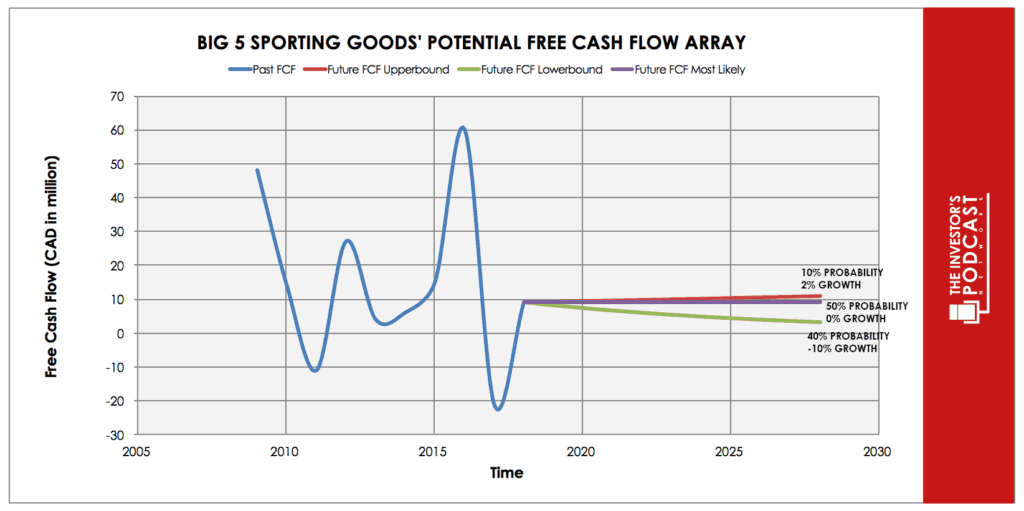

Each line in the above graph represents a certain probability for occurring. We assume a 10% probability for the upper growth rate of 2% per year, a 50% probability for zero growth, and a 40% probability for the worst-case scenario of a 10% annual decline.

Assuming these growth rates and probabilities are accurate, Big 5 Sporting Goods can be expected to give a 13.6 % annual return at the current price of $2.53. Even if the worst-case becomes a reality, the annual return is still a solid 7.4%. While quite high, these assumed returns are not quite outstanding due to the immense risks involved. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF BIG 5 SPORTING GOODS

Big 5 Sporting Goods possesses several advantages:

- Resilient Business. Despite all problems, Big 5 Sporting Goods’ revenue has almost not declined, and free cash flow has been mostly positive throughout the last years. This is still a business that makes money.

- Deep-rooted and Distributed Vendor Relationship. The company has developed strong vendor relationships over the past 64 years and purchases its merchandise from over 700 vendors – with only one vendor represented by more than 5% of total purchases, namely 11.6 %. This long and distributed relationship with its vendors gives the company an edge when buying its products.

- Experienced and Stable Management. The current CEO, Steven G. Miller, is the son of former chairman Robert W. Miller – who was one of the founders of Big 5 Sporting Goods 64 years ago. Combine this with an average tenure of multiple decades both of senior managers and store managers, and it becomes clear that Big 5 Sporting Goods is a business built on experience, long-term focus, and continuity.

RISK FACTORS

The risks for Big 5 Sporting Goods are plainly visible. While revenue has remained steady, same-store sales were often negative, and also margins have contracted sharply. Here is a list of the most important headwinds:

- Online Competition. The immense competition by Amazon and other online sellers. While Big 5 Sporting Goods has launched its e-commerce website in fiscal 2014 already, its small size puts it at a disadvantage compared to the deep pockets of a huge player such as Amazon, since setting up and maintaining an online shop requires much experience and financial resources.

- Regional Focus on The Western United States. Due to its focus on the western US, Big 5 Sporting Goods is highly vulnerable to regional risks such as a downturn in the housing market, a rise in unemployment, increased gas prices, or natural disasters like earthquakes or wildfires. Also, a United States recession would hurt Big 5 Sporting Goods hard, since it is not operating outside the USA.

- Minimum Wage of $15 in California. Over 50% of Big 5 Sporting Goods’ stores are located in California, which in 2016 introduced a $15 minimum wage per hour. Also, Big 5 Sporting Goods’ main distributing center is located in California, making the company even more vulnerable to high labor This hurts Big 5 Sporting Goods especially hard since it focuses on cheap low-margin products.

- Outdated Marketing Strategy. Big 5 Sporting Goods has been slow to adopt modern marketing strategies. As stated in a recent 10-K filing, the firm states: “We have advertised predominantly through weekly print advertisements since 1955. “The company also describes itself as a “leading sporting goods retailer” – although Big 5 Sporting Goods is really more an off-price retailer. Big 5 Sporting Goods’ marketing strategy seems therefore, both out-of-date and signaling a wrong message to its customers.

OPPORTUNITY COSTS

When looking at various investment opportunities on the market today, let’s compare the expected return of Big 5 Sporting Goods to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 1.8 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely to be barely positive. What about investing in US stocks? Currently, the S&P 500 Shiller P/E ratio is 30. As a result, the US Stock market is priced at a 3.3% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The retail sector currently experiences a major disruption– not only because of Amazon but also because of demographic factors and changed shopping behavior.

Since sports items are often small, they can easily be sent, ordered, and delivered online – which makes the company vulnerable. This is especially critical because Big 5 Sporting Goods has only some years ago started investing in its online platform. On the positive side, being the off-price retailer gives Big 5 Sporting Goods a niche.

SUMMARY

Big 5 Sporting Goods’ stock has been crushed alongside many other struggling retailers. Earnings and margins are under pressure, and its management has been too late to accept the new realities of online selling and marketing. Despite these negatives, the company is still profitable, has a solid financial footing, and has found its niche as the off-price retailer. Investors are well-advised to check further if the expected 13.8 % annual return adequately compensates for these risks.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.