Intrinsic Value Assessment Of Gazprom (OGZPY)

By David J. Flood From The Investor’s Podcast Network | 03 October 2017

INTRODUCTION

Gazprom is a Russian based global energy company whose integrated operations include exploration, production, transportation, storage, processing, and sale of gas and oil. The company is also engaged in the sale of vehicle fuel and the generation and marketing of both heat and electric power. Gazprom is amongst the top four oil producers in Russia and is the country’s only producer/exporter of liquefied natural gas (LNG). The company’s stock has seen a large decline in price over recent years thanks to both the bear market in energy commodities and political turmoil surrounding its sphere of operations. From a high of around $17 in 2011 the stock now trades at around $4.20. Below is an assessment of whether this lower price is a value to investors.

THE INTRINSIC VALUE OF GAZPROM

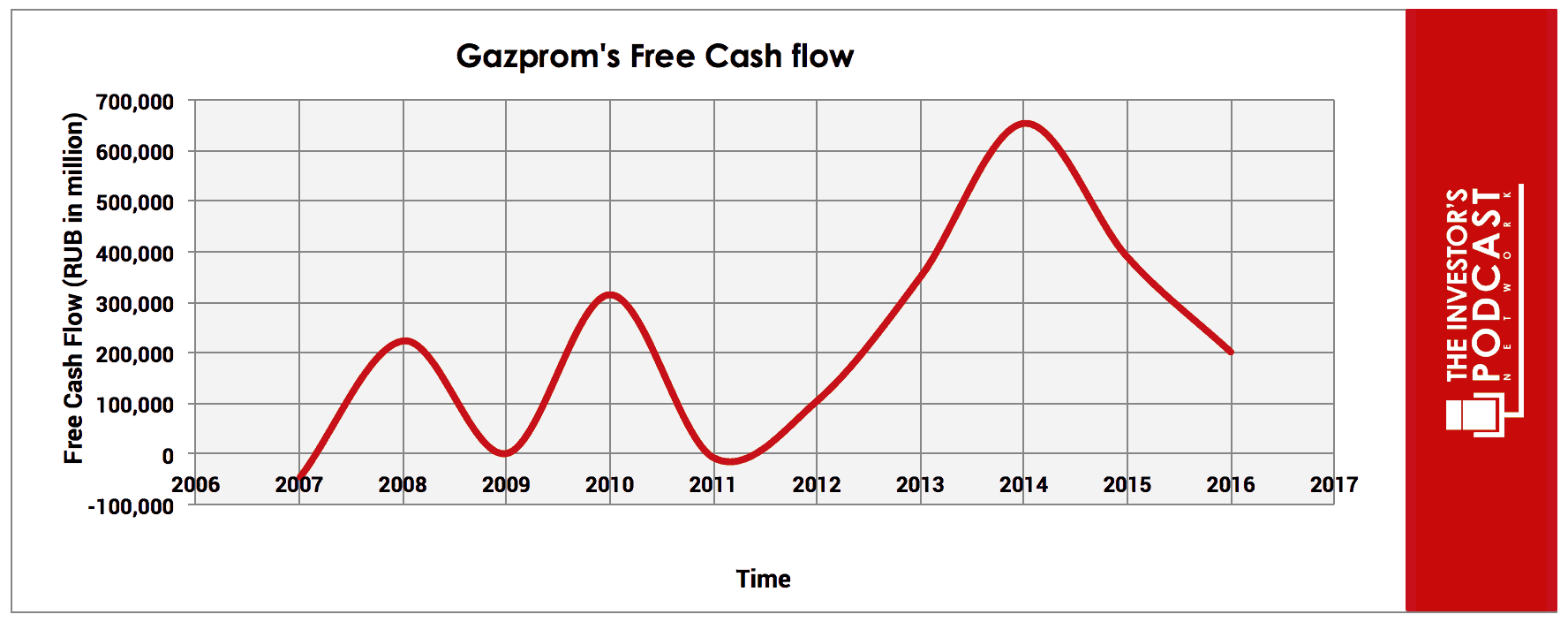

Gazprom is classed as a cyclical company since the value of its assets, and thus its revenue and earnings performance, are tied to the ebb and flow of the wider cycles present in commodities, credit and business cycles. As such, consideration of this fact must be borne in mind when conducting a calculation of intrinsic value. Below is a chart depicting Gazprom’s free cash flow for the last ten years.

As one can see, the trend in free cash flow has been extremely erratic — dropping significantly after the 2008 financial crisis, before rising and then falling dramatically again as commodity prices have declined over the past few years. Due to this high volatility in earnings, it is extremely difficult to make reasonable forecasts of future earnings which is the basis for the discounted cash flow method of valuation. Not only that, but the increased risk associated with investing in cyclical companies requires a corresponding increase in the discount rate which further complicates matters. For these reasons, the discounted cash flow method might not be suitable in this instance.

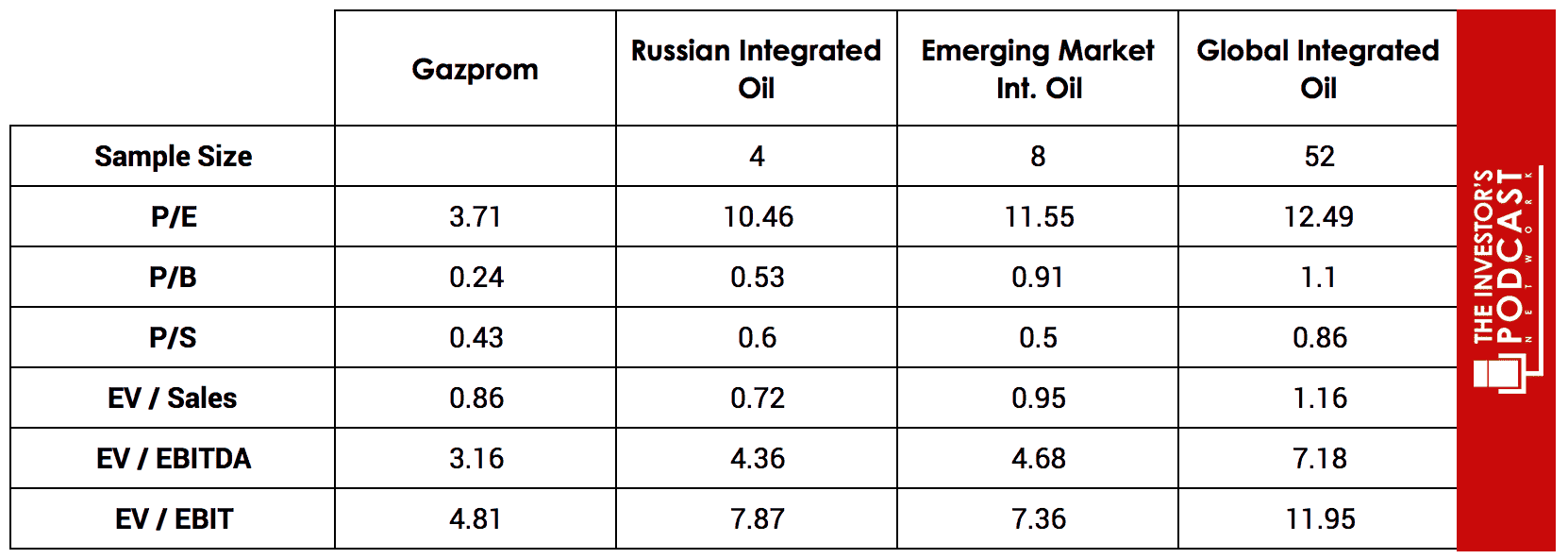

Another tool for assessing the value of Gazprom is the comparable method, which uses ratios from a given industry, peer group, or similar companies to estimate a company’s value. Below is a table listing several commonly used metrics when valuing cyclical companies.

The above table compares Gazprom against average values of the big four Integrated Oil & Gas firms from Russia, and against the median values for Emerging Markets Integrated Oil & Gas and the Global Integrated Oil & Gas Industry. When valuing cyclical firms on an absolute basis, the P/E ratio would typically be avoided since earnings fluctuations render it ineffective. In this instance, it is permissible since we are using it in a comparable manner against similar companies. Ratios utilizing both Enterprise value and Earnings before Interest, tax, depreciation, and amortization have been included to accommodate for differing debt levels, capital structures, tax rates and accounting practices.

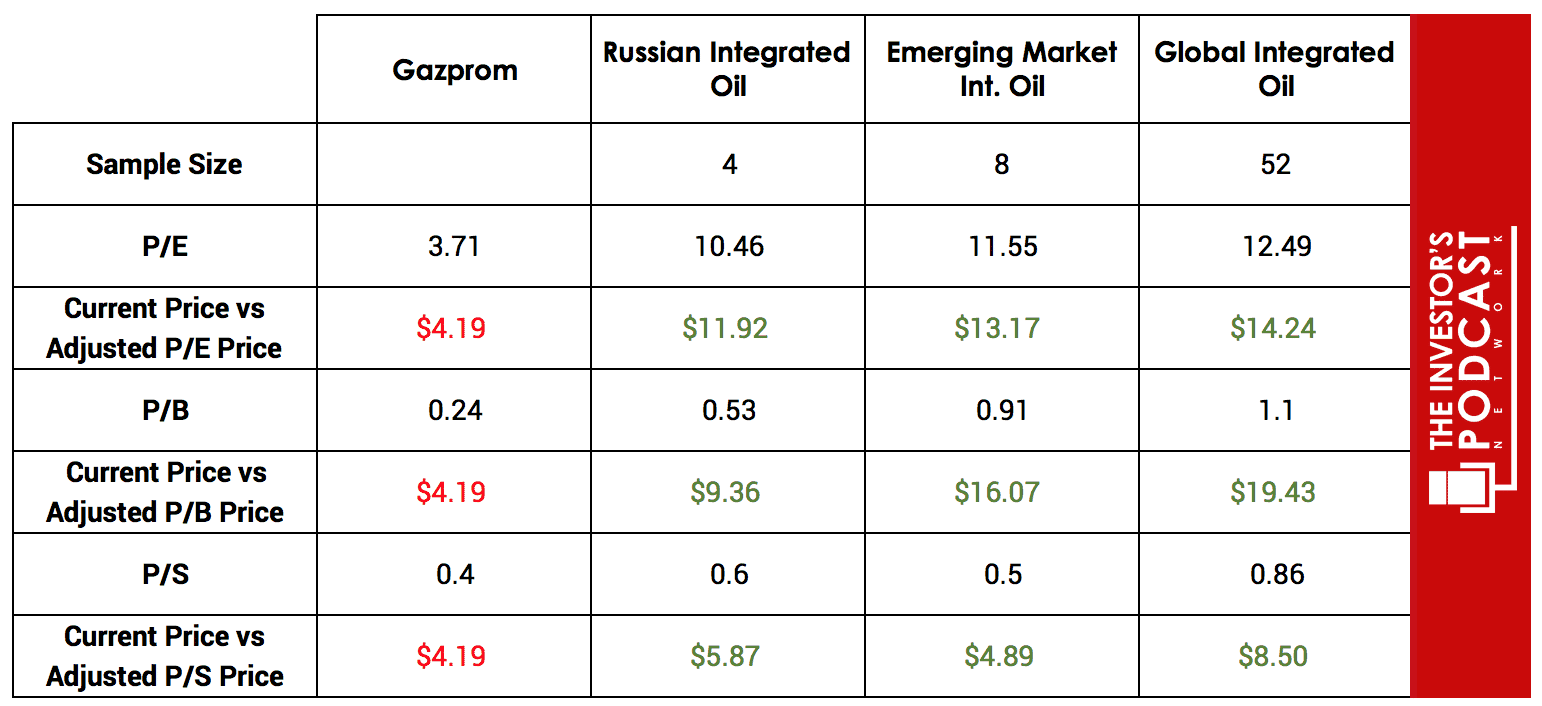

As one can see, not only does Gazprom appear undervalued on every multiple relative to both emerging markets and global oil companies, but it looks cheaper than the other Russian Oil & Gas majors on every metric. There are reasons, which will be discussed later, as to why the market is discounting Gazprom against the other averages. But we’ll now calculate what the company’s share price would be if it were repriced according to the per share ratios for the Russian, emerging market, and global averages. For this reason, aggregate ratios utilizing Enterprise Value have been omitted.

The reader will notice that while Gazprom appears undervalued, there is a large gap between the estimates of intrinsic value — ranging from $6-19. This spread is, in some part, a consequence of the variations in growth, profitability and perceived risks of the companies sampled. Additionally, the market has an extreme aversion to uncertainty, and so it will discount companies that operate in politically unstable environments. We’ll now turn our attention to the balance sheet to see if we can narrow this range of intrinsic value.

At present, Gazprom has a tangible book value per share of $17.54. Since we have seen significant asset write-downs and numerous bankruptcies within the industry and commodity prices appear to have left their trough, it seems reasonable to assume that it is unlikely this value will decrease. In fact, Gazprom’s book value has begun to grow in the last few years – after contracting due to asset write-downs in the wake of the slump in commodity prices. Book value tends to be a much better measure of value for cyclical companies whose balance sheets are predominantly comprised of fixed tangible assets. We now have an initial range of value of around $6-19 and a much firmer estimate of around $17 based upon the book value. This suggests that the true value of the company is more likely to be around the upper part of the range than the lower. We’ll now follow the advice of the late great investor Sir John Templeton and add a third valuation method, a technique he called ‘triangulation,’ to further establish if the company is undervalued and by what margin.

The final method of valuation will involve calculating the intrinsic value based upon book value growth since this is a much more stable trend than the revenues and free cash flows of cyclicals. We’ll also discount the expected dividend by 30% to err on the side of caution. With a current book value of $17.54, a $0.17 dividend (which is 60% lower than the dividend today), and a 2.5% growth rate on the equity, the company might provide a 15% return at the current price. Note that inflation in Russia is 3.3% and has been steadily decreasing over the past year. The high inflation rate in the past might have been another contributing reason why the company was so heavily discounted by foreign investors.

Based on Templeton’s method of triangulation, it seems reasonable to assume that Gazprom is undervalued and its intrinsic value lies in a range of around $15-19. Now let’s look at how and why the company may achieve this repricing of its stock.

THE COMPETITIVE ADVANTAGE OF GAZPROM

Gazprom possesses some unique competitive advantages.

- Monopoly status. Thanks to the large ownership and support of the Russian Government, Gazprom has a huge dominance over the domestic market. The company owns 72% of Russia’s natural gas reserves and accounts for 66% of national gas output. In terms of global reserves and output, the company accounts for 17% and 11% respectively.

- Low-cost producer/operator. According to a 2016 report by the Oxford Institute for Energy Studies, the cost for Gazprom to deliver its Gas to Germany is $3.5 per mmbtu (million British thermal unit) vs. an estimated $4.3 per mmbtu break-even for U.S. LNG supplies. Furthermore, according to the analysis conducted by Société Générale’s European gas analyst Thierry Bros, it would only cost Gazprom approximately $1.3 Billion in lost revenue to price U.S. LNG out of the market. This is less than 1% of the company’s historical annual sales. This is even more interesting considering that Gazprom is currently the only LNG producer/exporter in Russia. The company also has the highest operating margins amongst all the Oil & Gas majors with a 10-year median operating margin of around 29%.

- Economies and efficiencies of scale. Due to Gazprom’s scale of operations and capacity for growth investment, it has been able to continue to grow its revenues despite the slump in demand for energy commodities. Revenues have grown at a 5-year compound annualized rate of 5.7% vs. an industry standard of -3.5%. The sheer size of the firm’s power generation assets results in it accounting for 17% of the total established capacity of the national energy system.

GAZPROM’S RISKS

There are various risks associated with the company which must be considered as well.

- The commodities market could remain depressed for a protracted period of economic activity in the major economies such as China, the US, and India begins to stagnate.

- Rising political turmoil between Russia and the west could prompt increased sanctions, trade wars, tariffs, and economic instability, which may impact the company’s operations and profitability.

- The emergence of other low-cost producers from emerging markets could attempt to challenge Gazprom for its market share.

- The continued technical development and government policy drive toward green energy could impact demand for fossil fuels which may impede the company’s revenue and earnings growth.

OPPORTUNITY COSTS

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At present, 10-year treasuries are yielding 2.16%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of x 30, meaning it is priced for an earnings yield of 3.3%. Gazprom’s current dividend yield alone appears to offer a much better return for investors. When accounting for price appreciation plus dividends, an investor might expect to capture 4 to 5 times the return of the S&P500.

MACRO FACTORS

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns.

At present, the S&P is priced at a Shiller P/E of 30. This is over 85% higher than the historical average of 16.8, suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low, suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 199.6% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

SUMMARY

Gazprom is certainly not an investment for those with an aversion to risk. The majority ownership of the company is by the Russian Government. This raises concerns about the firm being used as a political tool and the ongoing geopolitical tensions. For the investor with an appetite for risk, Gazprom is an interesting investment. At the time of writing, the common stock has a dividend yield of 6.9%. The massive investment in the so-called ‘new silk road,’ a huge transport and energy network which will connect Russia, China and other parts of Asia, could result in increased growth for the company. Gazprom has already struck deals with China for the end of 2019. Furthermore, if political tensions do abate, the common stock would likely see significant capital appreciation as the market removes the current discount to the fair value placed upon the company.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.