Intrinsic Value Assessment Of Hibbett Sports (HIBB)

By Christoph Wolf From The Investor’s Podcast Network | 14 October 2018

INTRODUCTION

Hibbett Sports is a U.S. retailer focusing on athletic sports fashion and associated equipment. The company is unique in selling almost exclusively in small and midsized communities – which allows the company to pay lower rents than in large, expensive cities, and also reduces competition from other brick-and-mortar retailers. Hibbett Sports operates more than 1000 stores throughout the U.S.

Hibbett Sports has experienced multiple headwinds recently. Not only does it operate in the highly competitive and cyclical retail industry, which has led to stagnating sales and compressed margins. The company has also been very late to build its online platform – which is especially problematic since many of its products are rather small and can be easily sent by post. These problems are also reflected in its rather disappointing earnings during the last two years. From a high of $67 in 2014 the stock has declined sharply and today only trades at only $19. Is Hibbett Sports a buy at this price?

THE INTRINSIC VALUE OF HIBBETT SPORTS

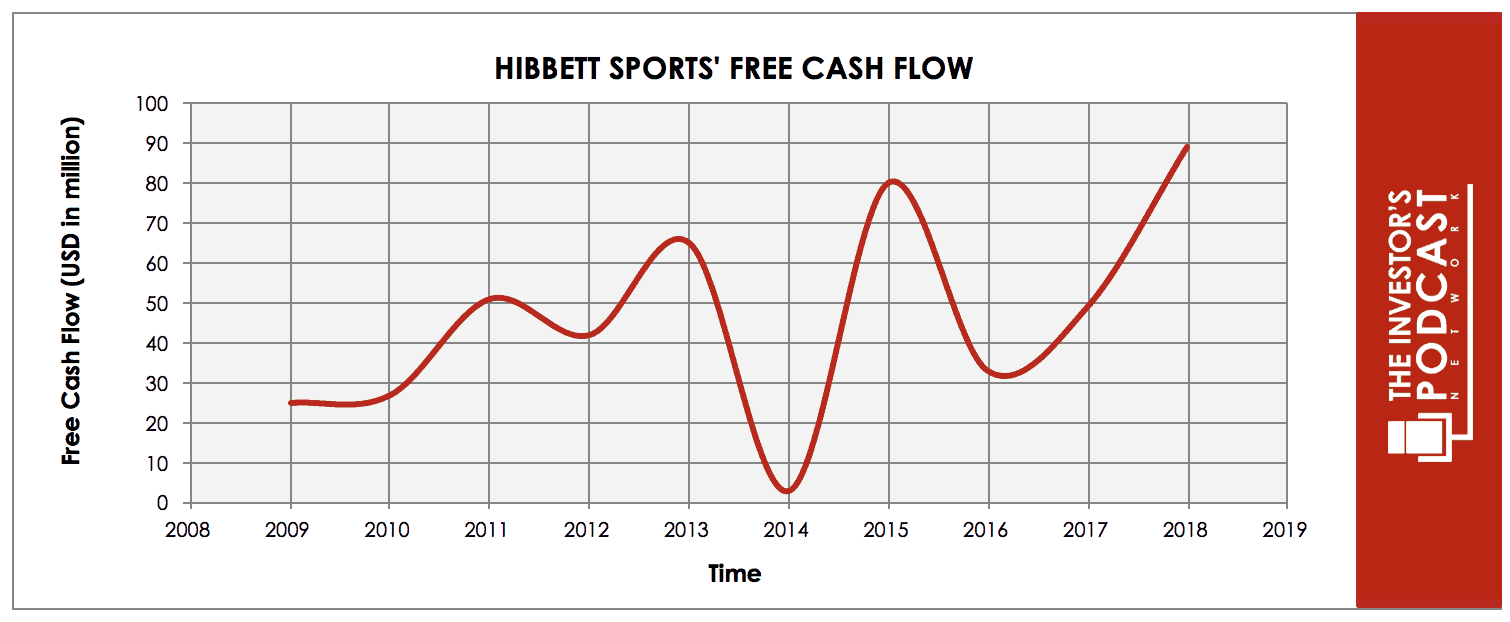

To determine the value of Hibbett Sports, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Hibbett Sports’ free cash flow over the past ten years.

As one can see, the results have been quite volatile – but with an upward trend. The volatility is due to fluctuations in the operating and net margins – and not because of volatile revenue. In fact, revenue has consistently grown throughout the last decade. Although these numbers look quite good, we will account for the recent drop in earnings and use a very conservative estimate of its future cash flows.

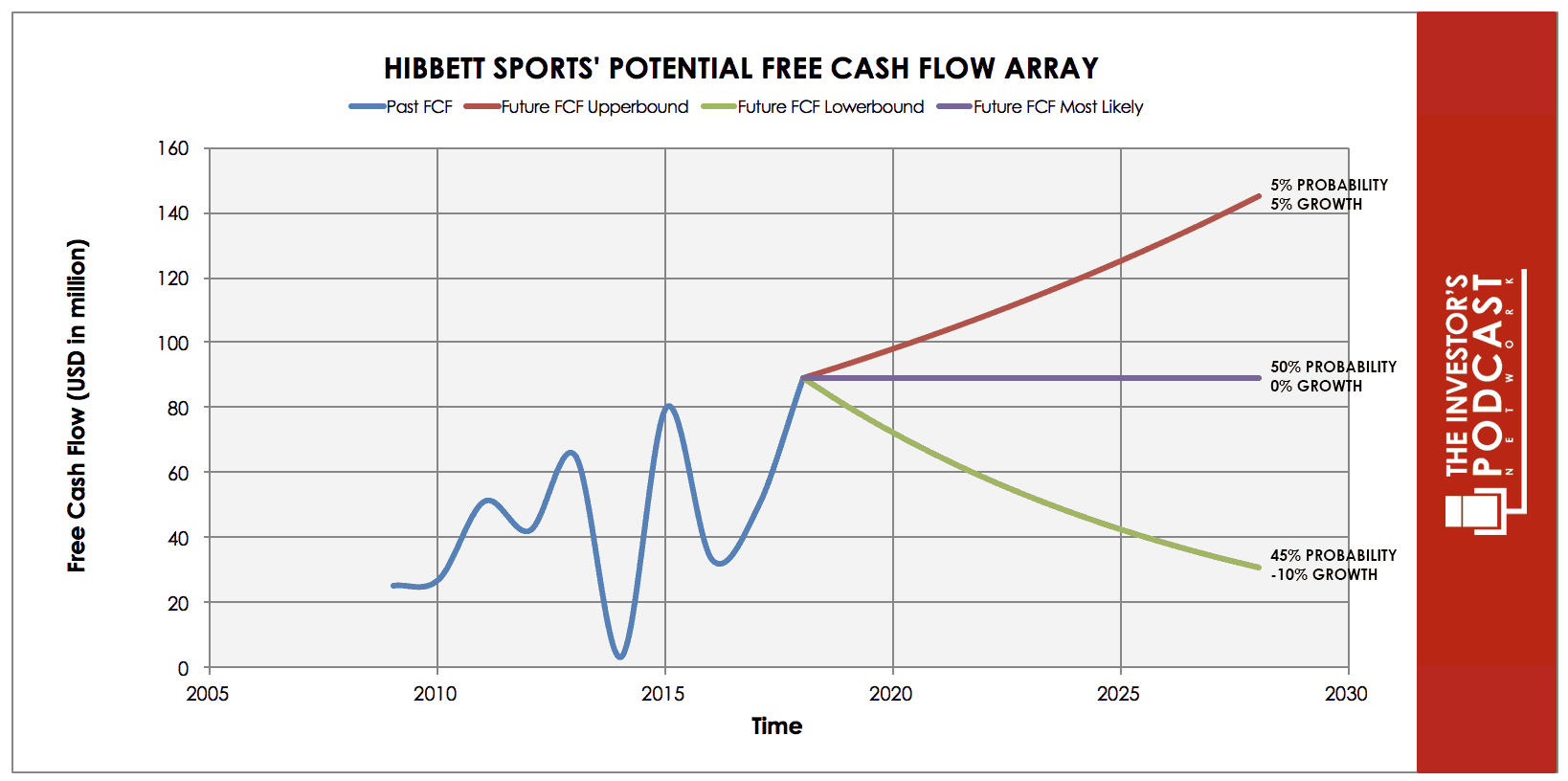

Each line in the above graph represents a certain probability for occurring. We assume a 5% chance for the upper growth rate of 5% per year, a 50% chance for zero growth and a 45% chance for the worst-case scenario of a 10% annual decline.

Assuming these growth rates and probabilities are accurate, Hibbett Sports can be expected to give a 19.3% annual return at the current price of $19. Even if the worst case becomes a reality, the annual return is still a solid 12.4%. Unless this company goes bankrupt in the next few years, these returns are truly outstanding. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF HIBBETT SPORTS

HIBB possesses several advantages:

- Niche in Rural Locations. By focusing on small and midsized communities, Hibbett Sports has found its niche within the highly competitive retail environment. This strategy results in lower rents and less competition since most brick-and-mortar shops are clustered in larger cities. This focus on rural locations allows Hibbett Sports to achieve margins that are higher than its competitors achieve.

- Very Strong Balance Sheet. Hibbett Sports’ foundation is very solid. During the last ten years, the company has never held any long-term debt, and its current ratio and quick ratio are conveniently high. These strong financials should protect HIBB from any short-term problems that might arise.

- Long-Term Focus and Stability. Hibbett Sports’ business might look rather boring. But by steadily investing and expanding its reach, the company has consistently increased revenue, book value, and cash flow. This is not a company that tries to grow by costly acquisitions, but by organically growing through internal investments.

RISK FACTORS

The risks for Hibbett Sports are visible. While revenue has still been growing during the last years, same-store sales were often negative, and also margins have contracted sharply. The last reported quarterly earnings were especially disappointing, resulting in a crash of about 30% of HIBB’ stock.

Here is a list of the most important headwinds:

- The Immense Competition by Amazon and Other Online Sellers. Hibbett Sports is especially vulnerable to digital competition because the company has launched its e-commerce website only in July 2017 and must now try to catch up.

- Risk of a U.S. Recession. Due to its sole focus on the U.S., Hibbett Sports is highly vulnerable to a U.S. downturn. Especially sports equipment, footwear, and apparel – which are Hibbett Sports’ main products – might either not be bought at all or customers might switch to cheaper no-name products. All of this would hurt Hibbett Sports’ revenue and margins.

- Fragmentation of Athletic Merchandise. The business of sports footwear, apparel, and athletic equipment is spread over a vast number of players – and Hibbett Sports is comparatively small. This gives the company a disadvantage when it comes to negotiating with its vendors, public visibility, and advertisement.

- Strong Dependability on Nike. While also selling products from Adidas, Under Armour, and others, Nike accounted for about 57% of Hibbett Sports’ purchases. This makes the company very dependent on Nike and Hibbett’s sport is therefore strongly correlated with the success of Nike’s products.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Hibbett Sports to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.2% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only about 1%. What about investing in U.S. stocks? Currently, the S&P 500 Shiller P/E ratio is 31. As a result, the U.S. Stock market is priced at a 3.3% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The retail sector currently experiences a major disruption– not only because of Amazon but also because of demographic factors and changed shopping behavior. Since sports fashion is mostly small, it can easily be sent, ordered and delivered online – which makes Hibbett Sports especially vulnerable. This is especially critical because Hibbett Sports has only recently started investing in its online platform. On the positive side, the focus on rural locations at least shields HIBB from conventional brick-and-mortar competition.

SUMMARY

Hibbett Sports’ stock has been crushed alongside many other struggling retailers. Earnings and margins are under pressure, and its management has been too late to accept the new realities of online selling. Despite these negatives, the company is still growing, has a solid financial footing and has good chances to survive due to its niche in rural areas. Since it is very hard to see the company going out of business anytime soon, the expected annual return of 19.3% should adequately compensate for all current uncertainties.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.