Intrinsic Value Assessment Of I Got Games Inc. (IGGGF)

By Robert Leonard From The Investor’s Podcast Network | 22 April 2019

INTRODUCTION

I Got Games Inc. is mobile game developer headquartered in Singapore with regional offices in the United States, mainland China, Canada, Hong Kong, South Korea, Belarus, Philippines, Japan, Thailand, and the United Arab Emirates. Despite being a small-cap company, IGGGF’s games have become some of the most popular across the globe, with over 480 million users across more than 200 countries. Its major hits include Lords Mobile and Castle Clash. Its revenue is generated via in-app purchases to enhance the game-playing experience.

At the time of writing, IGGGF’s market cap is about $1.7 billion and its revenue and cash flows for the 2018 fiscal year were $749 million and $234 million, respectively. Currently trading at $1.35, the stock has hit a 52-week low of $0.98 and a 52-week high of $1.65. At today’s price of $1.35, is IGGGF’s stock undervalued?

THE INTRINSIC VALUE OF I GOT GAMES INC.

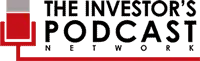

With net income being easily manipulated and not a true representation of the cash a business generated throughout the year, we will turn to IGGGF’s free cash flow to value its stock. Using free cash flow allows investors to value the company based on its actual cash generated that can be used to reinvest in the business, pay dividends, or buy back its own stock. Below is a chart of IGGGF’s free cash flow for the past seven years.

Starting in 2012, IGGGF had relatively minimal cash flow due to its limited game portfolio. However, in the latter half of 2013, one of IGG’s hit games, Castle Clash, was released. This led to cash flow generation increasing more than 7.5x from 2012 to 2014. With a small lapse in time before its next hit would be released, free cash flow dipped slightly in 2015. After its next hit, Lords Mobile, was released in early 2016, its free cash flow began growing rapidly again and has continued to do so through 2018. From 2012 to 2018, IGGGF’s free cash flow grew from just $9 million to $234 million, for a CAGR of 59% (2,500% cumulatively).

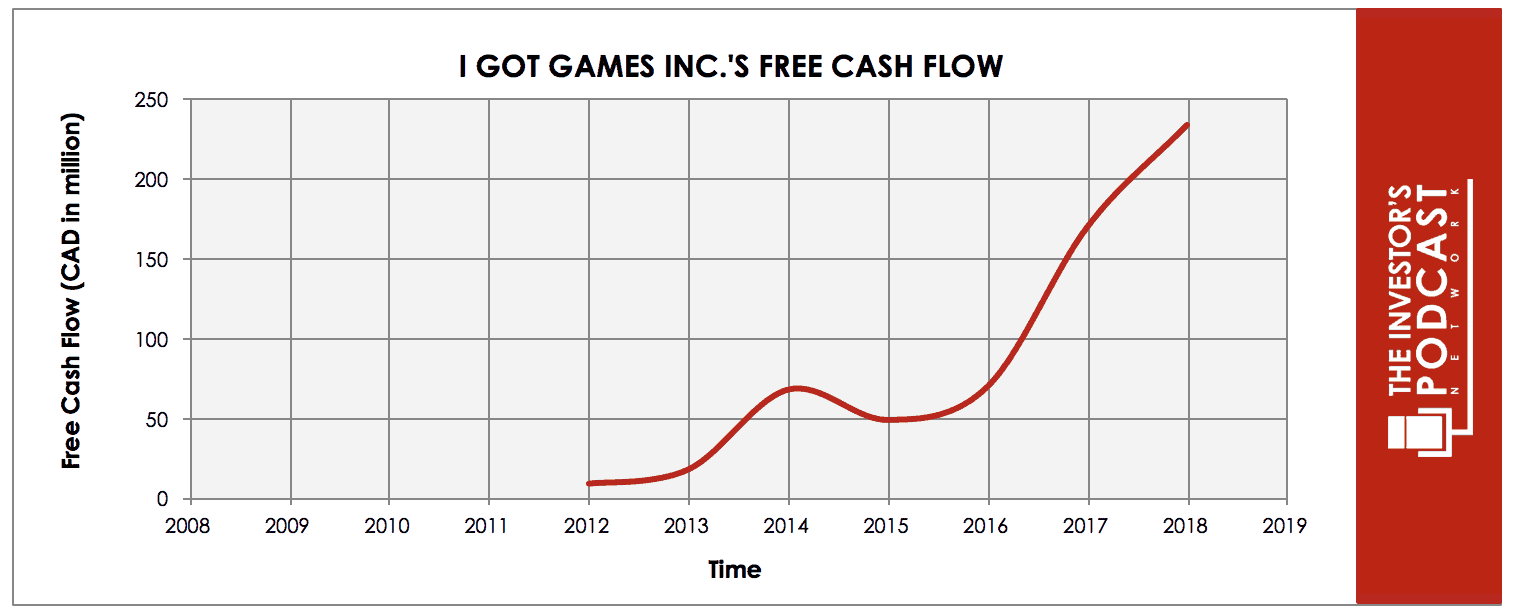

To value IGGGF’s stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of IGGGF’s future free cash flows.

The upper-bound line illustrates a 10% growth rate with a 15% probability of occurrence. This growth rate was determined using IGGGF’s current earnings yield (inverse P/E ratio), a slightly lower free cash flow yield (invest P/FCF ratio), and assuming it is able to turn a few of its currently in-development-games into future hits. It was assigned this probability to allow for the potential of high rates of growth in the short-term, while also accounting for the deceleration that is expected in later years, as IGGGF’s previously obtained growth rates are unsustainable over the long-term.

The middle line represents a 5% growth rate with a 55% probability of occurrence. This outcome assumes that IGGGF will be faced with competitive pressures but will be able to use its competitive advantages to produce popular and profitable games into the future.

Finally, the lower-bound line illustrates a -10% contraction with a 30% probability of occurrence. The contraction in IGGGF’s free cash flow generation is assuming its current portfolio of games slowly declines, and its pipeline fails to deliver promising results.

The 30% probability of occurrence for a -10% contraction may appear high, but this is to allow for a conservative valuation. Given where we are currently in the market cycle, it is likely wise for investors to err on the side of caution, which is what we have done here with this valuation. It is certainly possible for IGG to outperform these estimates, but it behooves investors to add in a margin of safety and be a bit defensive.

It is also important to recognize that the above growth rates are not expected to be exact every year for the next decade. The growth rates are to be expected on an annualized basis. IGG’s results will likely fluctuate from year-to-year, we shall not try to estimate those results, rather we look to estimate accurate growth rates annualized over the next decade.

Assuming the estimated outcomes discussed above prove accurate, IGG may be priced at a 14.5% annual return at today’s price.

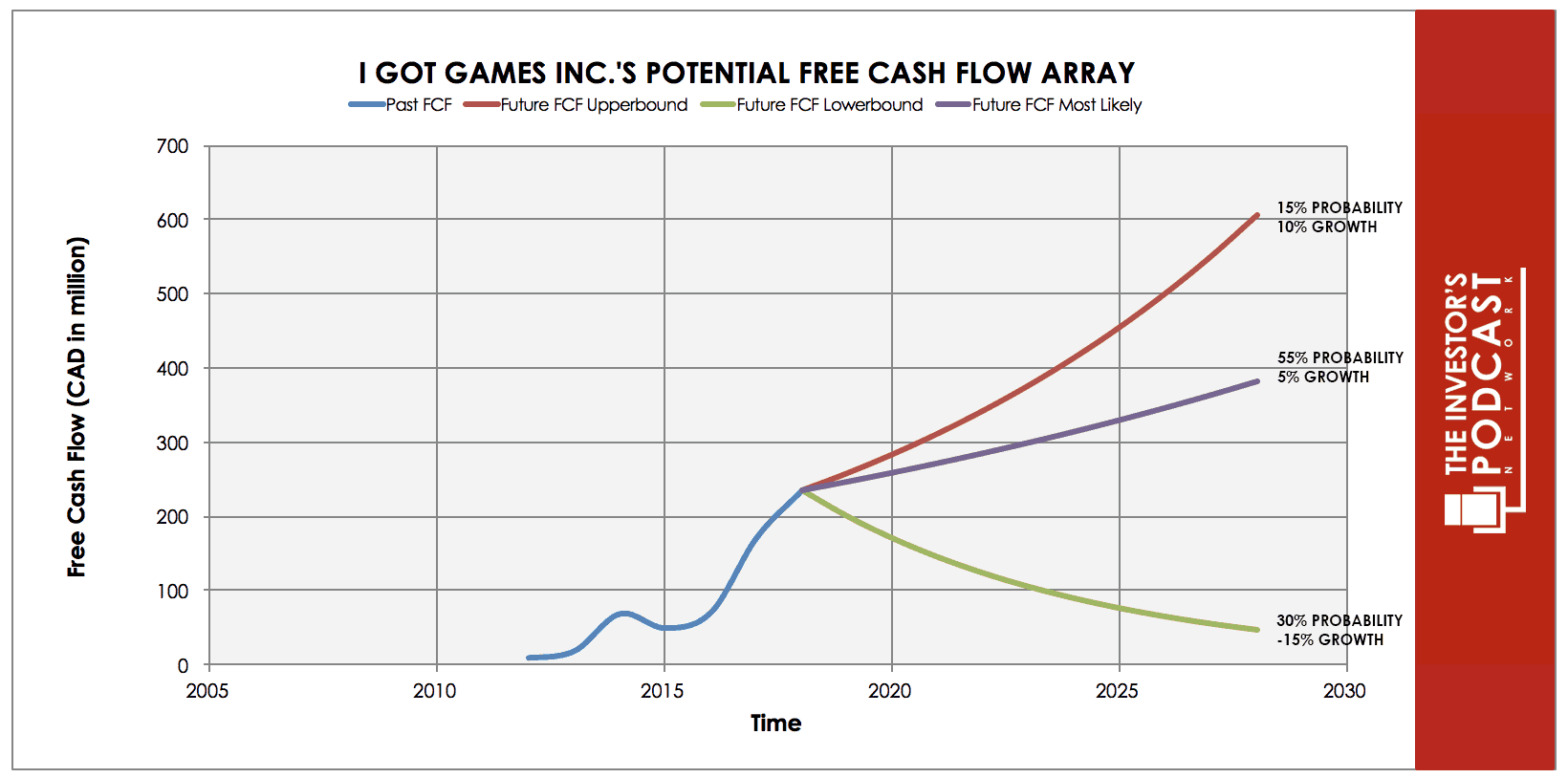

Two other valuable quantitative metrics to consider when considering a stock’s return are the earnings yield and free cash flow yield. At the time of this writing, IGGGF’s current earnings and free cash flow yields are 9.52% and 12.05%, respectively. The graph below illustrates the earnings and free cash flow yields for IGGGF and the S&P 500.

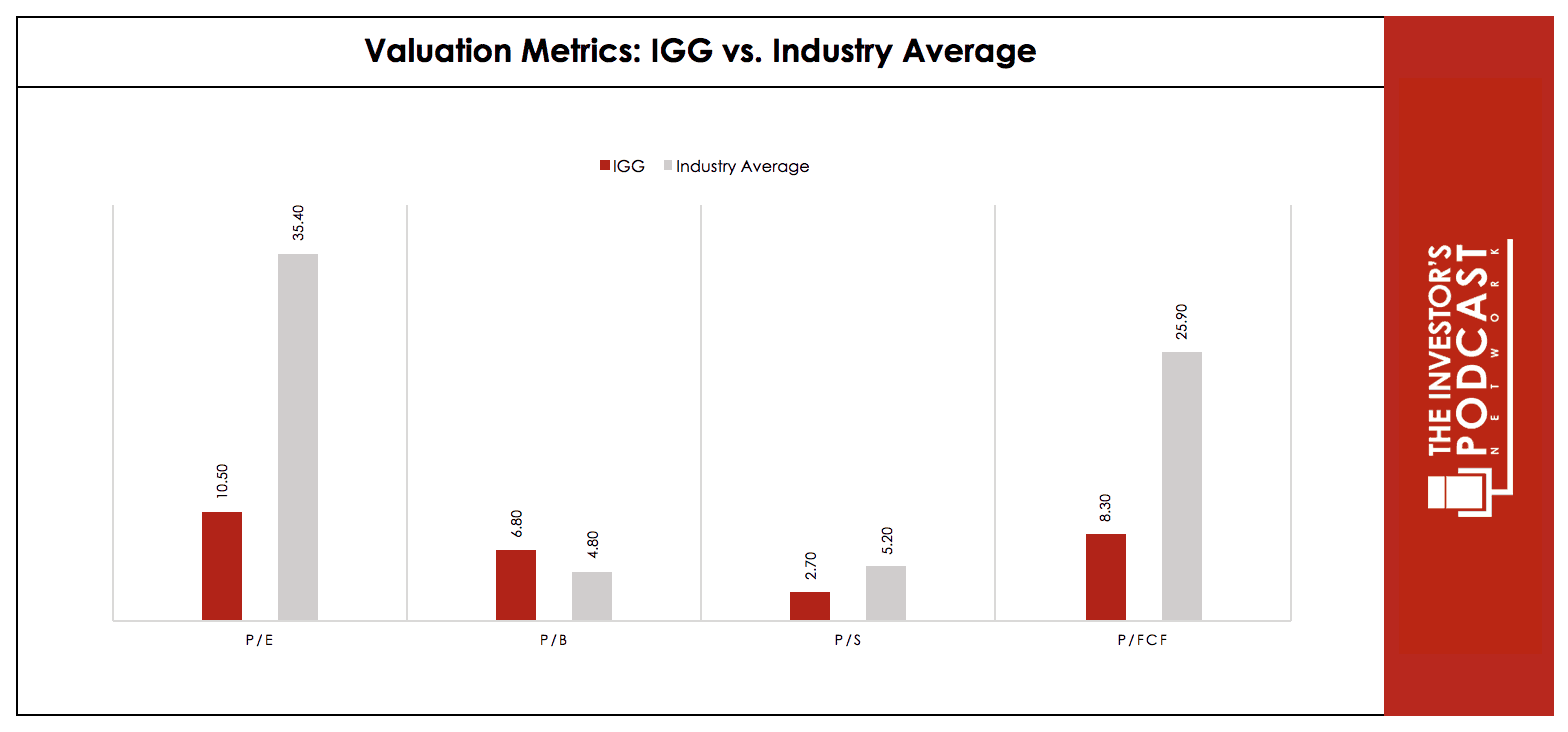

To increase our confidence in our previous valuations and to determine if other valuation metrics support our estimates, we will analyze IGGGF’s relative valuation to its peers. As seen in the graph below, IGGGF trades at less than one-third its industry average on P/E and P/FCF basis – arguably our two most heavily weighted metrics – and nearly one-half its industry average on a P/S basis. These three relative valuation metrics may indicate that IGGGF’ stock is undervalued in relation to its competitors, at today’s prices. You may be wondering about the P/B ratio; you’ll see that IGGGF is actually more expensive than its peers on a P/B basis. Given how the P/B ratio is calculated and that technology companies, of which IGGGF is, do not generally have many physical assets, the P/B ratio and its relative valuation do not carry material weight when valuing IGGGF’s stock. If we were valuing a manufacturing business heavily dependent on physical assets to operate its business, the P/B ratio would be far more important. However, given the lack of dependence on physical assets for technology companies, the slight overvalue result on a P/B basis is not of major concern.

Source: Morningstar

THE COMPETITIVE ADVANTAGE OF I GOT GAMES INC.

I Got Games Inc. has multiple advantages that will be discussed in detail below:

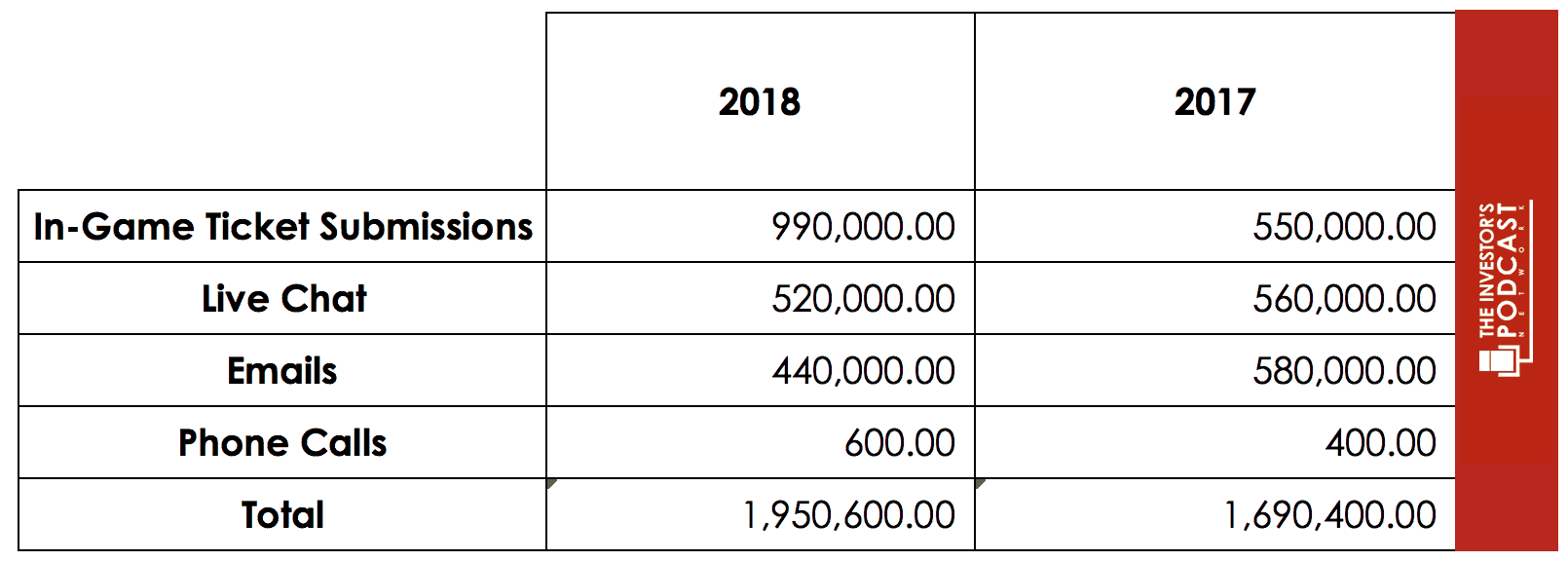

- Customer Service and Involvement. You may be a bit surprised this is the first competitive advantage listed, especially for a mobile game developer, but that is exactly why it is so powerful and has worked so well for IGGGF – none of its competitors have this focus. Management doesn’t just simply state that customer service, and involvement is its priority, it proves it by listing exactly how many customer inquiries its customer service team fielded and through which mediums.

Source: 2018 Annual Report

IGGGF also promotes customer involvement by hosting real-life, live, offline gaming tournaments, trade shows, and game shows. This unparalleled level of customer service and involvement has allowed IGGGF to extend the lifespan of its games, improve and cement its brand, and prove its commitment to high-quality customer experience.

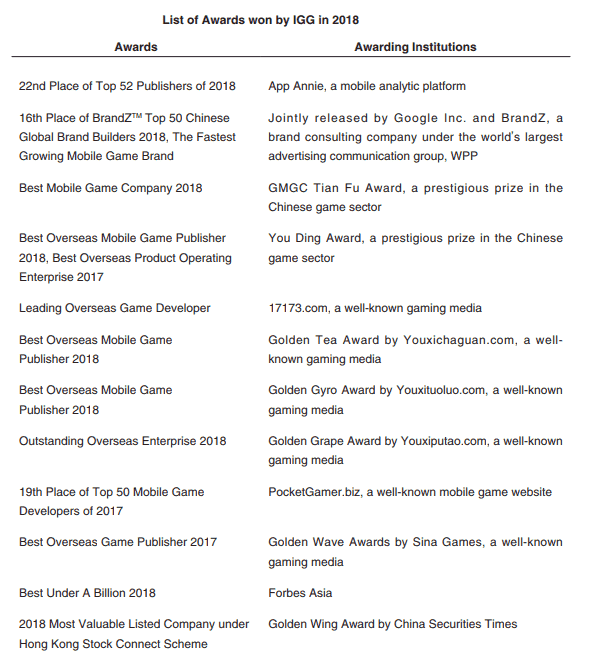

- Quality and Brand. While the focus on customer service and involvement improves the quality of the overall customer experience, management takes it a step further by using the interactions with its customers to further improve its games’ quality. IGGGF can use these customer interactions to gather data on changes that need to be made to its current games to improve them, as well as what customers are looking for in future games. IGGGF’s numerous awards year in and year out prove its strategy and ability to produce high-quality games are Customers have also consistently verified the quality of IGGGF’s games by rating them highly in the app stores.

Source: 2018 Annual Report

- As recent as the first two months of 2019, IGGGF has been able to prove the value of its pipeline. In early 2019, IGGGF released “Mobile Royale,” which attracted more 4 million registered users within just two months of its release date. This game was not created on a whim or acquired; it is a game that was developed entirely through IGGGF’s pipeline. IGGGF also notes it has multiple high-potential games in its pipeline currently, such as sequels to Castle Clash and Clash of Lords, and sandbox and casual games.

- Intellectual Property. The combination of the three previously discussed competitive advantages has led to IGGGF’s intellectual property becoming extremely valuable and a competitive advantage in and of itself. IGGGF is now able to use its intellectual property to not only produce more gaming content but also produce memorabilia and novelty products for its customers and fans to purchase.

- Streaming Subsidiary. IGGGF has a little-known subsidiary called PocketSocial, Inc., which is developing StreamCraft – a live stream gaming platform. This venture is in its early stage and management does not provide much guidance regarding it, but its popularity in the app stores, number of downloads, and the overall trend towards live streaming gaming illustrate the major potential competitive advantage IGGGF is currently holding close to its chest. Remember, Amazon recently purchased a similar company, Twitch, for just under $1 billion.

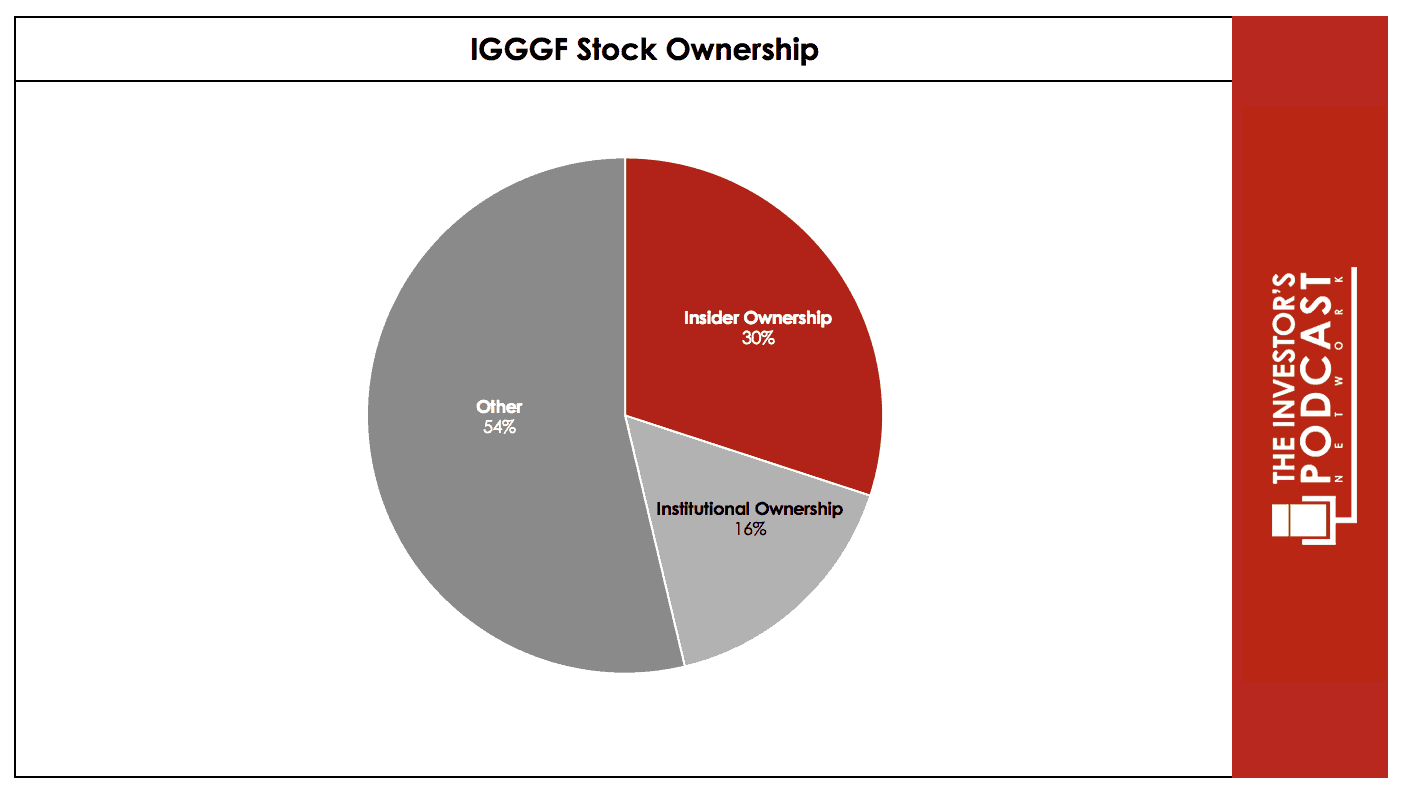

- Strong Management, High Insider Ownership, and Great Corporate Culture. Time in and time out management continues to show its ability to successfully lead IGGGF’s business. It is in tune with the ever-changing gaming and technology markets and is putting its business in a place to succeed. The two co-founders are also both active in the business, with Zong Jian Cai serving as the Chief Executive Officer and Chairman of the Board, while Yuan Chi is a non-executive adviser. Management and insider interests are aligned well with shareholders through its 30% ownership stake. The executives and management team at IGGGF also take great care of its employees and foster an entrepreneurial and innovative environment.

- Financial Strength. IGGGF is an abnormal tech company in the sense that it is cash rich, has no debt, and is actually Tech companies, especially in today’s market, are notorious for losing significant amounts of money and being ridden with debt. For IGGGF, it has current and quick ratios of 2.87 and 2.82, respectively. Its cash and cash equivalents alone are more than 2.4x its total liabilities. It has a history of strong revenue, income, and free cash flow growth. These characteristics not only allow IGGGF to be in a position to take advantage of future opportunities, but it also allows the company to weather a significant downturn relatively unscathed.

RISK FACTORS

Although IGGGF has strong competitive advantages and bright opportunities ahead, it is not without risks that could weaken an investor’s returns.

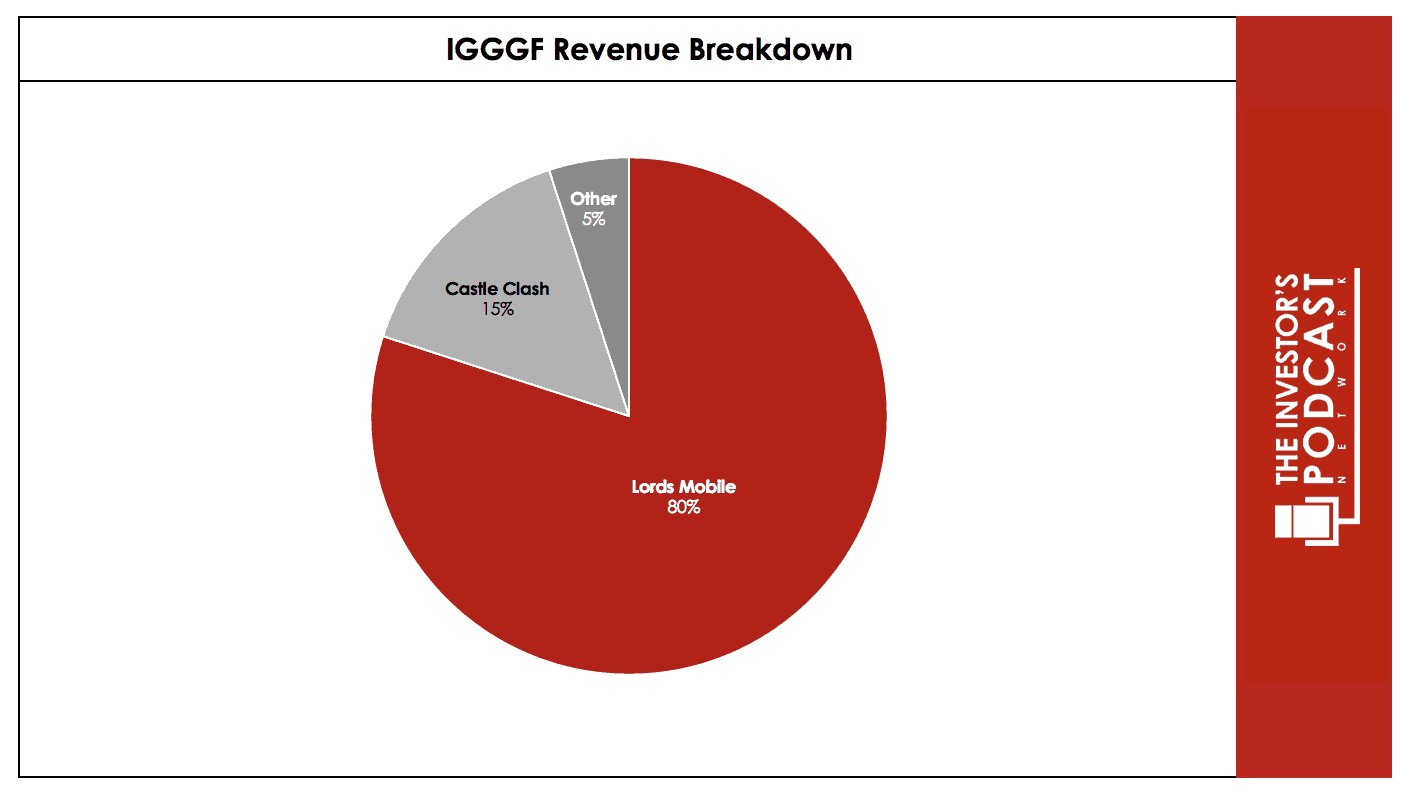

- Concentration of Revenue. Nearly 95% of IGGGF’s revenue came from just two games, with 80% coming from just one game. Lords Mobile and Castle Clash account for 80.1% and 14.7% of IGGGF’s revenue, respectively, with “other” accounting for just 5.2%. Relying so heavily on one revenue stream can lead to detrimental results if something were to impact negatively, or even remove, that income source.

- Severe Competition. The mobile gaming and app development space are extremely competitive. Not only is IGGGF competing against other mobile game and app developers, but in general sense, they are competing against all companies that provide entertainment. Arguably, any company that provides entertainment that could take time away from customers playing IGGGF’s games is a competitor. There are also relatively low barriers to entry to the mobile gaming and app development industry. Technological improvements have allowed nearly anyone with a computer to code apps.

- Lack of Switching Costs/Stickiness. There are very little switching costs, and therefore very little stickiness to IGGGF’s games. Users do not generally incur actual expenses to switch from one game to another; Their “switching costs” are only the value of previous in-app purchases that are surrendered when switching games. If a user exhausts all value from their in-app purchases before switching games, they have no switching costs. This dynamic can lead to relatively short-term and minimal stickiness for IGGGF’s games.

- International Exposure. Being an organization based internationally, IGGGF is open to foreign risks such as political, foreign exchange rate, different accounting policies, and corruption.

- Size, Exchange, and Lack of Liquidity. These risks do not directly impact IGGGF’s business, rather than impact the investor. IGGGF’s small-cap designation, trading on the OTC Markets in the US, and an illiquid stock can make for volatile prices and inefficient marketing pricing for irrational periods of time. The lack of trading volume can also make it difficult for an investor to exit their position when hoped.

OPPORTUNITY COSTS

It is not enough to simply analyze a company in isolation and make an investment decision. Investors must compare that expected investment result with the others available in the market. We previously saw that based on earnings and free cash flow yields, IGGGF is expected to significantly outperform the S&P 500 over the next decade. We also saw that our free cash flow estimates for IGGGF lead to a potential annual return of about 13-14%. Assuming the S&P 500 reverts to its long-term mean Shiller P/E ratio from its current level of 29.4, the expected return for the S&P 500 is -1.6%. 10-year treasuries are currently yielding 2.52% at the time of this writing. These three comparisons indicate that IGGGF may significantly outperform the S&P 500 and 10-year treasuries over the next decade. However, there may be other individual stocks that offer a similar, or better, risk-adjusted return.

MACRO FACTORS

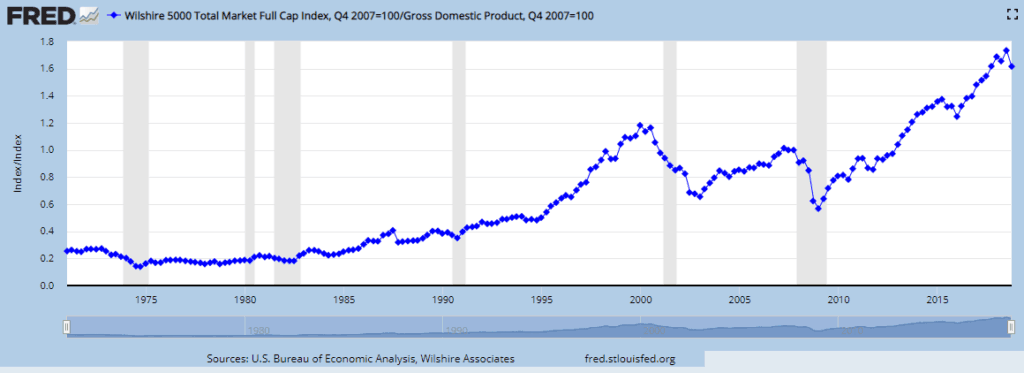

Although individual investors should not attempt to time the market, it would be unwise to not at least consider the overall macro environment when making an investment decision. According to one of Warren Buffett’s favorite market valuation indicators, Wilshire 5000 Total Market Cap vs. GDP, the overall market is significantly overvalued, and at its most expensive point since 1971. The Wilshire 5000 Total Market Cap is currently at 162% of GDP, which is 62% higher than the peak before the Housing Crisis and 44% higher than the peak before the Dot Com Bubble.

Source: Fred, St. Louis Fed

The S&P 500 is currently priced over 70% higher than its historical average on a Shiller P/E basis. Unemployment is currently at, or near, 50-year lows, and US private debt levels have crossed the previous financial crisis. It is not possible to accurately estimate when a downturn is coming, but economic and stock market characteristics are telling investors that we may be reaching a peak.

SUMMARY

IGGGF is currently selling at a discount to our calculated intrinsic value due to its revenue concentration, competition, international risks, lack of switching costs, and its size. These are very real risks that investors must weigh, but they should be realistically compared to the potential upside from IGGGF’s competitive advantages.

IGGGF has a great management team, significant ownership, great margins, non-capital-intensive business (low capex), growing income and cash flow statements, very healthy balance sheet with a lot of cash, multiple competitive advantages, and a promising game pipeline and streaming service.

The projected return of 14.5% is based on quite conservative assumptions and does not take into consideration the significant upside IGGGF would have if its StreamCraft offering continues to grow.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.