Intrinsic Value Assessment Of ANGLO PACIFIC GROUP (APF)

By Ladislao Zichy Thyssen From The Investor’s Podcast Network | 10 June 2020

INTRODUCTION

Anglo Pacific Group is a London-based, basic metal royalty streaming company predominately focused on the developed world (mostly in Australia and Canada). Currently, Anglo Pacific Group has a market cap of $341 million with an enterprise value of $380 million. Anglo Pacific Group produced royalty revenues of $72 million, with $45 million in EBIT for 2019. The revenue grew 20% year over year. Anglo Pacific Group’s free cash flow before royalty acquisitions is $56 million. Anglo Pacific Group currently trades at around .6 times NAV (net asset value), according to BMO, Peel Hunt, and Berenberg equity research. This cheapness, coupled with Anglo Pacific Group’s growing 5.8% dividend yield (and high dividend cover ratio), means that shareholders should expect about 17% annual returns over the foreseeable future.

- Basic Business Model

A royalty streamer in the mining sector is a company that invests money in mining projects in exchange for future payments, usually based on revenue. In the mining sector, royalty rates tend to be between 1% to 3% net of smelters fees. This fee structure is very different from franchises or other royalties, where the royalty rates tend to be higher. In mining, it is prevalent to have scaling royalty rates tied to the price of a commodity. When a commodity’s price goes past a set threshold, the royalty percentage rises. An advantage of investing in the resource sector through royalties is that as long as the mine produces and sells its extracts, the owner of the royalties makes money. This is not always true for mine operators.

- History and Management

Anglo Pacific Group is unique in the royalty streaming world in that it is one of the only companies that is transitioning its portfolio to be more in line with high ESG standards. Anglo Pacific Group’s recent investments have focused on minerals that will benefit from a shift towards a greener economy such as copper and vanadium, as opposed to their previous investments into dirty minerals like coal.

There has been a tectonic shift in how the firm operates in the past decade. Anglo Pacific Group has reduced the amount of money it has tied up in non-producing mineral royalties. It has recently focused on mine sites that need capital to expand production. It has also signed deals where Anglo Pacific Group does not deploy its capital in the development of the mine (constructing the mine) but rather when it starts producing. This investment philosophy ensures that the money invested will bring in revenue instead of getting wasted by an operator who fails to develop a mine correctly or does not have enough financing to start development.

Anglo Pacific Group has moved toward an investing model where it aims to obtain royalties on assets with high-grade ore bodies and low operating costs. The high grade ensures that the pollution produced from mining is less than those of its competitors. Investing in low-cost producers protects Anglo Pacific Group during a commodity downturn since the operator has more margin to cushion the drop in prices.

Anglo Pacific Group’s efforts to diversify its royalty streams has led it to invest over $230 million over the last six years. Most of these investments were made in the past two years. These investments currently produce over $25 million in royalties per year and are expected to continue growing as production in these mines continues to increase. These investments have diversified Anglo Pacific Group’s exposure to commodities like iron ore, vanadium, copper, gold, and uranium. The $230 million investments were paid with free cash flow, debt (~$40m outstanding), cash on hand, and $88 million in equity issuance. Although Anglo Pacific Group issued shares, it has paid over $107 million in dividends over the past six years. These dividends have increased by over 50% since 2016. In Q1 2020, management even increased dividends by 7% despite COVID-19. Surprisingly, COVID-19 has had a limited impact on Anglo Pacific Group.

Australia has declared that mining is an essential industry — mines there haven’t shut down. In Canada, a few companies have temporarily shut down some mining operations but only for 2 to 4 weeks. Anglo Pacific Group took advantage of the credit crunch in March to sign an attractive deal that is expected to pay $1.75 – $2 million per year for the first ten years, and after that, around $2.75 to $3 million for only a $20 million investment. This money will only be deployed once the project begins producing cash flow.

THE INTRINSIC VALUE OF ANGLO PACIFIC GROUP

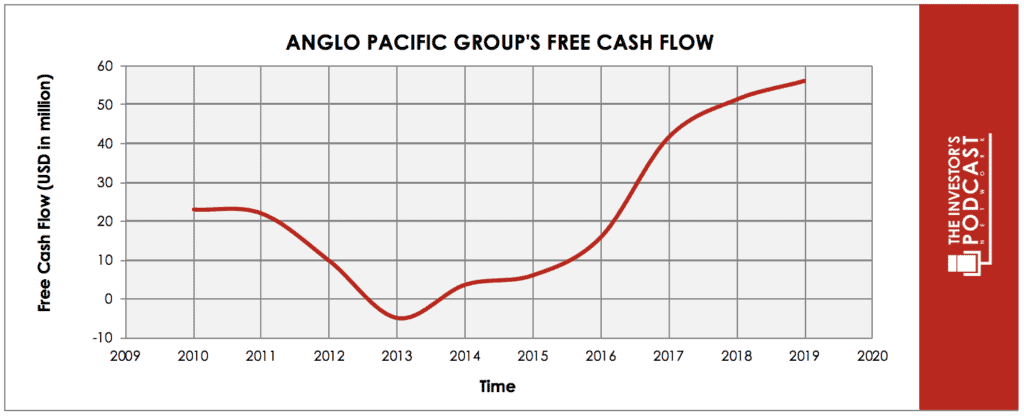

The fundamental value of any business is its future discounted cash flows. The free cash flow is the money that a firm produces that can be used to pay out equity holders or creditors. This money can also be reinvested into the firm to grow and hopefully increase shareholder value. Below is a chart of Anglo Pacific Group’s free cash flow over the past years.

As you can see, it suffered from low free cash flows during the bust of the commodity supercycle that occurred in 2014. This downturn, coupled with its poor underwriting in the prior years, resulted in shareholders suffering from poor returns. Still, over the last five years, the firm’s free cash flow has been increasing steadily. Higher investment standards have meant that more projects that generate cash flows have been undertaken.

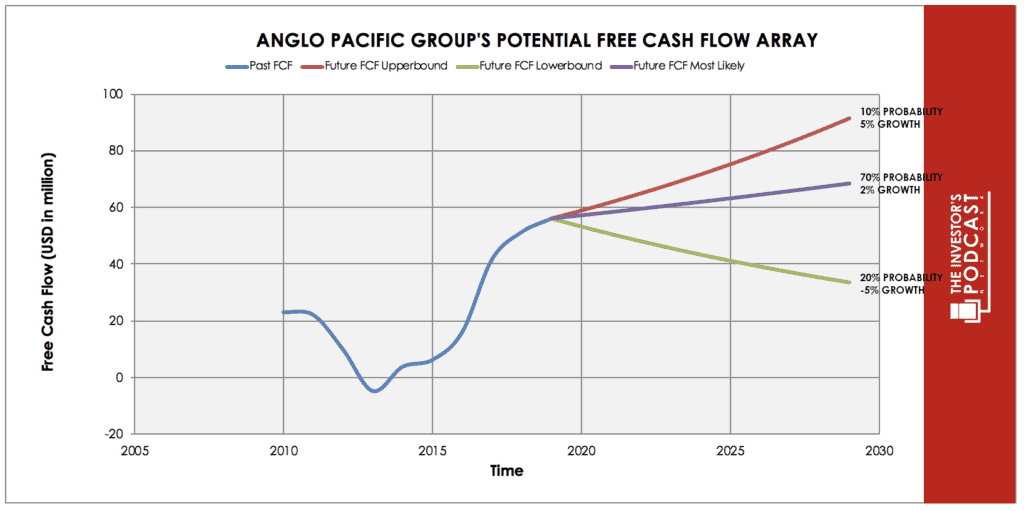

Looking above, there are three different scenarios reflecting alternative cash flows for this firm. The worst-case at a 20% probability envisions the firm’s free cash flow falling to about $34 million (-5% growth per year) in the next ten years. This massive drop assumes that the firm’s developmental projects fail to materialize. It also assumes that the firm will either end up returning or poorly investing the roughly $120 million windfalls expected from its Kestrel mine royalty ending in the next few years. The base case (70% probability) is that commodity prices continue to climb on average as most of the cheaply mined mineral deposits get depleted. This commodity upswing, combined with most of Anglo Pacific Group’s portfolio companies meeting their increased expected production goals as well as new acquisitions, should conservatively grow free cash flow about 2% per year. Finally, the best case at 10% probability assumes the same results as the base came but also that early-stage projects come online quicker. Furthermore, it assumes Anglo Pacific Group’s results will improve as a market develops where high ESG mines get a larger premium for their extracts. This positive development would result in free cash flow growing by about 5% over the next ten years.

Below is a summary of Anglo Pacific Group’s largest assets. It has several other assets not mentioned below:

- The Kestrel royalty is a royalty on an Australian Coke coal mine (Coke coal is used to make steel). The Kestrel mine was recently purchased and has increased its production close to 40% year over year. This has accelerated the payouts from the royalty and thus shortened the life of the royalty. Over the next three years, this royalty is expected to bring in over $120 million before going close to zero as production commences to move outside of the Anglo Pacific Group’s private royalty land.

- Labrador Iron Ore Royalty Corporation (stock ownership). Starting in late 2018, Anglo Pacific Group has slowly acquired around 7% of a publicly listed company called Labrador Iron Ore Royalty Corporation (LIORC). This company is a passive royalty streamer for one of Canada’s biggest and highest quality iron ore mine -IOC. LIORC gets paid through a 7% royalty on the revenue generated by IOC as well as from its 15.1% stake in the IOC mine. Anglo Pacific Group has treated this a regular long-term royalty because LIORC’s mandate forbids it from investing in other projects. Furthermore, the majority owner of IOC is Rio Tinto, one of the largest mine operators. They plan to increase production between 4% to 16% in 2020 as the mine has a mine life of over 25 years. Anglo Pacific Group’s cost basis is $71 million, and it has already realized returns of $9.2 million through LIORC large dividend. The mark to market of the equity is around $76 million, with the ten-year pass-through income being $8.2 million. Anglo Pacific Group expects to earn at least $3 million to $5.8 million per year from dividends.

- This was a 2015 investment of $51 million into an Australian Thermal Coal mine. Thermal coal is the type of coal used to create electricity (Anglo Pacific Group has stated they will no longer make investments in this mineral). The mine life of this project is 2042, with production approved to nearly double. The quality of the coal is improving to the benchmark average, which will further improve royalty payouts. Last year, $4.88 million was earned from this site. The broker assessed asset value is $63 million, with Anglo Pacific Group already realizing over $22 million through its royalty.

- Mantos Blancos. This was a $50.25 million royalty investment that occurred in the second half of 2019. The mine produces very-high grade copper. The investment is meant to alleviate a bottleneck that would allow for a planned production increase of 70% by 2021. The mine has low operating costs of $1.87 per pound, and there have been discussions to increase production significantly beyond the 70% increase. The mine at pre-investment production levels would payout Anglo Pacific Group around $3.66 million per year. In the past 15 years, copper prices were only lower in four other years. Thus, an increase in production and an increase in the price of copper would significantly increase the returns of this project.

- Maracas Menchen. This is a $17.5 million royalty investment into a Vanadium mine in Brazil. Vanadium is used to strengthen steel for things like aircraft, axles, gears. The production is expected to increase from 35% over the next few years. Currently, prices are below the 15-year average at around $6 per pound, which more than covers $3.21 cost per pound of the mine. The assessed value of the royalty is $39 million, with $14 million already realized and $4 million paid out last year. There is further upside from this investment. The current mine owner will begin marketing the high-quality vanadium for energy storage and batter equipment instead of relying on an intermediary. The mine owners are also building a new Ferrovanadium conversion plant. Anglo Pacific Group royalty entitles it to the new revenue generated from these businesses. Finally, the mineral rights owned are larger than the current mining permits meaning that expansion or creation of other mines in the land nearby will allow Anglo Pacific Group to capitalize with this royalty.

THE COMPETITIVE ADVANTAGE OF ANGLO PACIFIC GROUP

Below are some of the advantageous of Anglo Pacific Group:

- Available Capital and Low Borrowing Costs. Anglo Pacific Group has amended its revolving credit facility to US$90.0m and is retaining a US$30.0m accordion. Its borrowing costs are LIBOR plus 175bps. Currently, LIBOR rates are lower than 1%. This cheap capital is vial as mining operations tend to have higher WACCs, which allows APG to borrow and invest in new projects. Anglo Pacific Group has over $70 million of untapped credit ready to invest.

- Production in Safe Countries. Many companies have mines in countries with poor rule of law. In the past, resource nationalism has forced many foreign companies to write off or write down existing mining assets. Most of Anglo Pacific Group’s portfolio is in countries like Australia and Canada that have a strong rule of law.

- ESG. High-grade ore bodies tend to pollute much less. Premiums for these products should increase if carbon taxes are announced or if more customers desire to lower their environmental footprint.

- Low-cost Producers. Anglo Pacific Group has obtained royalties in mines with low production costs. Although Anglo Pacific Group does not directly benefit, this ensures that when commodity prices collapse that the mine operator will not shut down operations. Another benefit of this is that the owners of the mines have an incentive to increase production, thus increasing Anglo Pacific Group’s royalties.

RISK FACTORS

Although the company has strong assets that produce significant free cash flow, below are some of the risk factors that could impair my cash flow assumptions.

- China Retaliating Against Canada or Australia (most of APG’s assets are in these countries). In the past, China has retaliated toward countries that act in manners seen unfavorable to the Communist Party by introducing tariffs against those countries. This occurred when Australia decided to ban Huawei from selling its 5G equipment in Australia. China has also retaliated against Canada. This happened when Canada detained the daughter of Huawei’s founder for potentially violating US sanctions in Iran. If Canada or Australia continues to take action “against” China, they could experience further restrictions in the Chinese market. This would significantly reduce the price of commodities produced in either Canada or Australia.

- Commodity Price Swings.

- The mining industry tends to have many boom-and-bust cycles. These cycles occur as companies tend to over-invest during the good times only to see commodity prices collapse. Should prices fall sufficiently, Anglo Pacific Group may suffer from impairment charges related to the temporary shut down or even the permanent shut down of a mine.

- If COVID-19 creates a prolonged recession, a massive drop in the demand will see commodity prices fall.

- Management Making Poor Capital Allocation Decisions.

- This business requires management to make bets on resource deposits as well as invest in mining projects that banks or other financial investors would not. Management will end upwith a windfall of over $120 million from the Kestrel royalty ending. This money will need to be reinvested intelligently to ensure good long-term shareholder growth. Anglo Pacific Group has, in the past, squandered money on poor projects and may commit the same mistake.

- The management has been spending money and time presenting themselves to prospective investors such as institutional investors in the US and Canada. Their goal is to attract new investors to increase the share price. Management should instead be focusing on finding attractive projects for shareholders or returning money to them. They should let the results attract prospective investors instead of chasing them.

- Geopolitical Problems in Latin America. Many of the new royalties are in Latin America. Latin America has suffered from instability and resource nationalism. Thus, foreign ownership of mine sites could prove to be a liability. Resource nationalism can threaten projects in Brazil or Chile, as there are risks of nationalization or higher mineral taxes. Although Chile has had the most stable government in Latin America, current political events may change that.

OPPORTUNITY COSTS

There are various investment opportunities on the market today to compare this investment to. First, one could invest in the ten-year treasury bond, which is producing a 0.71 % return. Inflation is currently about 1.4% (excluding energy); thus, the yield on treasuries is negative. Another potential investment is buying a low-cost index fund that tracks the S&P 500. Currently, the S&P 500 Shiller P/E ratio is 27.9. As a result, the U.S. Stock market can expect around a 3.58% annual return.

MACRO FACTORS

There are several macro events to take into account. The first is the disruption that COVID-19 has caused the global economy. In the best scenario, output for many countries will fall only in 2020 but rebound to 2019 levels in 2021. In the worst-case scenario, the global economy will be significantly smaller, affecting the global appetite for commodities. Another macro event that affects the Anglo Pacific Group is the low/negative rates that prevail in most countries. Quantitative Easing has lowered long term borrowing costs while central banks brought down short-term interest rates. This has allowed Anglo Pacific Group to borrow money at around 3% to fund its investments. Should this scenario revert to the historical median, the WACC of Anglo Pacific Group will go up. This would impair many of its royalties.

Finally, Anglo Pacific Group is benefiting from the strength of the dollar. Most of Anglo Pacific Group’s production is in countries outside the US, like Canada and Australia, which have seen their currencies fall versus the US dollar. This has lowered the operating costs for the mines that Anglo Pacific Group has royalties on. This means that their owners are incentivized to increase production as their costs have gone down while their revenues have stayed the same (most commodities are priced in dollars).

SUMMARY

Anglo Pacific Group offers attractive high dividend rates in a world of low-interest rates. It is diversifying its portfolio holdings to be in line with a more environmentally conscious world. Most of its assets are in countries with robust rules of law. This, coupled with low operating costs of the mines it invests in, should ensure consistent, strong returns in the foreseeable future. After all, buying an asset at around 60 cents on the dollar with a free cash flow yield of over 13% seems like a bargain in today’s environment. The expected return of 17% ensures that there is plenty of margin of safety in case things go wrong.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.