Intrinsic Value Assessment Of Kohl’s Corporation (KSS)

By Robert Leonard From The Investor’s Podcast Network | 06 June 2019

INTRODUCTION

With over 1,150 stores across 49 states and its headquarters in Menomonee Falls, Wisconsin, Kohl’s Corporation is one of the United States largest traditional brick-and-mortar department stores. It has a wide range of product offerings, ranging from men’s and women’s clothing to cosmetics to home furnishings. Within its stores, it carries numerous national brands, such as Oakley, PUMA, and Adidas, as well as its own portfolio of exclusive brands (Simply Vera Vera Wang, LC Lauren Conrad, and Apt. 9).

At the time of this writing, the market capitalization for Kohl’s is about $8.34 billion and its revenue and cash flows for the 2018 fiscal year were $20.2 billion and $1.5 billion, respectively. Currently trading at about $51.83, the stock has hit a 52-week low of $50.40 and a 52-week high of $83.28. At today’s price of $51.83, is its stock undervalued?

THE INTRINSIC VALUE OF KOHL’S CORPORATION

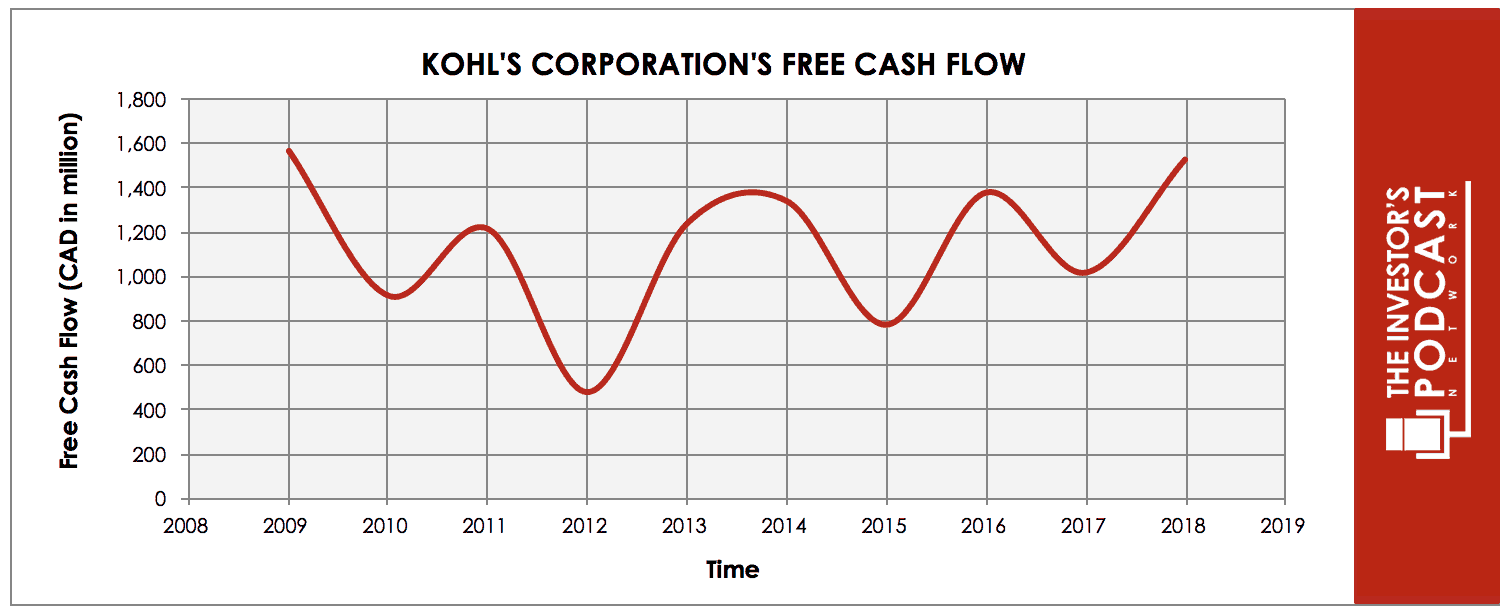

With the net income being easily manipulated and not a true representation of the cash available to a company’s owners, we prefer to use free cash flow to value a company’s stock. Using free cash flow instead of net income allows investors to value the company based on the actual cash it generated for its owners. Below is a chart of Kohl’s free cash flow for the past ten years.

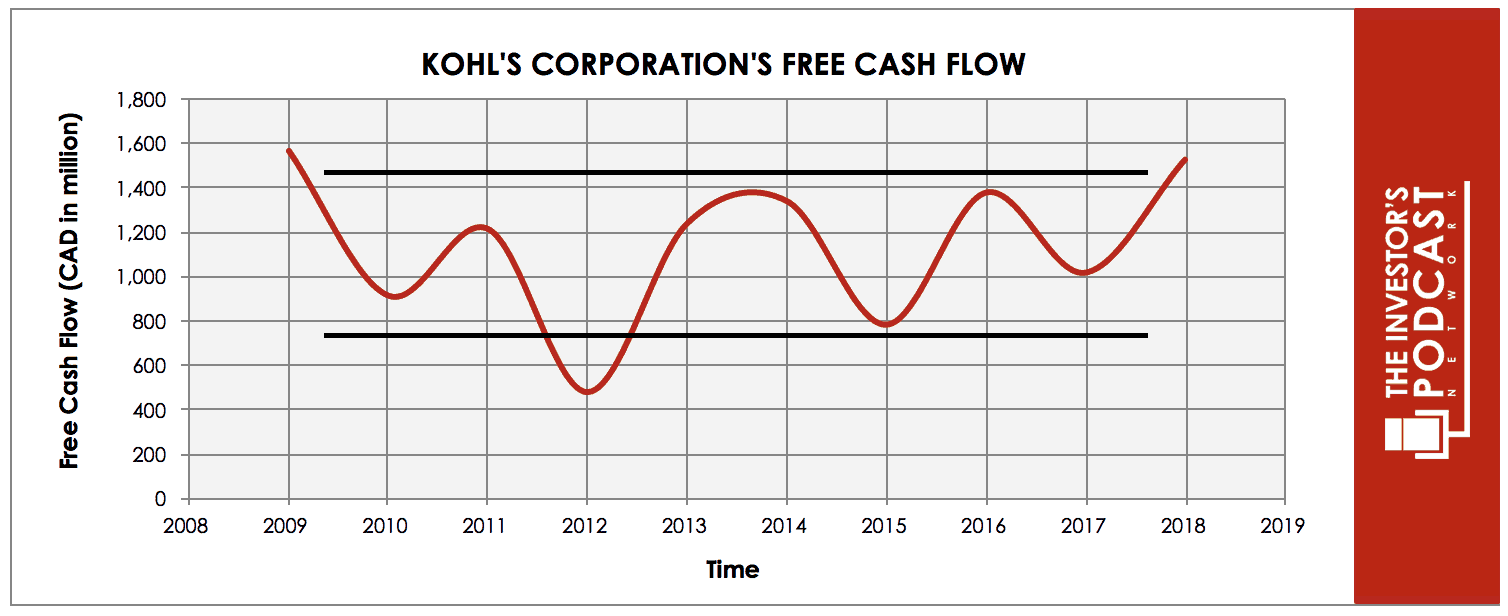

With the exception of 2012, Kohl’s free cash flow has remained in a range between about $800 million and $1.4 billion from 2010 to 2017, as illustrated by the lines on the graph below. There certainly has been volatility from year to year, but it has been successful in maintaining relatively consistent free cash flow generation as e-commerce companies have attempted to replace traditional retailers. Looking at Kohl’s free cash flow more closely from 2012 to present, it appears it may be slightly trending upwards as it has made higher lows and higher highs. In future sections when we value the company, we will not rely on growth in free cash flow, but it is important to note that it may be trending upwards.

From 2009 to 2018, Kohl’s free cash flow actually contracted by about 2.5%, cumulatively. From its low in 2012, Kohl’s free cash flow has grown from $915 million to $1.5 billion, for a compounded annual growth rate (CAGR) of about 5.9% (67% cumulatively).

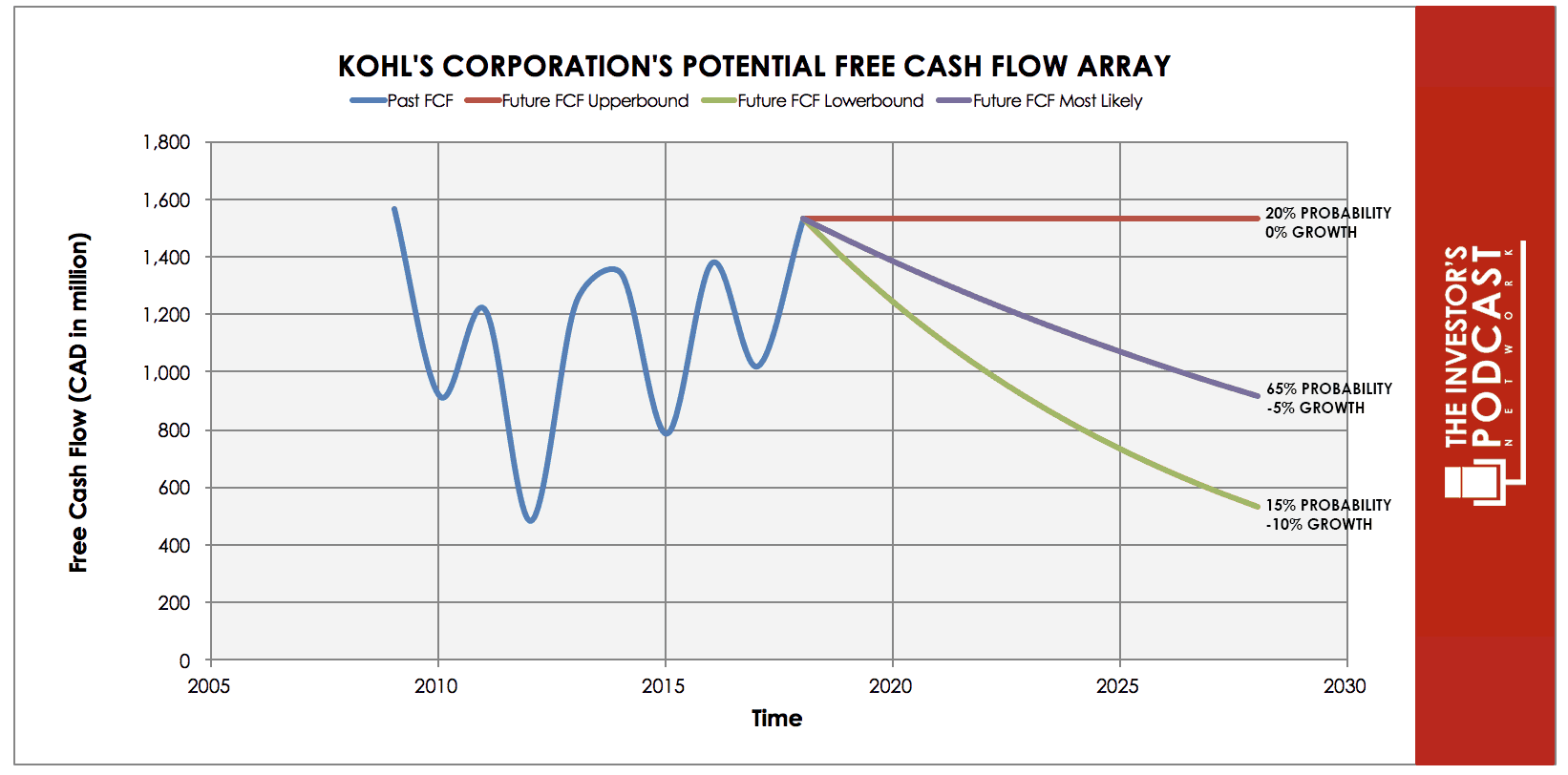

To value Kohl’s stock, its future free cash flows must be estimated. To do this, the array model below has been developed to account for three potential outcomes of Kohl’s future free cash flows.

The upper-bound line illustrates a 0% growth rate with a 20% probability of occurrence. This growth rate was assigned to allow for the potential of management to successfully maintaining its current free cash flow levels, while also considering the highly competitive nature of the retail landscape.

The middle line represents a -5% contraction with a 65% probability of occurrence. This outcome assumes that Kohl’s will be semi-successful competing in the increasingly competitive and changing retail industry, but will still see some of its free cash flow diminish.

Finally, the lower-bound line illustrates a -10% contraction with a 15% probability of occurrence. The contraction in Kohl’s free cash flow generation is assuming that competitors and online retailers continue to disrupt the retail industry, Kohl’s management fails in its new strategic initiatives, and the United States economy enters into a recessionary period, resulting in a significant slowdown in consumer spending.

Looking at these growth rates and probabilities, you will notice there is a skew towards negative growth or a contraction over the next decade. This may seem pessimistic, but it allows for a conservative valuation and to consider the potential downside risk. When creating a valuation model, one must consider the economic environment in which their investment would be made.

In today’s environment, it is likely wise to estimate growth rates very conservatively with a margin of safety. Any outperformance of the conservative growth rates would provide investors with additional returns above and beyond what was expected. It is also important to recognize that the above-estimated growth rates are not expected to be exact each and every year over the next decade. In fact, that is very unlikely. As they have since 2009, Kohl’s results will likely fluctuate from year-to-year. We do not attempt to estimate results on a yearly basis. Rather, we look to estimate accurate growth rates annualized over a decade. Assuming the estimated outcomes discussed above prove accurate, Kohl’s stock may be priced at a 13.1% annual return at today’s price.

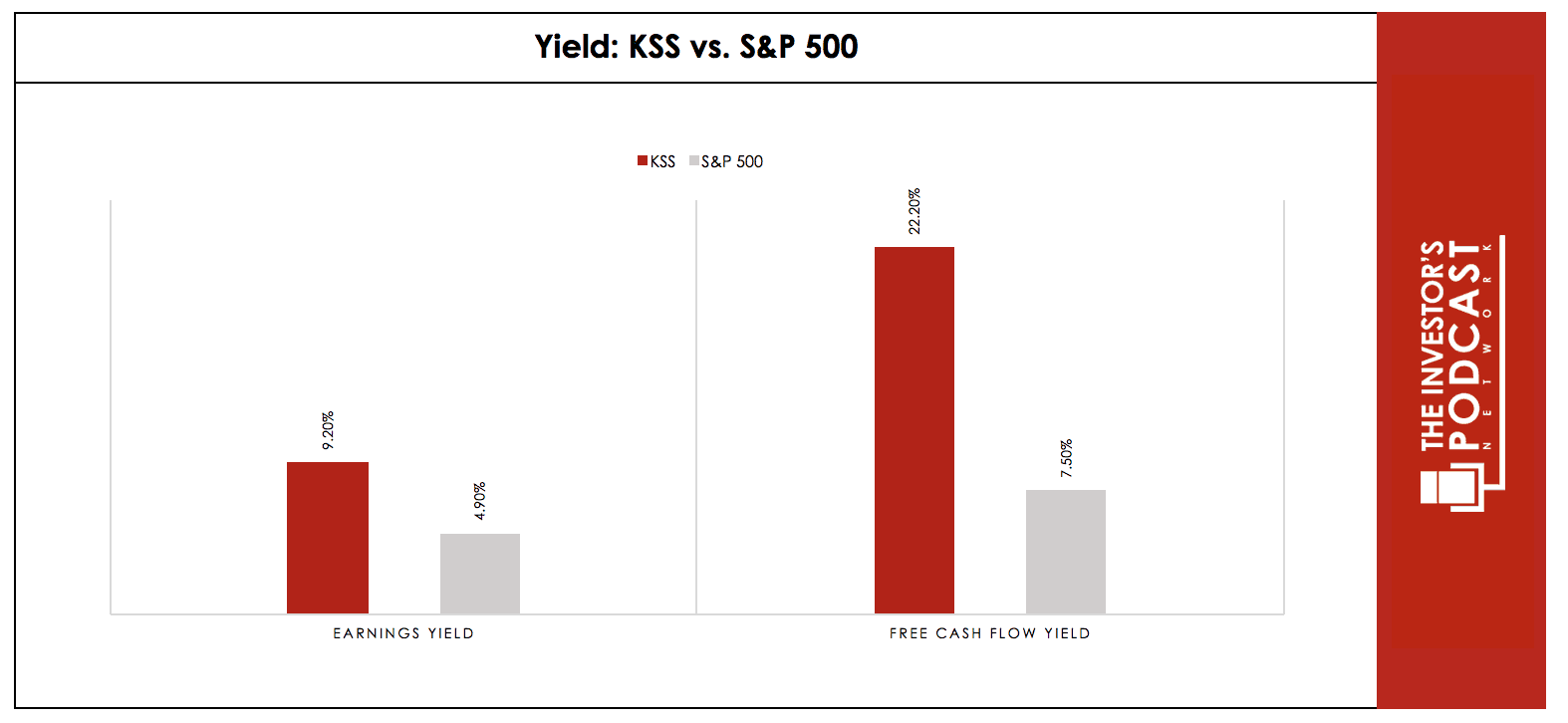

Two other valuable quantitative metrics to consider when analyzing a stock’s potential return are the earnings yield (inverse P/E) and the free cash flow yield (inverse P/FCF). At the time of this writing, Kohl’s current earnings and free cash flow yields are 9.2% and 22.2% respectively. Its earnings and free cash flow yields appear to be below and above our calculated expected return from our DCF analysis. Kohl’s also appears to be priced moderately better than the S&P 500 on an earnings yield basis and significantly better on a free cash flow yield basis. This relationship is not unexpected as it is indicative of investors having a higher required rate of return when investing in an individual company than they do when investing in a broad index, like the S&P 500, but it also puts into perspective the extra return an investor might be able to achieve by taking on more risk. The graph below illustrates the earnings and free cash flow yields for Kohl’s and the S&P 500.

Source: Morningstar

Up to this point, everything quantitative about Kohl’s valuation indicates it may be undervalued and priced to outperform the S&P 500 over the next decade. However, before we come to that as our final conclusion, let’s compare Kohl’s to its competitors.

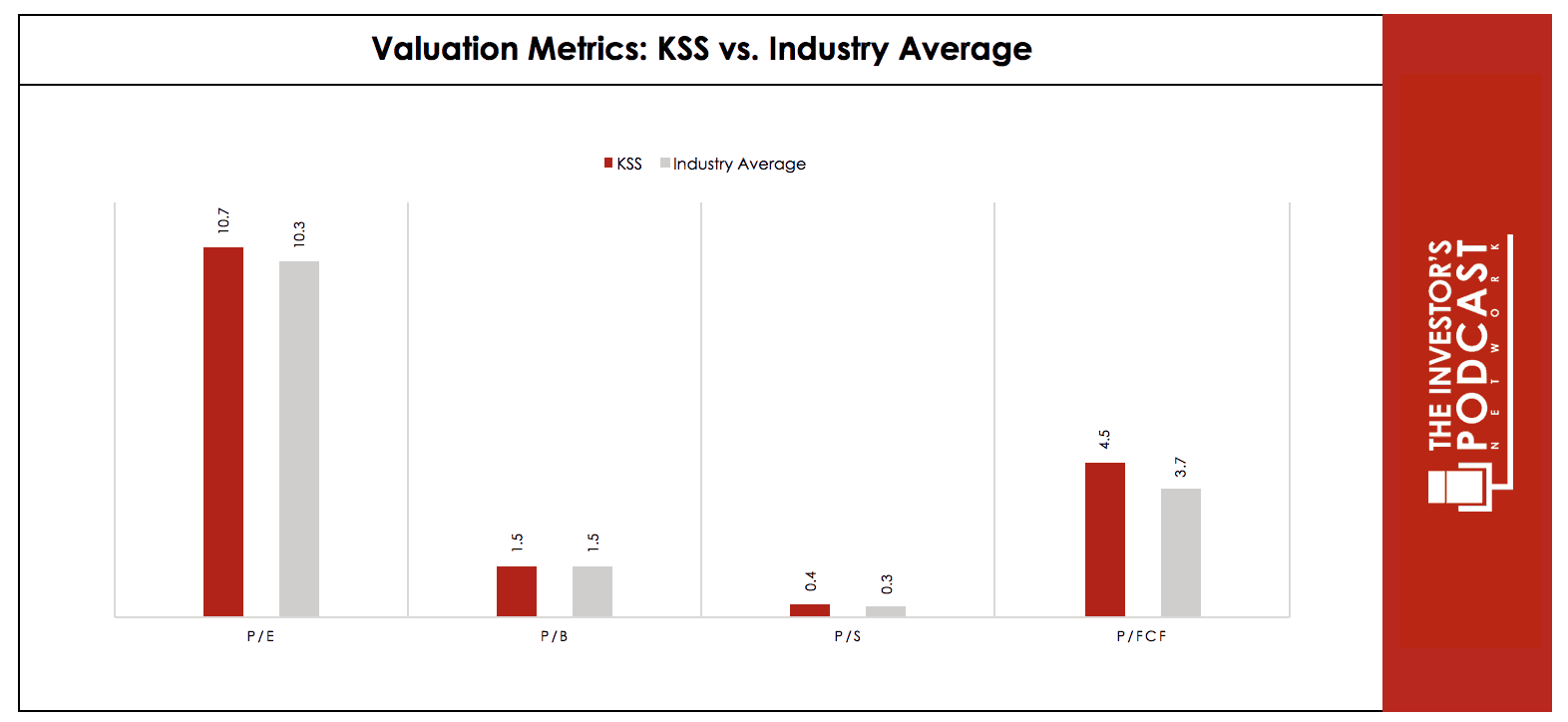

In the graph below, you will see Kohl’s valuation metrics compared to that of the industry’s average on a P/E, P/B, P/S, and P/FCF basis. It is quite close on all of these metrics. Given Kohl’s competitive advantages that we will discuss in the next section, it is reasonable that Kohl’s should trade at a slight premium to the overall industry.

Source: Morningstar

THE COMPETITIVE ADVANTAGE OF KOHL’S CORPORATION

Kohl’s has multiple advantages that will be discussed in detail below:

- While other companies and management teams have struggled to adjust to the changing retail landscape, Kohl’s management team has excelled. It has been willing to think “outside-the-box” and look for unconventional ways to drive traffic to the stores and ignite growth. It has entered into two strategic partnerships (one with Amazon and one with Planet Fitness) that really help illustrates management’s ability to differentiate itself from its competitors.

- Financial Strength. Despite a difficult environment over the past decade, Kohl’s has been able to grow its topline revenue, maintain high Returns on Equity and Returns on Invested Capital, pay down its debt and preserve a healthy cash position. It has consistently raised its dividend every year since 2012 and has bought back nearly half its stock.

- Rewards/Loyalty Program. As illustrated from the likes of Starbucks and Domino’s, customer loyalty programs can drive great customer retention. Kohl’s is widely known for its “Kohl’s Cash” rewards program, which management continues to focus on and improve. This has helped management successfully achieve positive comp sales year over year, while many retailers are struggling to get customers to return to its stores.

RISK FACTORS

Although Kohl’s has competitive advantages, it is not without risks that could weaken an investor’s returns.

- Severe Competition. It is no secret that the retail industry has become extremely competitive over the last 5-7 years, and this trend continues to this day. In addition to competing with major brick-and-mortar and e-commerce players like Walmart and Amazon, Kohl’s is increasingly having to compete with individual sellers and small businesses through platforms such as Etsy.

- Lack of Switching Costs/Stickiness. When it comes to buying well-known, non-exclusive brands, consumers do not generally have a preference where they purchase the products from – their main focus is on price. It is difficult to convince customers to continually purchase products from Kohl’s when there are other stores offering the same products at a cheaper price.

- Lack of Bargaining and Pricing Power. Due to the dynamic discussed in the previous bullet, this makes for a difficult bargaining and pricing power relationship for the retailers, such as Kohl’s. In general, an $11 billion retailer like Kohl’s cannot demand significantly better pricing from a major brand and/or manufacturer than other large, $290 billion retailers like Walmart can. This reduces its bargaining power and limits its ability to improve margins through lower cost of goods. On the other end of the transaction, Kohl’s also struggles with a lack of pricing power. Kohl’s cannot consistently demand a significantly higher price for its products when customers are able to get the same product at another retailer for a lower price. Lack of power on both the bargaining and pricing sides leads to increased pressure on Kohl’s margins.

- Protecting Customer Data. With mass amounts of customer data, retailers have become a target for hackers. In 2018 alone, nine retailers (Macy’s, Adidas, Sears, Kmart, Best Buy, Saks Fifth Avenue, Lord & Taylor, Forever 21, and Gamestop) were victims of data breaches. It can be a short-term problem if handled appropriately, but it still poses a major risk to companies in possession of large amounts of valuable data.

OPPORTUNITY COSTS

Although opportunity costs will not appear in your brokerage statements, it is a very real cost to investors that must be considered. When making an investment, an investor makes the conscious decision to forgo other investment opportunities for the one chosen. Despite having a positive real result, an investment could actually be negative when considering opportunity costs if capital is not allocated to its most successful and efficient use. Kohl’s is currently priced to return better results than the 10-year treasury and the S&P 500 over the next decade, but it may not offer the best risk-adjusted return in comparison to other individual companies.

MACRO FACTORS

Attempting to time the market is rarely a recipe for success when investing, but it would likely be unwise to not at least consider the overall macro environment. Specifically, with brick-and-mortar retailers like Kohl’s, economic conditions play a pivot role in their success. During a recessionary period, consumer spending is significantly reduced, and retailers see their sales plummet. Unemployed is currently at, or near, 50-year lows, and US private debt levels have exceeded previous major financial crisis. With various economic indicators pointing to a potential peak, an investor should consider protecting oneself from an economic downturn.

SUMMARY

While the current conditions of the retail industry have attracted many value investors, it is recommended you do extra due diligence when researching individual companies to help combat against the possibility of a value-trap.

Kohl’s skilled management and its ability to identify and implement intriguing strategic partnerships add potential upside that most retailers do not have. Although both initiatives are still in their infancy, Kohl’s has recently expanded its return-program partnership with Amazon to all its stores and plans to lease space to Planet Fitness next to ten of its stores this year. These characteristics do provide exciting potential upside, but the risks must not be forgotten. It currently trades at a discount to our calculated intrinsic value, but the risks may prove severe and dampen expected returns. Given the assumptions outlined in this analysis, a return of approximately 13.1% can be expected at today’s price.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclosure: The author, Robert Leonard, does not currently hold any ownership in Kohl’s (KSS), but may initiate a long position in KSS over the next 72 hours. The article was written himself, and it expresses his own opinions. He is not receiving compensation for it (other than from The Investor’s Podcast Network). He has no business relationships with any company whose stock is mentioned in this article. The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. Robert is not a financial advisor. Please always do further research and do your own due diligence before making any investments.