Intrinsic Value Assessment Of Lennar Corporation (LEN)

By Christoph Wolf From The Investor’s Podcast Network | 01 March 2019

INTRODUCTION

Lennar Corporation is one of the largest homebuilders in the U.S., focusing on the construction and sale of single-family homes targeted to first-time, move-up, and luxury homebuyers. Its homebuilding operations are made up 89% of consolidated revenues in 2017. The remaining business consists mostly of its financial arm, Lennar Financial Services, which offers mortgages to the buyers of its homes.

At the beginning of 2018, Lennar Corporation merged with CalAtlantic, another of the largest U.S. homebuilders. This immensely increased Lennar Corporation’s footprint in U.S. homebuilding, but also added even more to its already considerable debt pile. Considering that Lennar Corporation’s stock price has fallen from more than $70 in 2018 to only $48 today, is this a bargain investors should consider?

THE INTRINSIC VALUE OF LENNAR CORPORATION

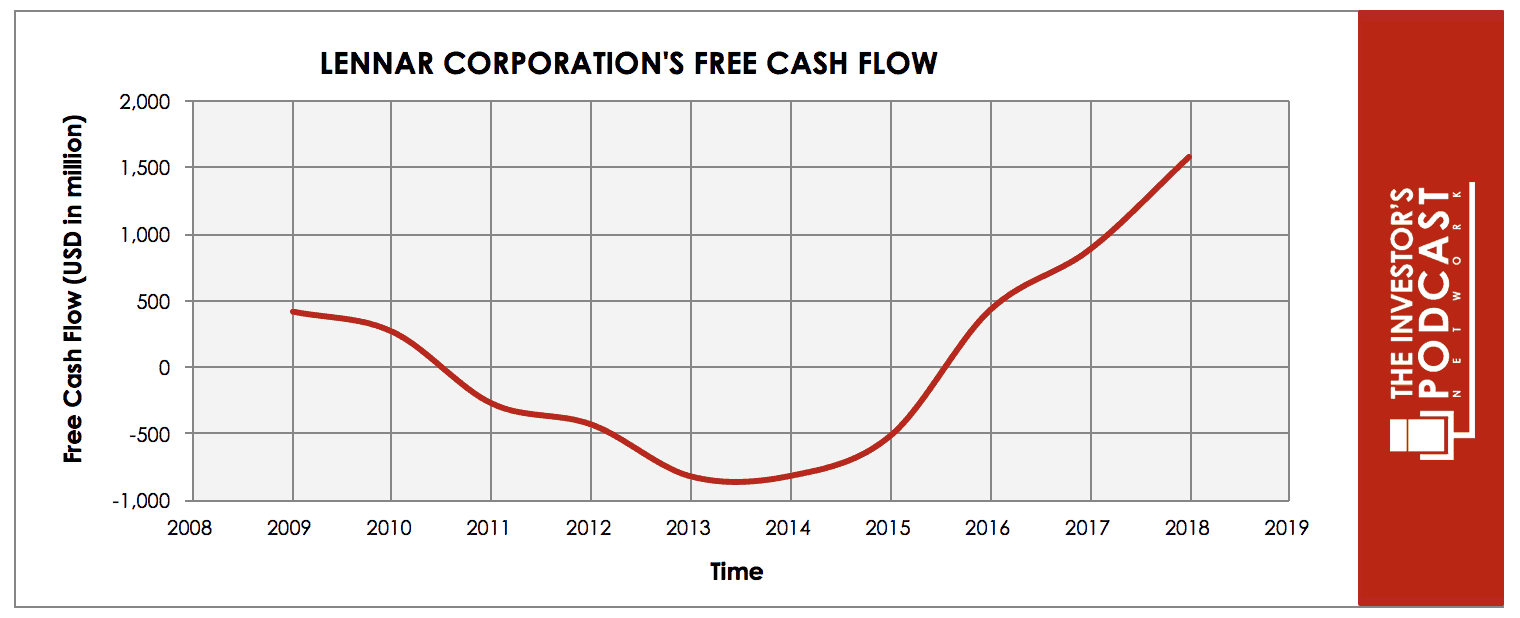

To determine the value of Lennar Corporation, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Lennar Corporation’s free cash flow over the past years.

One can see that Lennar Corporation operates in a very cyclical business, which makes it both harder to value and also adds uncertainty. We will, therefore, use caution when modeling the expected future cash flows.

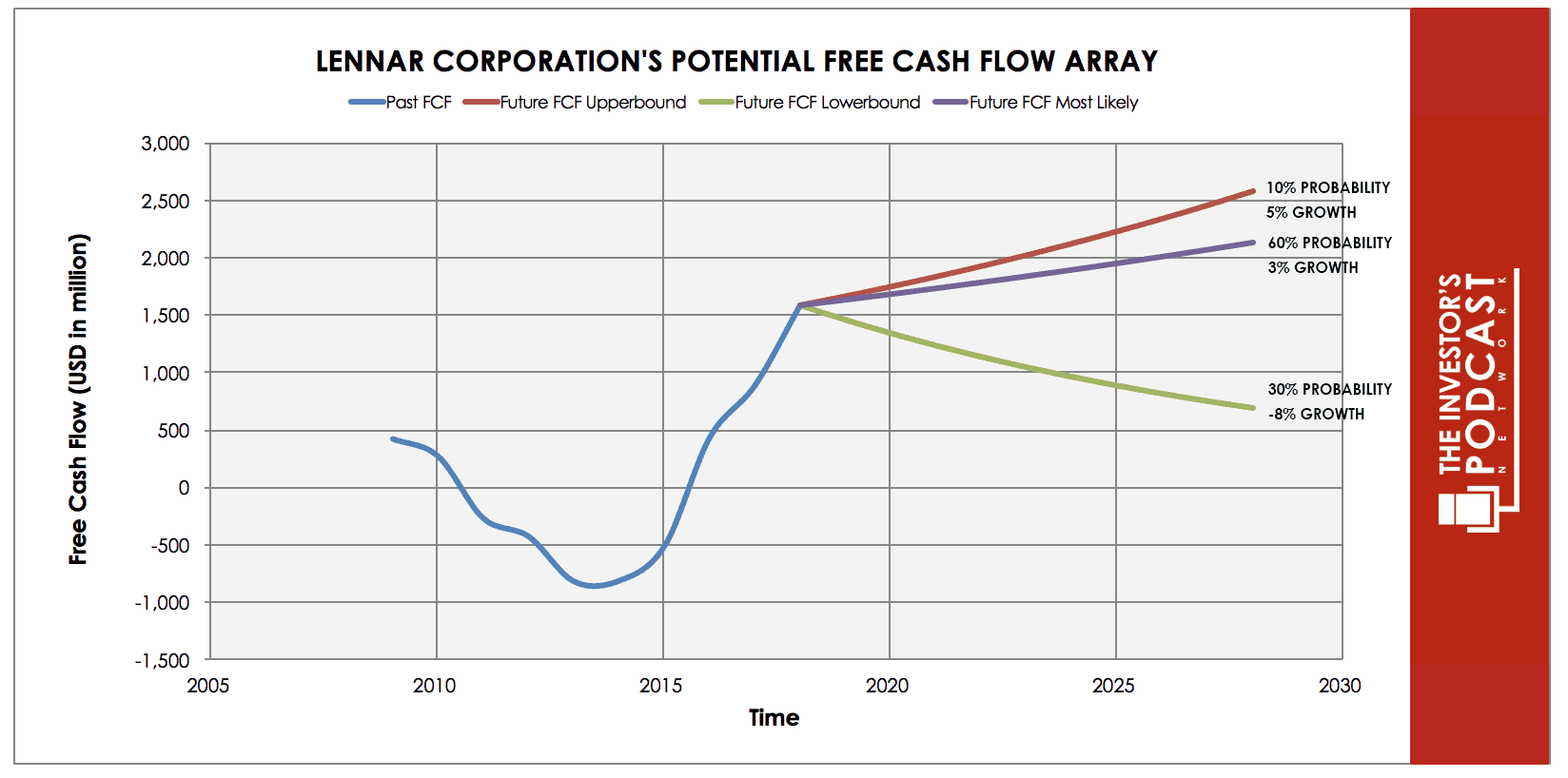

Each line in the above graph represents a certain probability for occurring. We assume a 10% chance for the upper growth rate of 6% per year. The most likely scenario of 3% is based on the approximately expected growth rate of the economy and is assigned a 60% chance. We denote a 30% chance to the possibility of a sharp annual contraction of 8% in case of a severe recession.

Assuming these growth rates and probabilities are accurate, Lennar Corporation can be expected to give a 10.1 % annual return at the current price of $48.5. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF LENNAR CORPORATION

Lennar Corporation possesses some unique advantages that should allow it to be successful in the future:

- Economies of Scale. Having merged with CalAtlantic, Lennar Corporation is one of the biggest players in U.S. homebuilding. This gives the company a good position when negotiating with suppliers, banks, and

- Due to its size and long-term experience, Lennar Corporation is a well-known and trusted brand in the homebuilding market. Its size also allows us to run a large marketing program, which further increases visibility and brand recognition.

- Vertical integration. By offering both homebuilding and mortgages, Lennar Corporation can profit from the complete value chain when building and selling a home to a customer.

RISK FACTORS

Several risks might limit the growth prospects of Lennar Corporation:

- Strong dependency on U.S. economic conditions. An investment in Lennar Corporation is a bet on a strong U.S. economy. In a downturn, Lennar Corporation will be affected in multiple ways: Demand for homebuilding will decline, more mortgages will turn sour, and write-downs of land will have to be undertaken.

- Large debt pile. Due to the acquisition of CalAtlantic, Lennar Corporation’s long-term debt increased to more than $10 billion. This limits Lennar Corporation’s financial flexibility and could be especially dangerous in an economic downturn.

- Much competition. Both homebuilding and mortgage lending are highly competitive industries. This can put pressure on Lennar Corporation’s margins and the size of its business operations.

- Dependency on Federal Reserve policy. Mortgage rates are strongly connected to the Federal Funds rate. When rates go up, mortgages become more expensive, which both makes homebuilding less attractive and also increases the default rate of mortgages.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Lennar Corporation to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 2.67% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only marginally positive. Also, investment in the U.S. stock market does not offer significantly higher returns. Since the S&P 500 Shiller P/E ratio is currently 30.5, the U.S. stock market is priced at a 3.28% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

Lennar Corporation’s business is completely based on the state of U.S. homebuilding. This, in turn, is strongly connected to the U.S. economy. When economic growth is strong, unemployment is low, and people feel confident, more citizens are able and confident to invest in a new home.

At the moment, the U.S. economy still runs strong, but there are multiple risks – international trade-wars, geopolitical risks, a Chinese slowdown, and a break-up of the eurozone – that can negatively impact the world economy, and in turn also the situation in the U.S. Lennar Corporation’s business success is also connected to the policy of the Federal Reserve since its policy strongly affects mortgage rates.

SUMMARY

Lennar Corporation is a very interesting company. Due to its size, it has a strong position in U.S. homebuilding and reaps benefits due to its vertical integration. It has high visibility and very long experience in its business. The downside is mainly the dependency on the state of homebuilding, the U.S. economy and the actions of the Federal Reserve – all of which are out of Lennar Corporation’s hands. The company is well-run and can be expected to retain its strong position in U.S. homebuilding. Also, the expected annual return of 10.3% seems rewarding. Nevertheless, investors are well-advised to only invest in its stock, if they expect a strong U.S. economy in the next years.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.