Intrinsic Value Assessment Of VOXX International Corp. (VOXX)

By Christoph Wolf From The Investor’s Podcast Network | 01 October 2019

INTRODUCTION

VOXX International Corp. is a manufacturer and supplier of consumer electronic products in the automotive, premium audio, accessory and biometrics industries.

Their business is divided into three segments:

- The Consumer Electronics unit sells speakers, headphones, audio systems, and other mostly audio-related electronics products. It includes the former Premium Audio segment and the former Consumer Accessories segment, less EyeLock, LLC. The company’s Klipsch brand is the number one premium speaker brand both in the US and in Canada.

- Automotive Electronics consists of the Company’s OEM and aftermarket automotive business. Here, VOXX offers several solutions for the automotive market, such as rear-seat entertainment devices, automotive security and remote start systems, advanced driver assistance systems, aftermarket satellite radio, and others.

- Biometrics is a newly formed segment which includes EyeLock, LLC, the Company’s majority-owned investment. EyeLock offers iris-authentication solutions for protecting identity and assets.

The revenue of International Corp. has massively declined during the last years. While in 2013 the company still reported sales of $836 million, this figure today stands at only $439 million. A recent decline in car sales and the timing of various programs explains this drop during the last one or two years, but the company’s problems run deeper. Lately, VOXX International Corp. also had to write down a large part of its goodwill, sending earnings sharply negative. One reason for these problems might be the various business segments, which seem to have little overlap and therefore offer only limited synergy savings.

VOXX International Corp.’s stock price has fallen from more than $18 in 2013 to a price of only $4.90 today. Is this a bargain, or is the stock market right to be so pessimistic?

THE INTRINSIC VALUE OF VOXX INTERNATIONAL CORP.

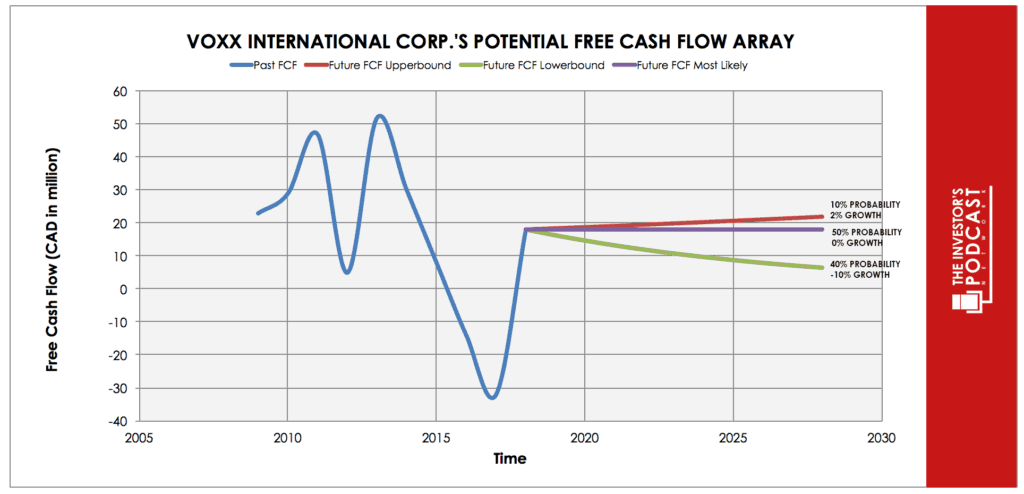

To determine the value of VOXX International Corp., let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of VOXX International Corp.’s free cash flow over the past years.

As one can see, the cash flows have been highly volatile. This is due to the cyclical business VOXX International Corp. is operating in. Also, the company has been repeatedly reorganized, and its business has constantly changed. As a consequence of these additional risks, we will use a conservative estimate for VOXX International Corp.’s future cash flows.

Each line in the above graph represents a certain probability for occurring. The upper growth rate of 2% assumes that the company can be successfully transformed and that its revenue stabilizes. While it might not be unreasonable to assume this scenario, we only set a 10% chance for this outcome. This might be overly pessimistic, but the company’s future is quite unpredictable. As most probable, we consider zero change in cash flow. For this scenario, we assign a probability of 50%. The worst case is assumed to be a sharp decline of 10% annually, which might be caused by a severe recession or if VOXX International Corp.’s current transformation is unsuccessful. We estimate the chance for this happening at 40%.

Assuming these growth rates and probabilities are accurate, VOXX International Corp. can be expected to give a 12.1 % annual return at the current price of $4.90. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF VOXX INTERNATIONAL CORP.

VOXX International Corp. possesses some unique advantages that should allow it to be successful in the future:

- Solid balance sheet. Despite its problems, VOXX International Corp. has consistently managed to keep a solid balance sheet. The current ratio and quick ratio are very healthy, and the company managed to get rid of almost its complete long-term debt. This was achieved by selling assets such as Hirschmann Car Communication.

- Profitable Consumer electronics. The Consumer Electronics segment is profitable and growing. The incorporated Klipsch brand is the market leader both in the US and in Canada.

- Growth Potential. Biometrics is a new segment with vast possibilities. Due to the rise of the Internet of Things, secure verification procedures such as iris identification may yield vast rewards.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of VOXX International Corp. to other ideas. First, one could invest in the ten-year treasury bond, which is producing a 1.79% return. Considering the bond is completely impacted by inflation, the real return of this option is likely barely positive. Currently, the S&P 500 Shiller P/E ratio is 30.1. According to this valuation metric, the US Stock market is priced at a 3.3% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The Consumer Electronics segment is strongly dependent on the general state of the world economy. In a recession, people first save on luxuries – such as state-of-the-art loudspeakers or high-end multimedia devices.

VOXX International Corp.’s Automotive Electronics segment is especially dependent on car sales, which in turn is again depending on the state of the global economy. Recently car sales have already plunged, and the company was negatively affected.

The rise of the Internet of Things (IoT) offers use growth possibilities for the Biometrics segment, although this is also a new field which can be quite unpredictable. If the IoT does not deliver on its promises, this could also lead to disappointment for the Biometrics segment.

RISK FACTORS

There are several risks that might limit the growth prospects of VOXX International Corp.:

- Uncertainty Due to Transformation. Revenue has fallen sharply for several years, showing that VOXX International Corp.’s business model was not sustainable. As a result, management tries to change course: Several parts of the company were sold and the structure of its business units reorganized. It is yet unclear if this new business model will be more successful than the old one.

- Declining Automotive Car Sales. This already negatively impacts the automotive electronics segment. Car sales are very cyclical and closely connected to the state of the world economy. If another global recession strikes or if car sales continue to drop because of other reasons, demand for products of VOXX International Corp.’s Automotive Electronics products might be lowered.

- Disconnected Business Parts. While the Consumer Electronics and Automotive Electronics segments are similarly aligned, it is hard to see a huge connection to the Biometrics segment. Loudspeakers and automotive entertainment devices bear very little resemblance with iris identification solutions. This limits the scope of synergies, and it remains to be seen if these different segments can be successfully integrated within a single company.

SUMMARY

VOXX International Corp. is currently undergoing a vast transformation of its business model, and the outcome is as yet unclear. The company has solid finances, looks cheap, and offers the potential for huge growth – especially in its Biometrics segment. On the other hand, things can also easily go downhill, if the business transformation fails, global car sales deteriorate further, or the Internet of Things does not fulfill its vast promises.

The Biometrics segment is especially the big unknown variable: This company part has yet no meaningful revenue, the potential of the technology is still unknown, and management has little experience in this field. But if all works out well, the rewards are huge.

At this point, it is quite hard to determine if VOXX International Corp. is a bargain or a value trap. If the company manages to prosper within the new business environment, the expected annual return of 12.1 % seems generous. But the risks are equally large. Before investing in VOXX International Corp., investors are well-advised to investigate the company in more detail.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not currently hold any ownership in VOXX and has no intentions of initiating a position over the next 72 hours.