TIP Academy

Intrinsic Value of Top Stocks Starter Pack

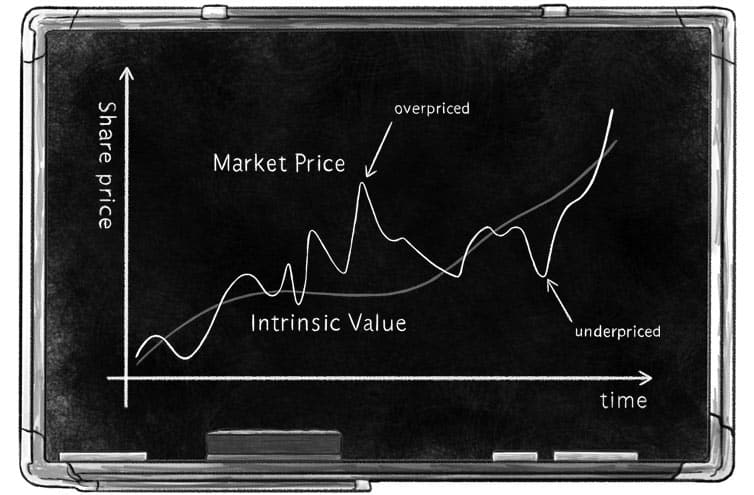

Here are the top episodes about intrinsic value of stocks. Learn how to estimate the intrinsic value and determine the risk and growth opportunities of a company from expert investors.

The following podcast episodes are from the We Study Billionaires show, where we interview and study famous financial billionaires to learn how you can apply their investment strategies in the stock market.

1. The Intrinsic Value of Facebook w/ John Huber – TIP249

1. The Intrinsic Value of Facebook w/ John Huber – TIP249

2. Intrinsic Value Assessment of Disney – w/ David Trainer – TIP277

2. Intrinsic Value Assessment of Disney – w/ David Trainer – TIP277

2. Intrinsic Value Assessment of Disney – w/ David Trainer – TIP277

Preston Pysh and Stig Brodersen talk about the intrinsic value of Disney with founder and CEO of New Constructs, David Trainer. They also talk about how to understand earnings calls and why return on invested capital is important to understand and use.

3. Intrinsic Value Assessment of Mastercard w/ Sean Stannard-Stockton – TIP281

3. Intrinsic Value Assessment of Mastercard w/ Sean Stannard-Stockton – TIP281

4. Intrinsic Value Assessment of Bank of America w/ Bill Nygren & Mike Nicolas – TIP293

4. Intrinsic Value Assessment of Bank of America w/ Bill Nygren & Mike Nicolas – TIP293

4. Intrinsic Value Assessment of Bank of America w/ Bill Nygren & Mike Nicolas – TIP293

Stig Brodersen and Preston Pysh talk with investment experts Bill Nygren and Mike Nicolas from Oakmark Funds. The topic is determining the intrinsic value of a company and the company being assessed is Bank of America.

5. Intrinsic Value Assessment of Fairfax w/ Jake Taylor – TIP317

5. Intrinsic Value Assessment of Fairfax w/ Jake Taylor – TIP317

6. Intrinsic Value Assessment of Charles Schwab w/ Arif Karim – TIP319

6. Intrinsic Value Assessment of Charles Schwab w/ Arif Karim – TIP319

7. Intrinsic Value Analysis of Dollar General & Apple – TIP489

7. Intrinsic Value Analysis of Dollar General & Apple – TIP489