Stig Brodersen’s Track Record Since 2014

By Stig Brodersen • Published: 29 • 11 min read

The Investor’s Podcast was founded in 2014, and I have been repeatedly encouraged to publish my track record. With hesitation, I decided to disclose it for the first time in public.

The foundation of TIP has always been to provide our audience with the tools to make their own investment decisions. It has put me in a difficult situation without good solutions. Imagine the situation where I beat the market. In that case, I would run the risk of many people following my investments without doing their due diligence. I’ve seen this happen repeatedly with the herd, uncritically following certain well-known investors. In my early years, you could have counted me as a part of them, typically with a terrible result.

Disclosing a market-outperforming track record could give me certain biases, too, where I would take additional risks and make bad decisions to “beat the market.” Today, my strategy focuses more on capital preservation and less on growing the capital base. I, for example, own gold. I make no illusion that gold will outperform stocks, and I could easily paint myself into a corner where I would sell my gold holding in the quest for higher returns. In reality, I own gold as insurance in the event of – you know what – hitting the fan geopolitically and not beating a somewhat arbitrary benchmark.

Let’s turn the tables and imagine the other scenario where I, after a decade, did not beat the MSCI All Country World Index. One could quickly conclude that I shouldn’t host a show about stock investing. After all, why listen to me when you can just buy an ETF? While it’s certainly a valid opinion, it would defeat the purpose of what we want to achieve with TIP. The hosts of We Study Billionaires do not intend to have their positions copied. Rather, we interview and study the best investors and learn alongside our audience.

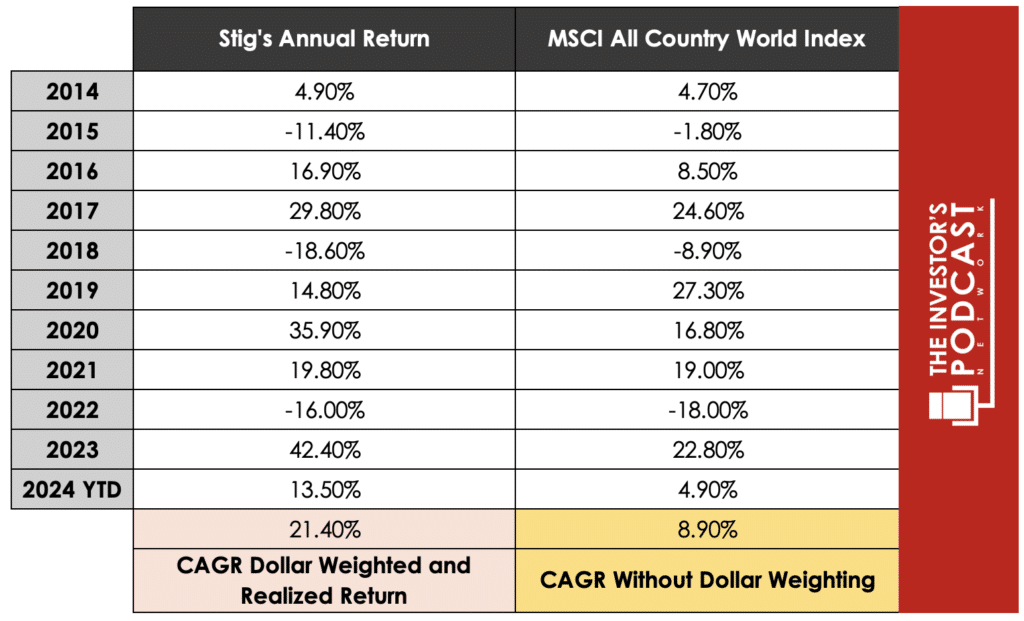

My returns from 1 January 2014 to 29 February 2024 are 21.4% CAGR. The MSCI All Country World Index returned 8.9% CAGR over the same period. I calculated my returns by importing all my trades since 2014 into Sharesight. This is the methodology behind the calculation, and I’ve chosen to use the “compounded method” as this is the most conservative and is preferred to compare returns for private investors as they can control the money inflow and outflows.

It makes me humble to look back at the past 10 years, which is a very short time period for investing. With a very high level of certainty, I expect to achieve a significantly less impressive track record over the next 10 years. A track record of 20% for decades is reserved for the likes of Warren Buffett, and while you can say many things about me, being even remotely as skilled as Buffett is certainly not one of them.

Speaking about billionaires, I highly recommend reading Jeff Bezos’s wonderful book “Invent and Wander.” In a letter to his shareholders, he said (and I’m going to paraphrase) that he and the Amazon team are not much smarter because the stock price is on a tear, but also not the opposite if the stock takes a nose dive. I couldn’t agree more, as much of this is noise, and it’s no different in my case.

For example, I have been lucky to contribute more money in the most bullish years and contribute less in other years. You can see this below when you compare the results of being money-weighted and not being so. As I generally like to be fully invested, there is an element of luck when I coincidently had more new cash to invest when the “timing was right.” Though I carefully consider when to invest and at the right price, I’m well aware that it’s “time in the market” and not “timing the market” that makes you wealthy, and I expect my good luck to even out sooner rather than later.

Since starting TIP, I’ve achieved my goal of financial independence, and, in addition, I have less time to start over today than I did in 2014. As a natural consequence, besides the gold position I mentioned above, I also hold two ETFs. Both investments are bound not to make the same high returns over time that a single stock can – potentially – achieve. It also comes with a different type of downside. This is a feature, not a bug, as my risk profile has changed to be more conservative, and my returns will change accordingly.

Below, I have listed my track record compared to the MSCI All Country World Index. You’ll see the discrepancy in CAGR to be even more significant because it is dollar-weighted. In other words, as I have been very lucky to invest at the “right time” when I had better returns, and as you, by definition, can’t rely on luck, I expect much lower returns in the future. Not only did I not invest much in 2015, 2018, and 2022, which were losing years, but I proportionally had a higher inflow of capital that was put to work in the best years, such as 2017, 2020, and 2023.

I, of course, like all other investors, could be investing in non-listed assets. In my situation, I have mainly invested in private equity and my operating company, which everything else is more appealing when I can’t find alternatives in the public markets and vice versa. One could argue that my ability to “time the market” was a derivative of those opportunity costs and attributed it to skill. However, looking back, I would argue that my investment timing has overwhelmingly been due to luck. Bad decision-making in life, business, and investing has convinced me to be humble, and reviewing my surprisingly good track record doesn’t change that.

CAGR = Compounded Annual Growth Rate

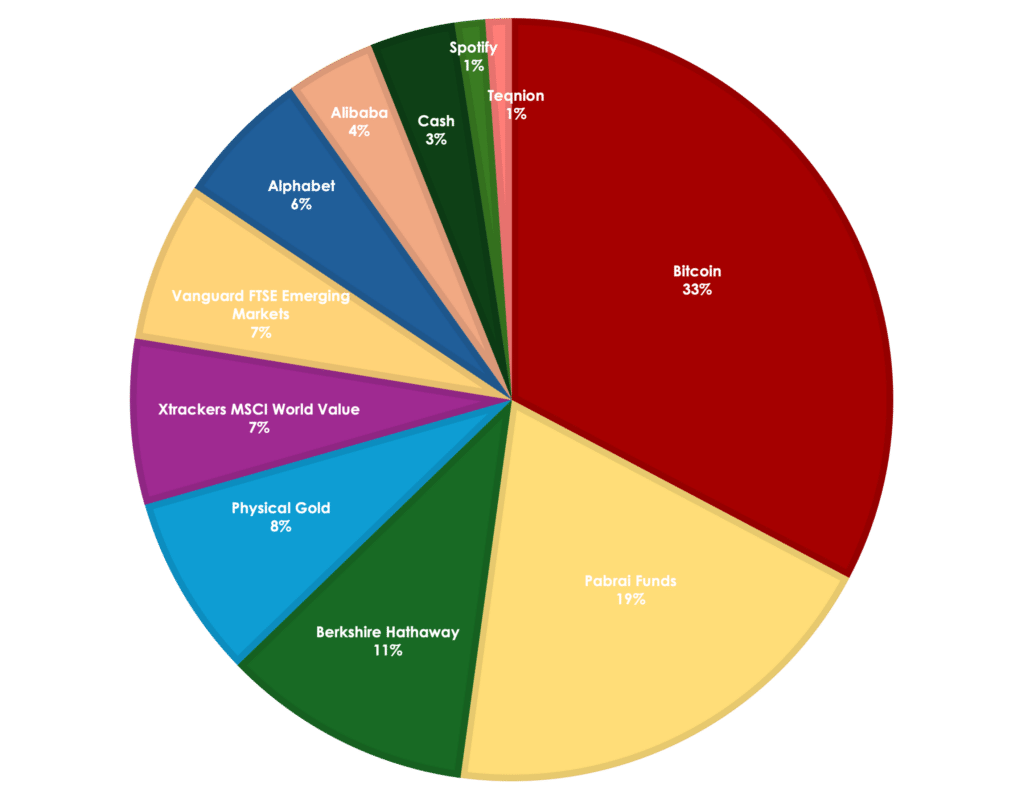

STIG BRODERSEN’S PORTFOLIO AS OF 29 FEBRUARY 2024

Below, I have listed my current holdings. Since our founding in 2014, we have hosted a mastermind discussion roughly once a month where we document what we invest in and what is on our watchlist. If you’re curious about the bull theses on my positions, I’ve linked them to the corresponding mastermind discussion or other relevant episodes.

Bitcoin | Pabrai Funds | Berkshire Hathaway | Physical Gold | Xtracker World Value and Vanguard FTSE Emerging Markets

*Positions are inflated as they do not include Stig’s private investments.

One investment I made in 2022 that I would like to highlight is Pabrai Funds – which today is a sizable position of mine. I was torn about whether or not I should have included this in my overall return. I decided to do so because since 2014, I have interviewed hundreds of investors, and Mohnish Pabrai was the only investor I would invest with. This is an investment decision, even though you can argue that I didn’t pick the stock but the manager. In this case, I don’t see this to be too different than investing in Berkshire Hathaway stock and having Warren Buffett manage my assets.

Another thing I would like to highlight is that my private equity investments are not included in my portfolio above, as it would inflate my returns significantly. One example is a private equity investment where the General Partner wanted me to be among their investors because he felt I could add value aside from my investment in dollars. As a result, my returns went 10x the second I signed the dotted line. You can, therefore, argue that my 21.4% CAGR is on the conservative side. On the other hand, private investments often come with sweat equity that counters some of that return.

Thank you for reading to the bottom of this blog post. I wish you the best of luck with your investments.

Warmly,

Stig Brodersen | 29 February 2024